A STRONGER THAN expected performance by U.S. hotels in the fourth quarter of 2021 led CBRE Hotels Research to upgrade its forecast for the rest of 2022. CBRE now forecasts RevPAR will reach 2019 nominal levels by the third quarter of this year, one year earlier than the previous forecast.

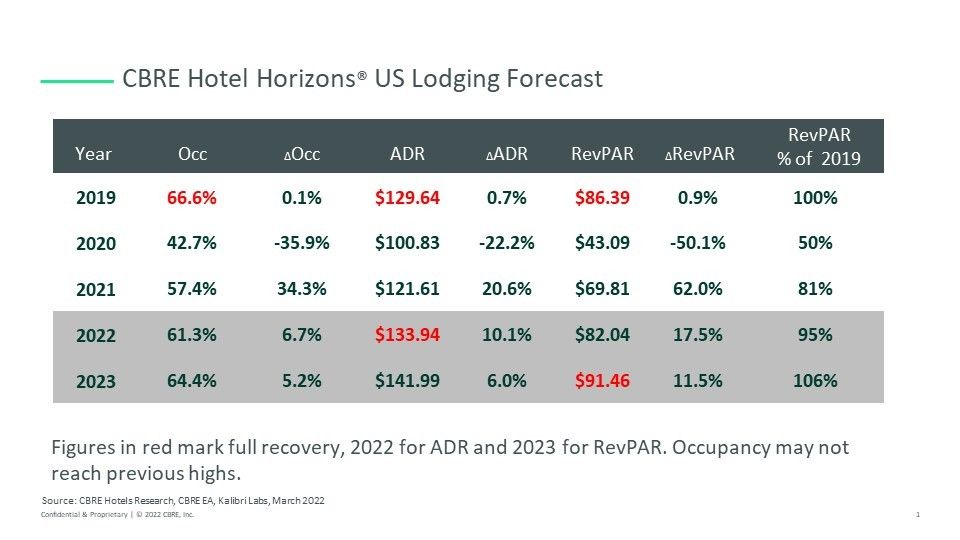

Occupancy is expected to rise 6.7 percent to 61.3 percent this year, then rise 5.2 percent to 64.4 percent in 2023. ADR is forecast to rise 10.1 percent to $133.94 in 2022 and go up 6 percent more to $141.99 in 2023. CBRE expects RevPAR to rise 17.5 percent in 2022 overall to $82.04 and then rise 11.5 percent to $91.46 in 2023.

Positive trends, such as high employment and the return to the office for many workers who had been working from home contributed to the revised forecast, CBRE said. Other factors contributing to the improvement include below-average supply growth, strong domestic leisure trends, the resumption of inbound international travel and a predicted return to office later this year. However, ongoing inflation and geopolitical tensions connected to the war in Ukraine still threaten progress.

In December, RevPAR exceeded 2019’s levels for the first time since the pandemic began, then dropped back to 21.7 percent below 2019 by January. A shift from the leisure-centric holiday season to the business-driven first quarter likely caused the drop, along with heightened geopolitical and inflation risks.

ADR reached 2019 nominal levels in last year’s third quarter, according to CBRE’s December 2021 edition of its Hotel Horizons report. CBRE expects ADR to again exceed 2019 levels this quarter following a pause. A recovery in higher-rated, inbound international travel, the resumption of more traditional business travel, labor market tightness and higher overall inflation will lead to higher rates.

The U.S. consumer price index was 6.7 percent year-over-year in the fourth quarter of 2021 and hit 7.9 percent in February 2022, according to the Bureau of Labor Statistics. CBRE forecasts that CPI will reach slightly more than 6 percent in 2022 before dropping to around 2 percent in 2023 and after.

“Higher room rates will lead to a quicker return to 2019’s nominal ADR levels,” said Rachael Rothman, CBRE’s head of hotel research and data analytics. “But, from a profitability perspective, inflation will be a headwind through higher utilities, supplies and labor.”

The effects of inflation on ADR won’t be uniform, said Bram Gallagher, CBRE senior hotel economist.

“Historically, most hotels can respond to inflation with price increases, but only luxury hotels have demonstrated that they can exceed the pace of inflation to achieve real gains,” he said. “Economy hotels have the most difficulty raising prices enough to keep up.”

Domestic and drive-to resorts are expected to once again be top destinations in 2022 because the war in Ukraine and a resurgence of COVID in Asia could persuade wealthier U.S. travelers to lean toward domestic destinations closer to home. However, elevated gas prices could hurt interstate hotels as fewer budget-minded consumers cut travel.

“Longer-term, muted supply growth will mitigate the blow for the hotel industry. High construction-material prices, including lumber, steel and labor, make the development of most new projects cost prohibitive, limiting the delivery of new rooms over the medium to longer term,” said CBRE. “CBRE forecasts that supply will increase at a 1.2 percent compound annual growth rate over the next five years, well below the industry’s 1.8 percent long-term historical average.”