Extended-Stay Hotels Outperform in March 2025

U.S. EXTENDED-STAY HOTELS outperformed the overall hotel industry in supply, demand, room revenue, ADR and RevPAR in March, according to The Highland Group. While occupancy saw a larger decline, the segment’s lead over the broader industry remained in line with historical averages.

The “U.S. Extended-Stay Hotels Bulletin: March 2025” reported strong metrics, though with signs of a slowing performance trend.

“Extended-stay hotel ADR growth has been fairly steady for the last six months, but demand increases have moderated considerably,” said Mark Skinner, The Highland Group's partner.

March also marked 42 consecutive months of supply growth at 4 percent or less, with annual increases ranging from 1.8 to 3.1 percent over the past three years—well below the long-term average.

Room nights available rose 3 percent year over year, partly due to the addition of mid-price brands Water Walk by Wyndham in May 2024 and Executive Residency by Best Western in January, The Highland Group said.

A 10.3 percent increase in economy segment supply, along with modest changes in mid-price and upscale segments, was primarily driven by conversions. New construction in the economy segment accounted for only about 3 percent of rooms added over the previous year.

Demand and supply

Demand rose 2.1 percent in March—more than double the 0.8 percent increase reported for the total industry. Adjusted for the extra day last February, demand has risen in 27 of the past 28 months.

Supply comparisons have been affected by re-brandings that moved rooms between segments, de-flagging of hotels no longer meeting brand standards and sales to multifamily and municipal buyers, the report said. Meanwhile, conversion activity is expected to decline and total supply growth for 2025 is projected to remain well below the long-term average.

Excluding February, which was impacted by the 2024 leap year, March’s 3.3 percent increase in room revenue was the smallest monthly gain in six months. By comparison, STR/CoStar reported just a 1 percent increase for the overall hotel industry.

Key metrics trends

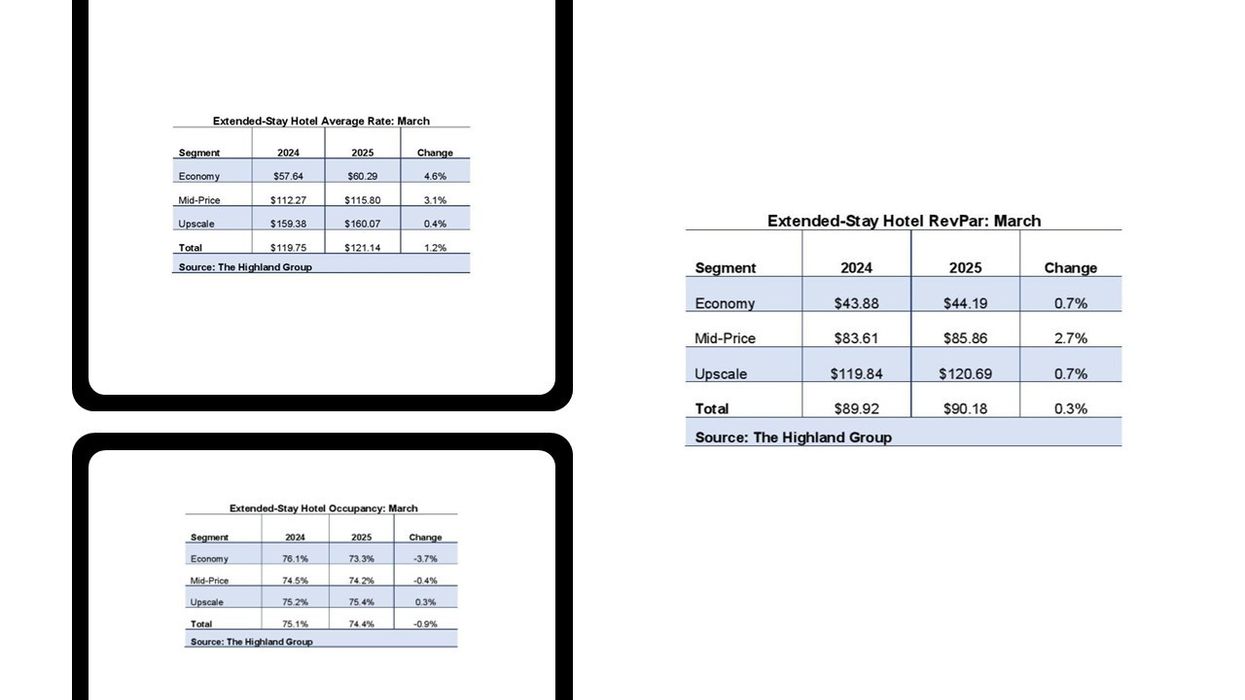

Occupancy fell 0.9 percent in March, marking the third consecutive monthly decline and exceeding the 0.4 percent drop reported for all hotels, the report said. Still, occupancy was 12.3 percentage points higher than the broader industry, consistent with the long-term average premium.

ADR increased for the twelfth straight month, with the gain significantly outpacing the 0.2 percent rise reported for all hotels. Each segment posted higher ADR growth than its corresponding class.

RevPAR rose 0.3 percent, the eleventh monthly gain in the past year. Although the smallest increase in six months, it compares favorably to the 0.2 percent decline for the overall hotel industry.

Total RevPAR growth for the segment was lower than the individual segment increases due to the economy segment’s larger share of room supply in March 2025 compared to March 2024.

In February, the U.S. extended-stay hotels outperformed the industry in revenue, occupancy, ADR and RevPAR in February, with RevPAR rising 0.7 percent for the fifth consecutive month.