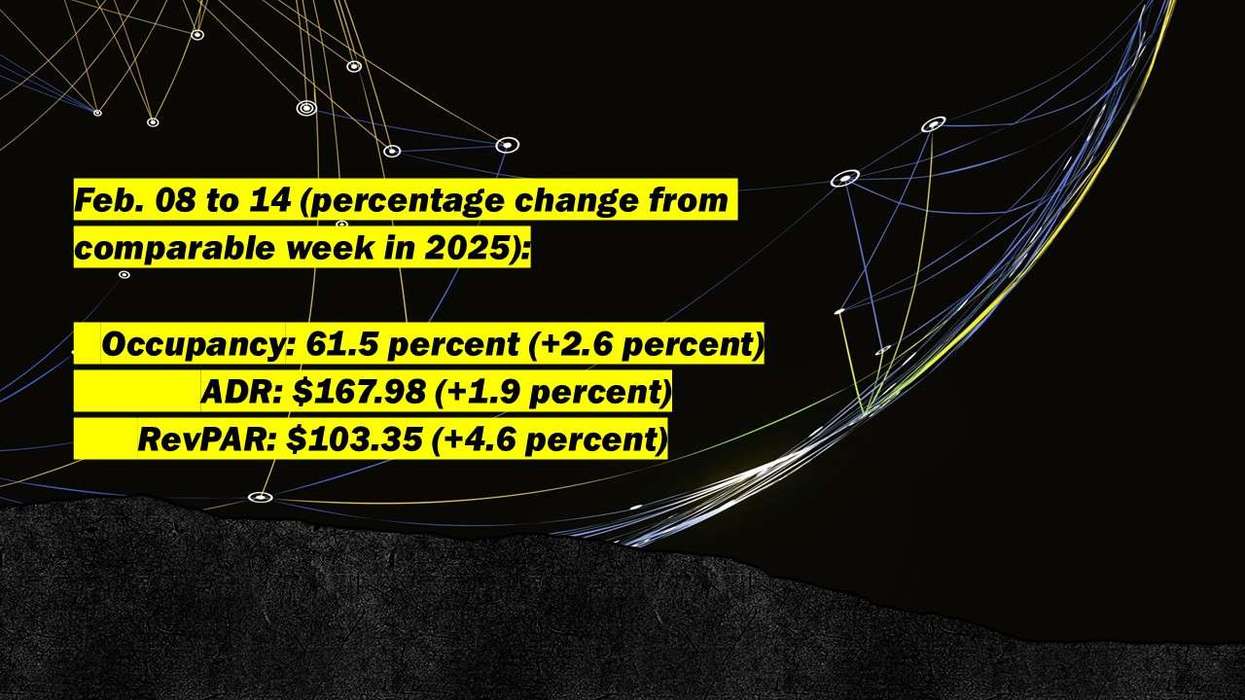

COSTAR AND TOURISM Economics lowered growth projections in the revised 2025-26 U.S. hotel forecast. Growth rates fell across metrics due to first quarter underperformance and macroeconomic factors, with supply down 0.1 percent, demand 0.6 percent, ADR 0.3 percent and RevPAR 0.8 percent.

Similar adjustments were made for 2026, with supply down 0.5 percent, demand 0.3 percent, ADR 0.7 percent and RevPAR 0.6 percent, CoStar and TE said.

“Top-line performance is still growing even in the current environment,” said Amanda Hite, STR president. “Until consumer confidence improves, however, demand is going to remain softer—especially in the middle and lower price tiers. Rate is pushing the top line in the group segment, and business transient should continue to recover in many industries, but leisure gains will be more isolated. Our forward-looking data continues to support the observations of many industry stakeholders that booking windows have shortened. That adds to the challenges hoteliers will face in the coming quarters.”

Aran Ryan, TE’s director of industry studies, said the second half of the year will see higher consumer prices, a weaker labor market, lower business investment and soft international visitor volumes.

“While recession risks have eased, the economy, and the travel sector, will walk on a tightrope through this period,” Ryan said.

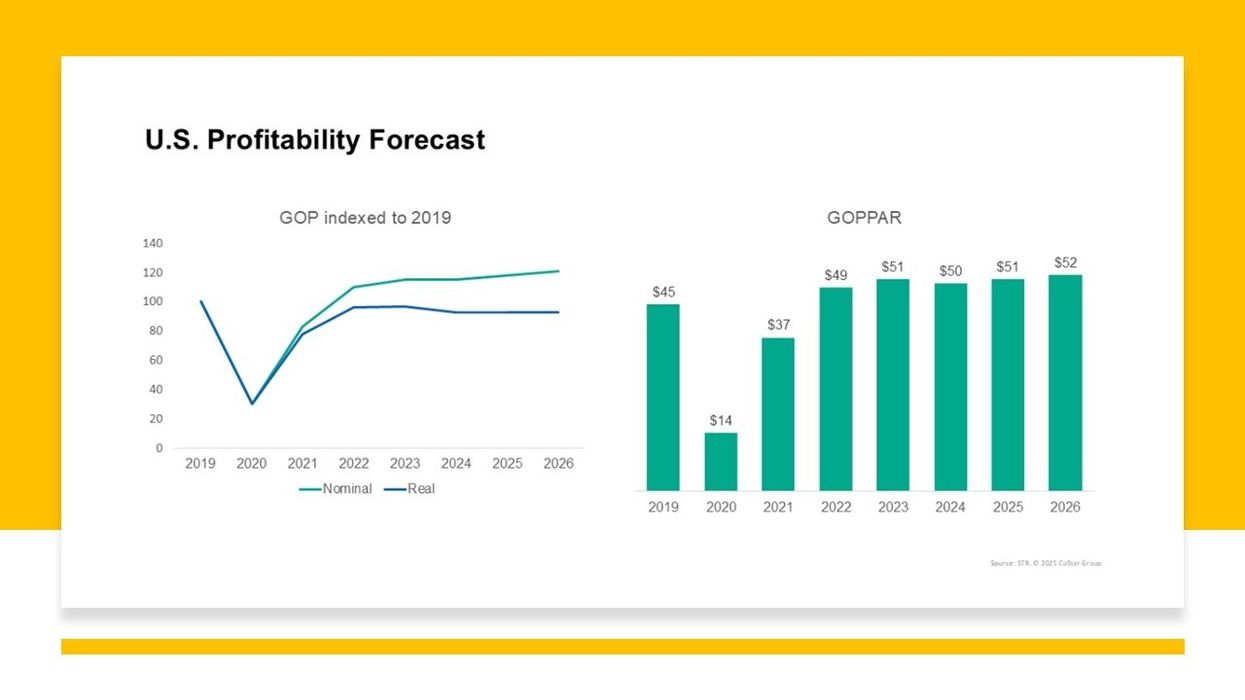

The 2025 projection for gross operating profit per available room was lowered by $3. “While GOP growth will continue, the pace will be modest due to softer demand, rising departmental costs, and limited margin gains from ancillary revenues,” Hite said. “When adjusted for inflation, GOP is down from last year.”

In its January report, CoStar and Tourism Economics made minimal changes to their 2025 U.S. hotel forecast, keeping ADR and RevPAR gains at 1.6 percent and 1.8 percent, while occupancy increased 0.1 percentage point to 63.1 percent.