U.S. HOTEL PERFORMANCE continued to decline in the first week of August compared to the previous week, despite slightly positive year-over-year comparisons, according to CoStar. Key metrics, including occupancy, RevPAR and ADR, all fell from the prior week.

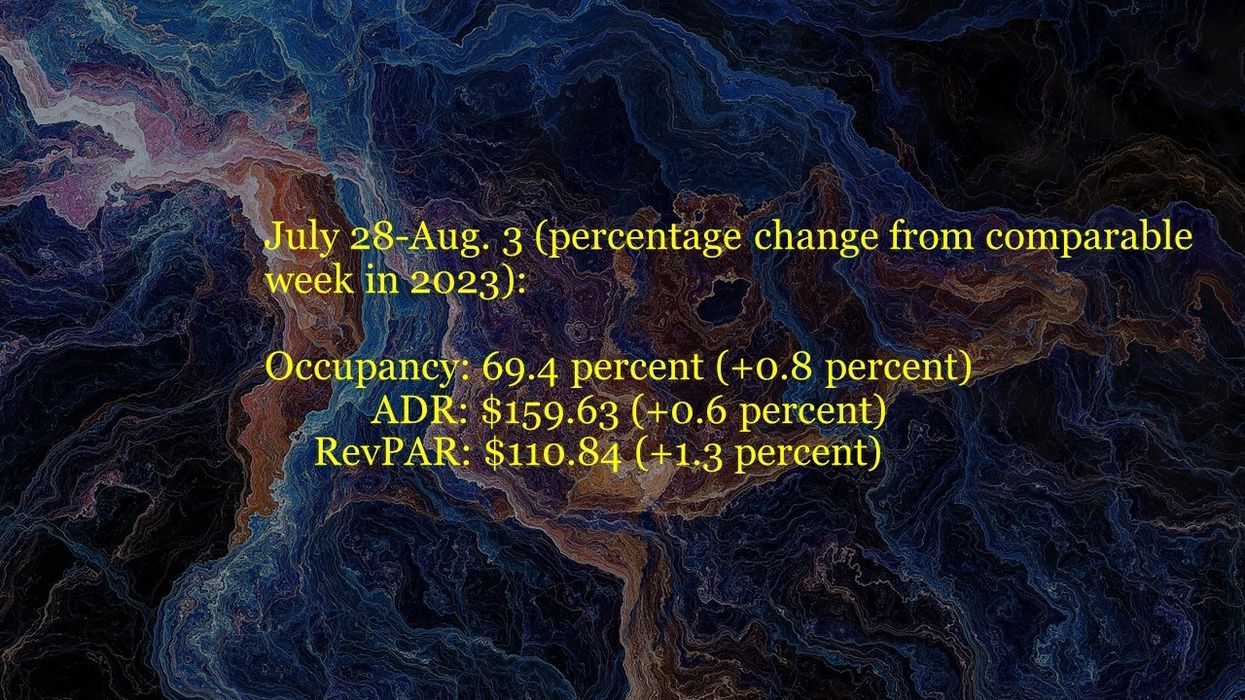

Occupancy reached 69.4 percent for the week ending Aug. 3, down from 72 percent the previous week, yet showing a 0.8 percent year-over-year increase. ADR stood at $159.63, compared to $164.45 the prior week, reflecting a 0.6 percent increase from last year. RevPAR dropped to $110.84 from $118.37 the previous week but was 1.3 percent higher compared to the same period in 2023.

Among the top 25 markets, Houston experienced the highest year-over-year increase in occupancy, up 28.1 percent to 75.8 percent, and RevPAR rose 45.7 percent to $93.88.

Houston and Philadelphia recorded the largest ADR increases, up 13.7 percent to $123.82 and $161.02, respectively. Anaheim and Los Angeles experienced the steepest RevPAR declines, dropping 12 percent to $171.55 and 10.7 percent to $158.64, respectively.