IN RECENT WEEKS, CBRE Hotels Research has revised its forecast for the hospitality industry upward in light of several factors, such as rising occupancy levels, improvement in domestic travel and some opening in international travel. Recent developments, however, including the rise of the Omicron variant of the virus that causes COVID-19, elevates the uncertainty level of those forecasts, but still the industry is expected to return to 2019 levels by the second half of 2023 rather than 2024.

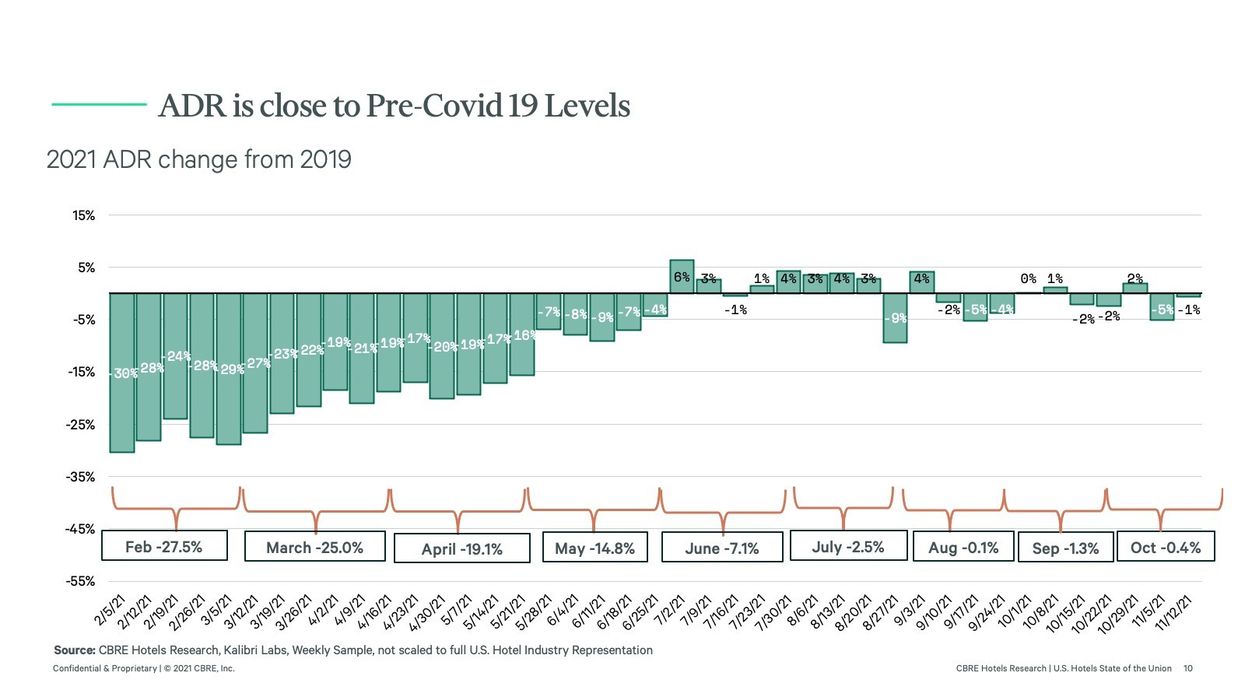

Hotel occupancy in the third quarter rose 35.1 percent over the previous year, according to CBRE’s December 2021 edition of Hotel Horizons. ADR also saw gains, reaching 2019 nominal levels in the third quarter.

“CBRE expects ADR will continue to exceed 2019 levels, followed by a demand recovery in early 2023,” CBRE said in a statement. “Pent-up demand for leisure destinations, an increase in household personal savings and fewer constraints on availability compared with earlier in the pandemic contributed to the brisk pace of ADR recovery. The resumption of inbound international travel will help gateway markets regain occupancy in the coming year.”

CBRE also expects existing hotels will benefit from below-average new construction elements, such as labor, that will restrict supply growth to 1.2 to 1.3 percent through 2025, below the long-run average of more than 2 percent.

Room rate will lead the hotel recovery, CBRE said, so that should be the focus for hotels’ revenue management efforts. This factor, along with staffing shortages, may keep occupancy from reaching the highs of the last cycle, but the research firm said an ADR-led rebound contributes to faster recovery of profits.

“Typically, when recovering from downturns, ADR growth lags occupancy gains,” said Rachael Rothman, CBRE’s head of hotel research and data analytics. “The trend has reversed this cycle, owing to strong leisure demand and a nascent recovery in corporate and group demand.”

The rise of Omicron and other pandemic concerns may dampen business, convention and large-group travel, CBRE said. Still, the firm said lower-cost, high-amenity markets will see a surge in those categories of travel in the second half of 2022 while denser urban markets with higher operational costs that depend more on international and large-group travel will be slower to recover.

“The continuing development of the Omicron variant as well as the potential for additional novel variants causes the uncertainty surrounding any forecast to remain elevated,” CBRE said. “While the hotel sector could face renewed travel restrictions, we expect higher occupancy levels from an increase in inbound international and business travel in 2022.”

CBRE previously forecast that the return of business travel may be delayed by the spread of the Delta variant.