What’s Ahead: Trends to Watch in Hospitality M&A

HOSPITALITY AND LEISURE dealmakers entered 2025 with cautious optimism, but ongoing volatility in capital markets and trade policy has led to a reassessment of growth strategies, according to Pricewaterhouse Coopers. Large, transformative deals remain limited, while targeted M&A is helping operators adjust portfolios, refine strategy and expand digital capabilities.

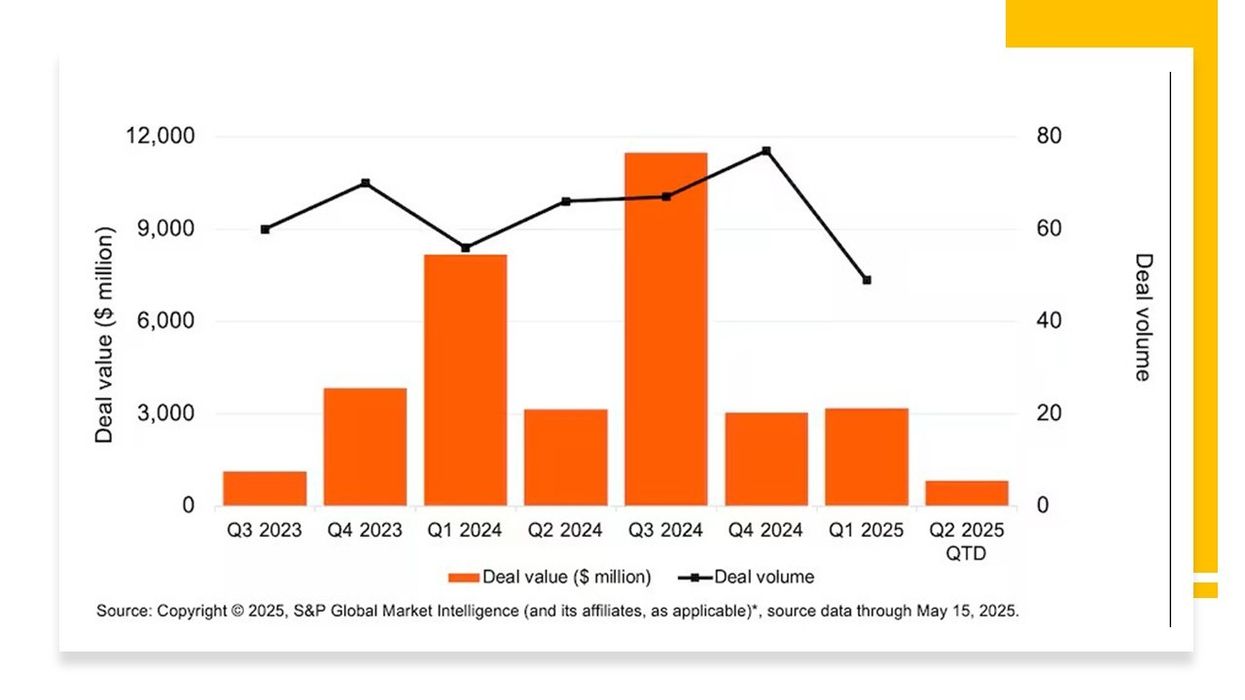

PwC’s “Hospitality & Leisure: U.S. Deals 2025 Midyear Outlook,” based on S&P Global Market Intelligence, found that well-capitalized buyers view current conditions as an opportunity to acquire assets on favorable terms.

High borrowing costs, valuation gaps and policy uncertainty are limiting deal volume, the report said. Market participants with strong balance sheets and disciplined capital allocation remain positioned to act. Tariff uncertainty and trade challenges are curbing cross-border activity, while domestic-focused, service-oriented H&L operators remain more active in dealmaking.

Shifting sentiment around global travel may lead H&L operators to expand U.S. portfolios, using strategic deals to respond to evolving trends, PwC said. For brands reassessing market exposure, demographic focus, and asset-light strategies, divestitures are becoming a tool for portfolio realignment. H&L operators may use M&A to evaluate brands, geographies, and customer segments with the most potential and accelerate strategic shifts.

Operators are focusing on experience-driven growth, using M&A to enter luxury, lifestyle, and bespoke travel segments aimed at high-income consumers, as this group continues to drive U.S. consumption growth. Technology remains a priority, with acquisitions and partnerships advancing digital-first models, AI-driven systems and customer personalization.

Three of the largest H&L deals by value in 2024 involved private equity firms acquiring gaming operators at favorable valuations. While private equity remains cautious in early 2025, stock market volatility may create openings for financial buyers to return and influence M&A activity across the sector.

Amid continued economic uncertainty, H&L operators and investors should monitor emerging value opportunities. Distressed and underperforming assets may enter the market as volatility prompts exits. At the same time, steady demand for high-end travel and the need for digital transformation are guiding capital toward operational efficiency and long-term value.

The report advised monitoring interest rate policy and trade developments, which will influence valuations, deal pacing and consumer sentiment. Companies should focus on experience-led assets that appeal to high-spending, digitally native consumers—segments that support sustained revenue and growth.

It also recommended pursuing joint ventures and alliances to reduce risk in technology initiatives, including AI-driven engagement, cybersecurity, and automation. M&A should be used to reshape brand portfolios for resilience, with scalability offering potential for stronger returns compared to traditional expansion.

In July 2024, GlobalData reported 347 M&A, private equity, and venture financing deals in the global travel and tourism sector during the first half of the year, down 12.6 percent from 397 deals in the same period in 2023.