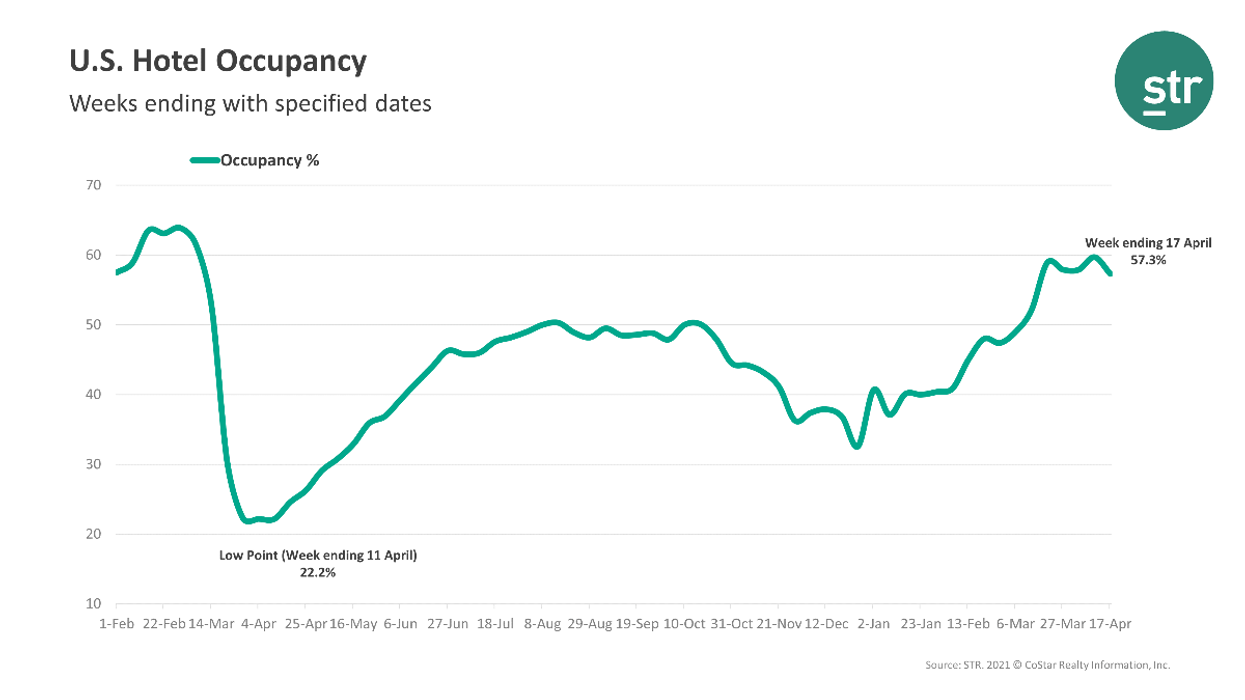

MARCH MARKED THE one-year anniversary of the COVID-19 pandemic and U.S. hotels saw their best performance for the month since the beginning of the outbreak, according to STR. The end of spring break, however, led to a drop in occupancy during the second full week of April.

Occupancy for March was 54.6 percent, up from 45.3 percent in February. ADR was $106.08, up from $98.31 the previous month, and RevPAR was $57.87, up from $44.57.

“Occupancy and RevPAR were the highest for any month since February 2020, while ADR was the highest since March 2020,” STR said. “While year-over-year percentage changes show significant increases because of comparison with a pandemic-affected period in 2020, the country’s performance levels remained well below the pre-pandemic comparable of March 2019.”

Tampa, Florida, saw the highest occupancy level with 77.1 percent, 12.2 percent below the market’s benchmark from 2019. Miami had the next highest occupancy level with 72.7 percent, and the city also recorded the highest ADR at $248.26 and RevPAR at $180.36.

“Miami’s ADR level was just 1.9 percent lower than the pre-pandemic comparable,” STR said. “Markets with the lowest occupancy for the month included Boston at 35.7 percent and Minneapolis at 36.1 percent.”

For the week ending April 17, occupancy dropped to 57.3 percent after hitting 59.7 percent the week before. ADR reached $107.16, also down from $112.22 the previous week, and RevPAR was $61.37, down from $66.99.

“Following the end of spring break, weekly demand fell back below the 22 million mark, and occupancy dipped to its lowest level since mid-March. The ADR level was also $5 less after two straight weeks above $112,” STR said. “After elevated performance throughout the spring-break period, Florida saw its largest week-to-week decline in occupancy, 8 points, since early January. Most Florida markets that were trending above corresponding weeks from 2019 fell back when using that same comparison. Additional insights are available in STR’s Market Recovery Monitor.”

Tampa saw the highest occupancy for that week among the top 25 markets, too, with 77.7 percent, followed by Miami with 73.8 percent. Boston also had the lowest at 40 percent, followed by San Francisco with 41.1 percent. The top 25 markets together had slightly lower than average occupancy with 55.4 percent and higher ADR with $115.74.