NOVEMBER BROUGHT A little less for U.S. hotels to be thankful for compared to the prior month, according to STR, but also saw improvements over 2019’s performance. Meanwhile, with Christmas a week away, performance surpassed the comparable time period for 2019.

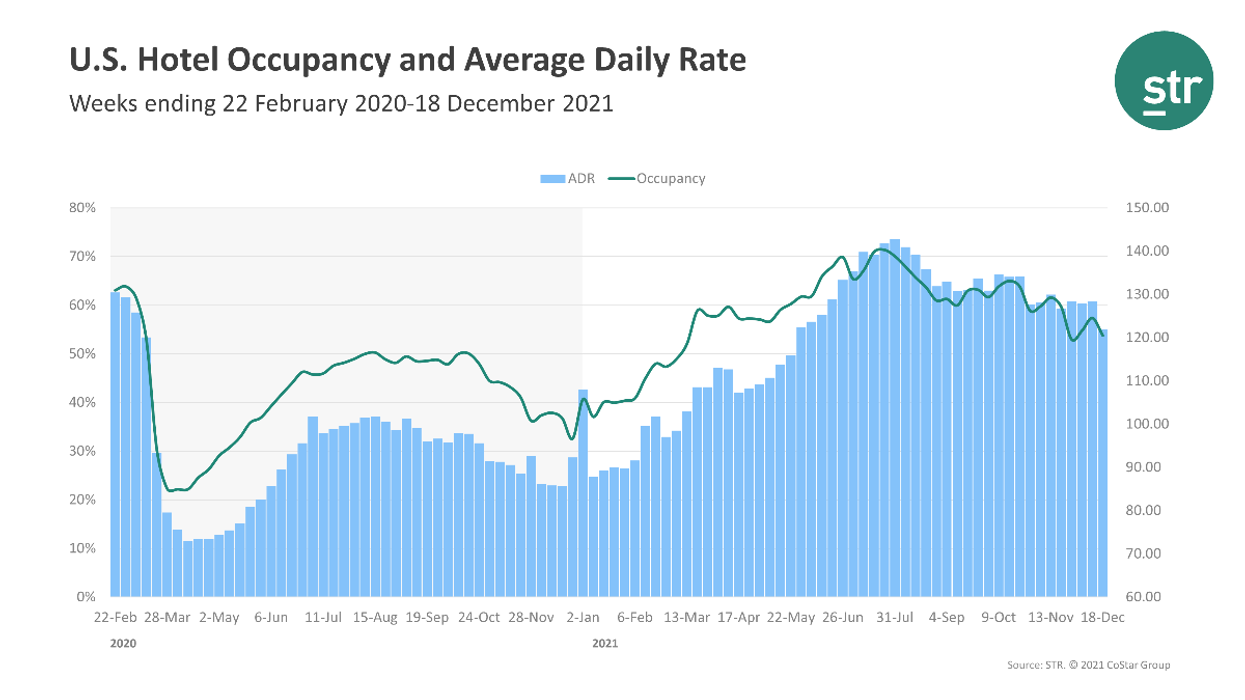

Occupancy for November reached 57.6 percent, down from 62.9 percent in October and down 6.2 percent compared to 2019. October’s occupancy was 8.8 percent lower than the same month in 2019. ADR was $128.50 for the month, lower than October’s $134.78 but 2.4 percent higher than November 2019.

RevPAR also was down on a month-to-month basis, $74.03 versus $84.75, but it was only down 3.9 percent from the same month in 2019 versus a 7.6 percent difference between October 2021 and October 2019.

New York City had the highest occupancy for the month among STR’s top 25 markets with 71.2 percent. That was still down 17.9 percent from 2019. None of the top 25 markets saw higher occupancy than 2019.

Minneapolis and St. Louis had the lowest occupancy for the month with 44 and 50.3 percent respectively. At the same time, Oahu Island in Hawaii reported the steepest decline in occupancy compared with 2019, down 34.9 percent.

Overall, the top 25 markets showed higher occupancy and ADR than all other markets.

As December passed the halfway mark, hotel performance surpassed 2019 levels. Occupancy was 53.8 percent for the week ending Dec. 18, down from 57.4 percent the prior week but up 7.7 percent from the comparable week in 2019. ADR was $121.87 for the week, down from $128.35 the prior week but up 11.6 percent from 2019. RevPAR reached $65.61, down from $73.73 the week before but up 20.2 percent from 2019.

“Percentage changes were in part lifted by the comparable week of 2019, ending Dec.21, being closer to Christmas,” STR said.

Norfolk/Virginia Beach, Virginia, saw the largest occupancy increase over 2019 among the top 25 markets, up 20.4 percent to 51.8 percent. New York City experienced the steepest occupancy decline from 2019, dropping 12.4 percent to 73.4 percent, but also reported the second-highest absolute occupancy level among the STR-defined U.S. markets.

New Orleans had the largest ADR increase compared with 2019, up 38.1 percent to $152.28. San Francisco/San Mateo, California, and Oahu Island had the largest RevPAR deficits with drops of 10.4 percent to $87.69 and 9 percent to $160.41 respectively.