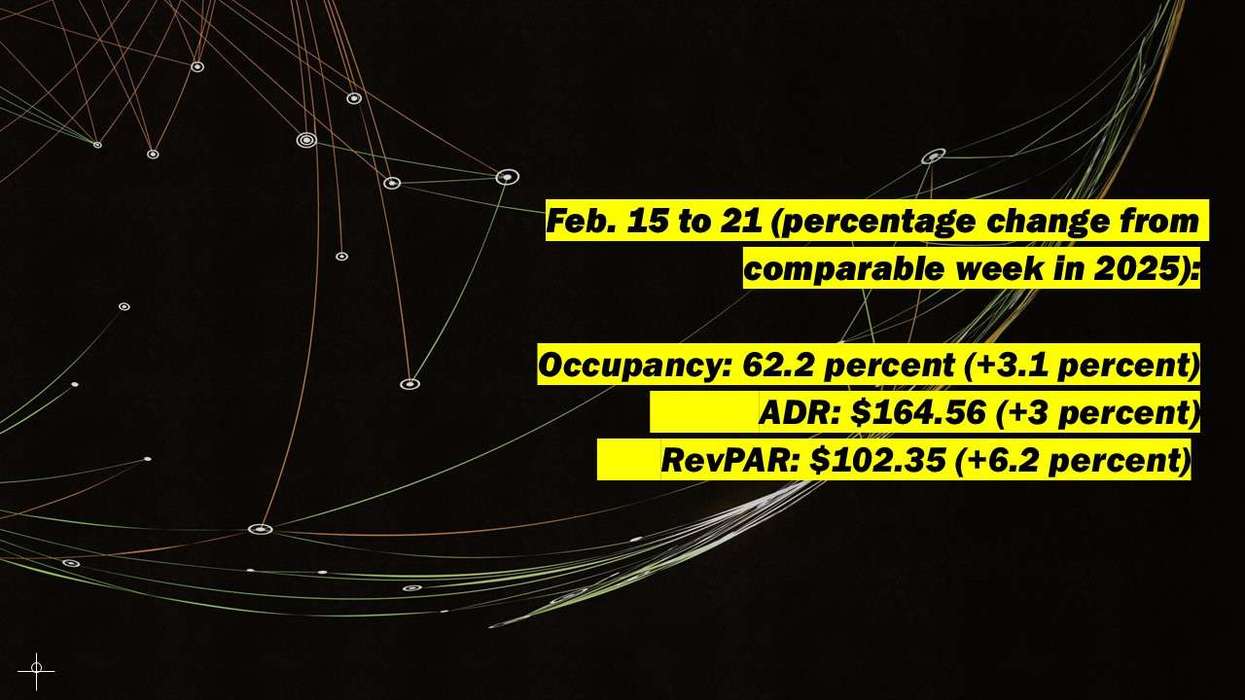

U.S. REVPAR IS projected to rise 3.1 percent to $103.02 in 2025, driven by a 3.7 percent ADR increase to $164.54 and a 0.6 percent occupancy decline to 62.6 percent, according to Lodging Analytics Research & Consulting. U.S. hotel EBITDA is expected to grow 1.8 percent with slight margin erosion, while hotel values rise 3 percent.

LARC attributes 2024 RevPAR growth acceleration to election tailwinds, improving group trends, and easing domestic leisure headwinds, while projecting an 8 percent increase in hotel values over five years.

“Our 2025 operating outlook has slightly improved from a quarter ago,” said Ryan Meliker, LARC’s president. “The most significant change is growing confidence that leisure demand has bottomed out, with growth set to resume in 2025, along with continued modest growth in the corporate transient segment. This translates to higher ADR growth, but occupancy will be lower, primarily due to difficult comparisons from disaster relief efforts in the fourth quarter. Our value appreciation forecast also improves, tied to an improving long-term cash flow outlook.”

The first and third quarters will see the strongest growth, while the fourth quarter will be softer due to tough disaster relief comparisons in the Southeast and Texas.

Market forecasts

- Top markets for 2025 RevPAR growth are Maui, Hawaii; San Francisco; Palm Beach, California; San Jose, California; and Savannah, Georgia.

- Bottom markets for 2025 RevPAR growth are Houston, Cleveland, Chicago, Las Vegas, Milwaukee

Five-year outlook: 2024-2029

- Top markets for RevPAR growth are Raleigh, North Carolina; Orlando, Florida; Maui; Palm Beach; and Washington, D.C., with projected 2029 inauguration impact.

- Bottom markets for RevPAR growth are Cincinnati; Kansas City, Kansas/Missouri; Indianapolis; Houston; and Louisville, Kentucky.

- Top markets for value change are Puerto Rico; Charlotte; North Carolina; New Orleans; Salt Lake City; and Orlando.

- Bottom markets for value change are Austin, Texas; Boston, Chicago, St. Louis and Portland, Oregon.

Sluggish growth

U.S. economic growth slowed in the fourth quarter of 2024, with real GDP rising 2.3 percent, down from 3.1 percent in the third quarter. Despite this, U.S. RevPAR growth accelerated 3.6 percent year over year, driven by increased demand from natural disaster relief and pent-up demand following the swift resolution of the U.S. general election.

“Corporate transient demand is expected to remain solid in the near term as pent-up demand from the election cycle is unlocked in the first half of the year,” Meliker said. “However, our positive short-term outlook for corporate transient demand growth moderates as the year progresses, limited by sluggish job growth and declining corporate profits. Group trends remain strong, contributing to a base level of demand that will further support pricing power. Nationally, we estimate the convention center booking pace will be up 4 percent year over year in 2025, following a 3 percent increase in 2024.”

In 2024, outbound international travel was 21 percent above 2019 levels and up 9 percent year over year, with 13 million more U.S. travelers than in 2019. Meanwhile, inbound travel remained 8 percent below 2019 levels but rose 9 percent year over year, with 5 million fewer foreign visitors than in 2019.

The U.S. shifted from a net importer of 5 million travelers in 2019 to a net exporter of 14 million in 2024—an 18 million traveler swing that is weighing on hotel performance, especially in gateway markets, LARC said.

Rising expense pressures

Meliker said expense pressures will be a substantial factor in identifying market winners and losers, especially in major cities with recent or upcoming collective bargaining negotiations.

“In recent agreements nationwide, the hotel union and hotel owners/operators agreed to roughly a 10 percent annual wage increase over the next five years and a reset to pre-pandemic staffing levels,” he said. “We expect non-union hotels to keep pace with wage growth at union properties in these markets, though many already pay above union-mandated levels.”

With added political risks like New York City's Safe Hotels Act potentially expanding to other markets, wage and expense growth will likely impact value more than top-line performance, LARC said. Their strain on margins heavily influences the investment outlook on the best and worst markets.

U.S.-Canada trade tensions are impacting tourism, with Canadian drive-in visits to the U.S. down 23 percent year over year in February, the second consecutive monthly decline and only the second since March 2021.