Rising Costs Challenge Hotels in 2024, But Growth Opportunities Remain

HOTELS STRUGGLED WITH rising costs outpacing revenue growth in 2024, hindering economic growth and job creation, according to American Hotel & Lodging Association’s 2025 State of the Industry report. Despite these challenges, opportunities remain, driven by guest spending trends, shifting traveler behaviors, and major upcoming events.

The report, published with Accenture, found property costs outpacing revenue, with operations, maintenance, sales, marketing, and IT expenses rising nearly 5 percent in 2024, adding to hotel industry challenges.

“America’s small business hotel owners have been struggling as rising costs, compounded by high inflation and interest rates, make it difficult to stay open and serve guests,” said Rosanna Maietta, AHLA's president and CEO. “That’s why we will be focused on promoting policies that help our members overcome these challenges so they can focus on what they do best—creating pathways for their employees to find lasting careers and creating unforgettable experiences for their guests.”

Findings from the 2025 report include:

- Employee compensation: Hotels are projected to pay a record $128.47 billion in wages and benefits in 2025, up from $125.79 billion in 2024.

- Job growth: Hotels are expected to add 14,000 employees in 2025, reaching 2.17 million workers, still 200,000 short of the 2019 pre-pandemic level.

- Community impact: Hotels are projected to generate a record $55.46 billion in state and local tax revenue in 2025, up from $53.97 billion in 2024, including $26.82 billion in lodging-specific taxes.

- Federal tax revenue: Hotels are also expected to generate a record $30.14 billion in federal tax revenue, up from $29.55 billion in 2024.

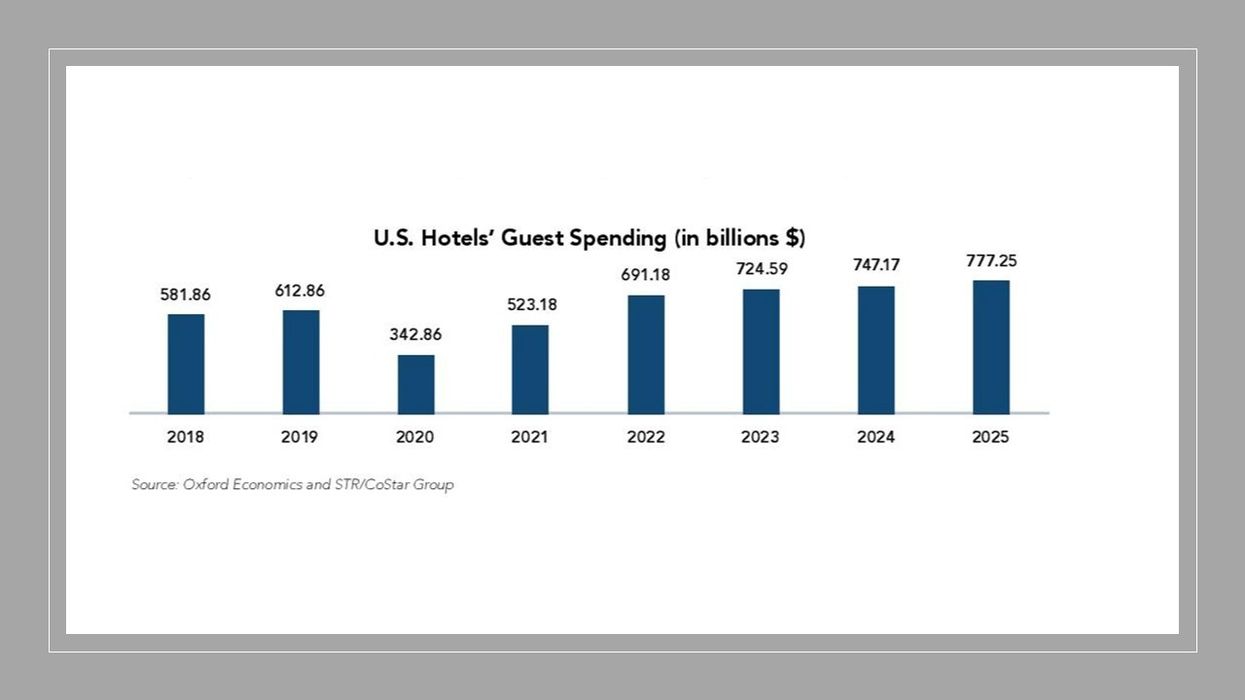

- Guest spending: Nominal hotel guest spending across lodging, transportation, food and beverage, retail, and other expenses is expected to reach $777.25 billion in 2025, a 4 percent increase from $747.17 billion in 2024.

Liselotte De Maar, Accenture’s managing director of global strategy for travel, said hoteliers will capitalize on growing travel demand and new revenue opportunities in live sports and entertainment.

“There is a balance to strike in delivering on customer expectations and keeping a careful watch on the bottom line,” she said. “Leveraging data and embedding technologies such as artificial intelligence can boost personalization of experiences across rising new customer segments, along with agility and cost-effectiveness. Done well, this can lead to increased loyalty, strengthened relationships and new growth opportunities.”

The report also highlighted emerging travel trends that could drive revenue and growth, including:

- Shifting demographics create opportunities to serve multiple generations and expand offerings for aging and solo travelers.

- Hoteliers are generating new revenue through camping accommodations, entertainment-focused stays, and loyalty program partnerships.

- Growing sports and entertainment tourism is driving demand for travel and accommodations for attendees and staff.

- Technology and AI are enhancing personalized travel experiences for trip planning and bookings.

The AHLA Foundation recently raised more than $1 million at its Night of a Thousand Stars gala to support hotel workforce development.