What are the key findings from Colliers’ 2025 Hospitality Outlook?

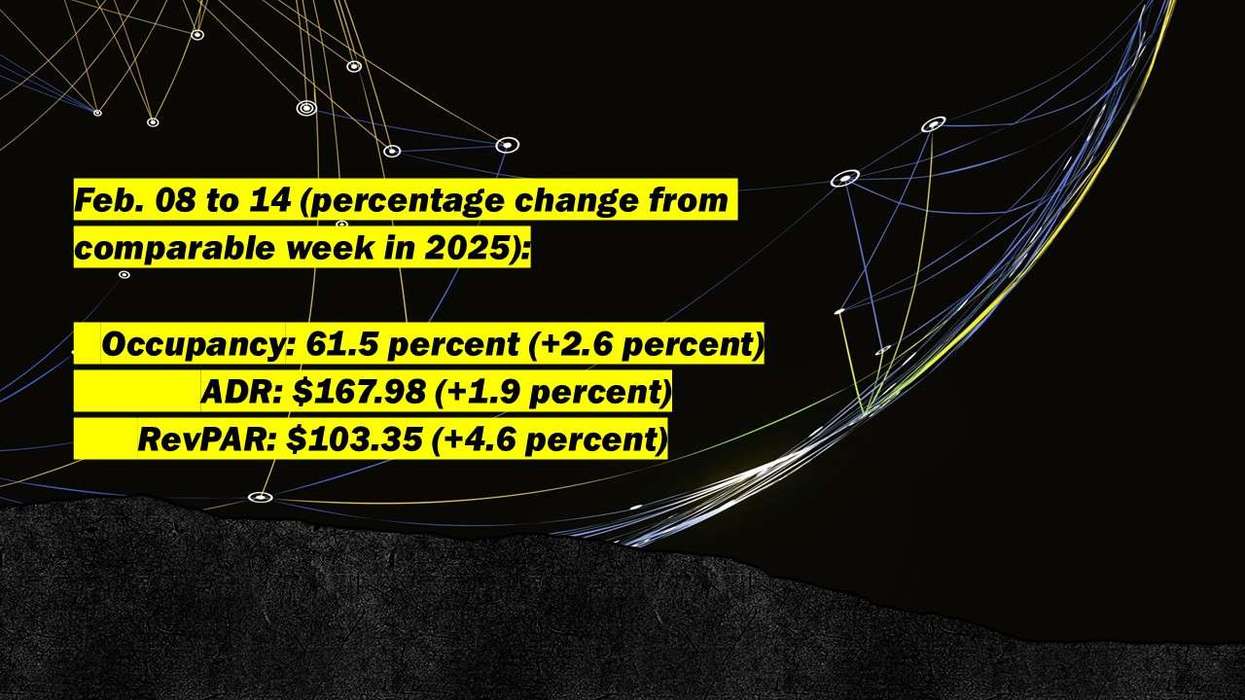

THE FINANCIAL HEALTH of hospitality assets, especially in the northeast and central regions, is improving, driven by leisure travel and the return of conferences and events, according to Colliers. U.S. hotels saw RevPAR rise 2.4 percent, ADR 1.9 percent and a slight uptick in occupancy from April 2024 to March 2025.

Colliers' 2025 Hospitality Outlook report found that some regions are still returning to pre-pandemic demand levels, while others are reaching prior cyclical peaks.

“We’re seeing performance diverge by region and asset type, which is creating targeted opportunities for investors who understand how to navigate today’s complexity and capitalize on long-term fundamentals,” said Mark Owens, Colliers’ vice chair for capital markets.

The northeast and central regions led the country in occupancy growth at 1.3 percent, as cities like New York, Chicago and Nashville saw gains from both leisure and business travel, the report found. The South accounts for over 51 percent of all rooms under construction, driven by travel and investor demand in the Sunbelt. In the West, ADR is nearly 20 percent above pre-pandemic levels, with hoteliers focusing on rate growth over occupancy gains.

However, the report found a decline in consumer travel spending, with lodging down 2.5 percent and airfare down 6 percent year-over-year.

International travel may face short-term challenges tied to economic conditions, particularly in gateway markets, but domestic demand, especially for leisure and group travel, continues to support sector performance, the report found. While new supply remains active in some regions, rising costs and selective lending are slowing development elsewhere, helping align supply and demand.

Investors, developers and operators will need to balance near-term dynamics with long-term opportunity as the hospitality sector evolves, the report said. From shifting traveler behavior to roles in mixed-use environments, hotels are shaping the future of real estate.

Separately, the Hospitality Group and Business Performance Index by Cendyn and Amadeus showed U.S. hospitality businesses recorded a 109.1 percent year-over-year increase in their health index for the first quarter of 2025, the highest in four quarters.