U.S. Hotel Performance Surges with Growth in Occupancy & ADR

U.S. HOTEL METRICS improved for the week ending Feb. 15, with both week-over-week and year-over-year gains, according to CoStar. Chicago led the top 25 markets in year-over-year occupancy growth.

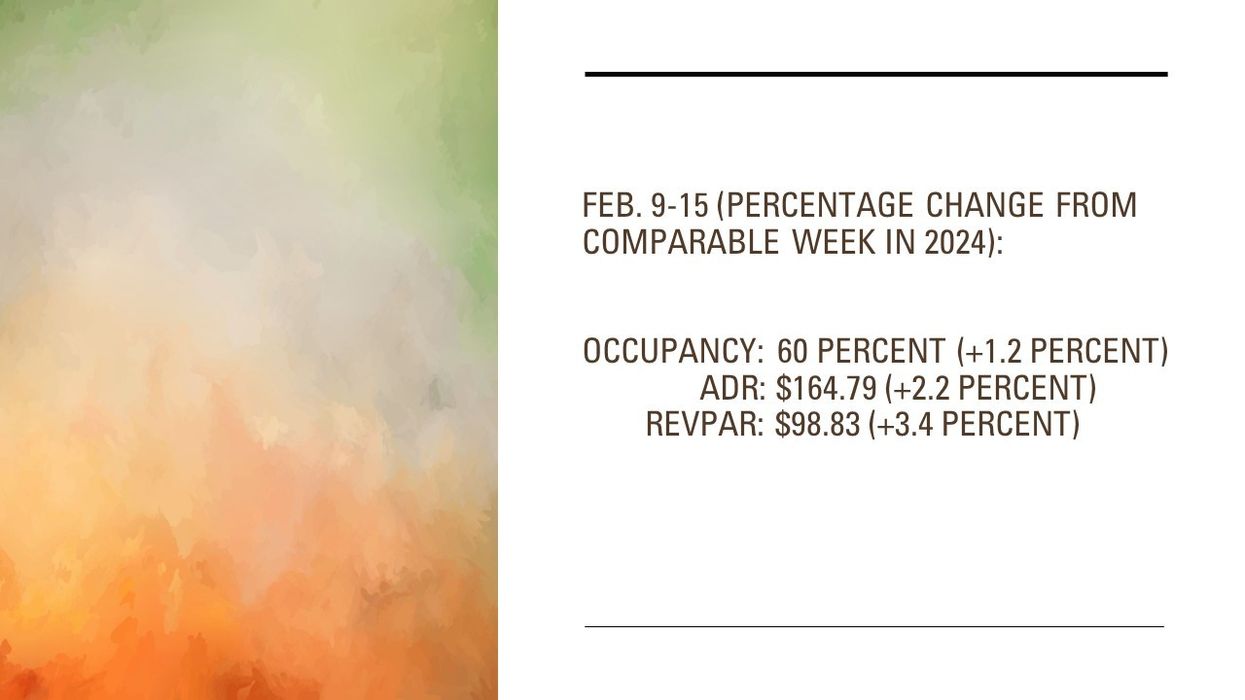

Occupancy rose to 60 percent for the week ending Feb. 15, up from 55.9 percent the previous week, reflecting a 1.2 percent increase compared to the same period last year. ADR climbed to $164.79 from $156.03, marking a 2.2 percent year-over-year gain. RevPAR also saw an increase, reaching $98.83 from $87.22, representing a 3.4 percent improvement over the previous year.

Among the top 25 markets, Chicago led in occupancy growth, rising 14.4 percent to 55 percent.

New Orleans, host of Super Bowl LIX, saw the highest ADR increase, up 42.8 percent to $314.37, and RevPAR, up 33.5 percent to $222.66. However, occupancy fell 6.5 percent to 70.8 percent, reflecting a comparison to Mardi Gras in 2024.

Las Vegas, which hosted Super Bowl LVIII during the same week in 2024, saw the sharpest performance declines. Occupancy dropped 7.1 percent to 76.4 percent, ADR fell 30.6 percent to $202.10, and RevPAR decreased 35.5 percent to $154.44.