U.S. HOTEL PERFORMANCE remained largely stable from the previous week, with mixed year-over-year comparisons, according to STR.

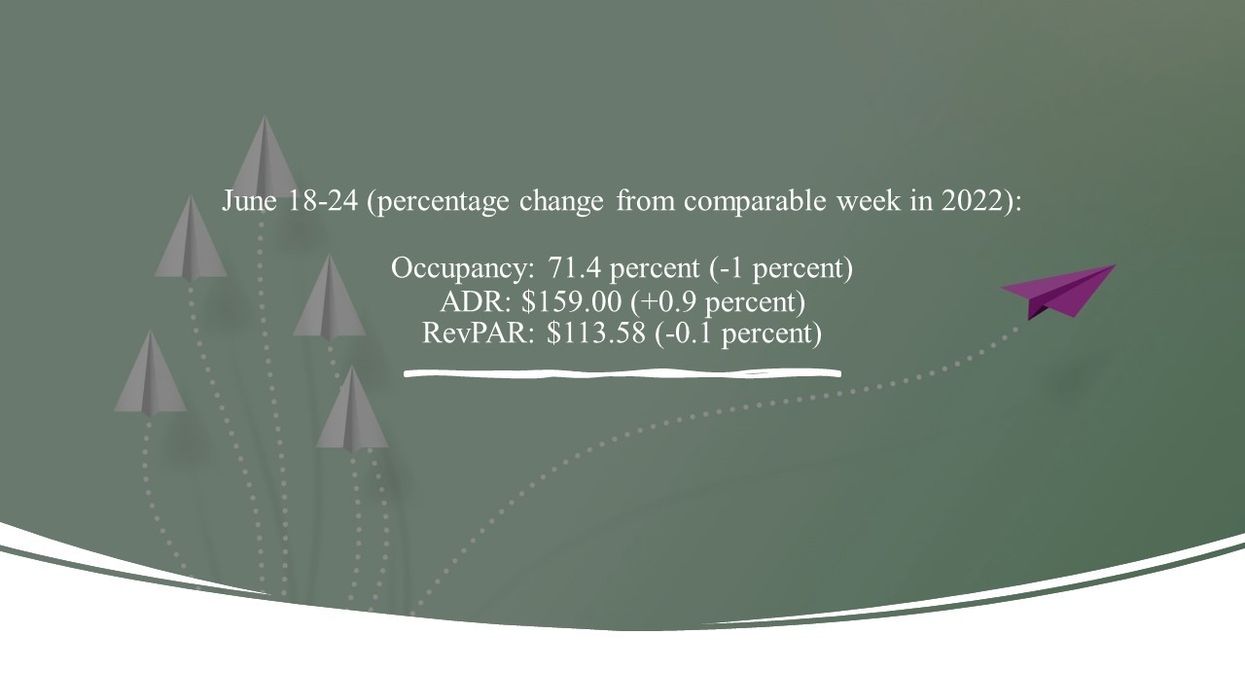

In the week ending June 24, U.S. hotel occupancy rose slightly to 71.4 percent, surpassing the previous week's 70.8 percent, but down 1 percent compared to 2022. ADR was $159, down from the previous week's $159.82, but still reflecting a 0.9 percent increase compared to the same period last year. RevPAR came in at $113.58, up from the previous week's $113.17, indicating a 0.1 percent decline compared to 2022, according to STR.

Among the top 25 markets, Minneapolis saw the highest year-over-year increases in each of the three key performance metrics: occupancy, up 9.1 percent to 74.5 percent; ADR increased 20.2 percent to $158.08, and RevPAR rose 31.1 percent to $117.80. The growth in these metrics was driven by Taylor Swift's Eras Tour.

The steepest RevPAR declines were reported in New Orleans, down 14.6 percent to $87.85, and Miami, which declined 11.9 percent to $122.22.