GROUP TRAVEL CAME to the rescue for U.S. hotels during the second week of September, bringing occupancy up to a 4-week high, according to STR.

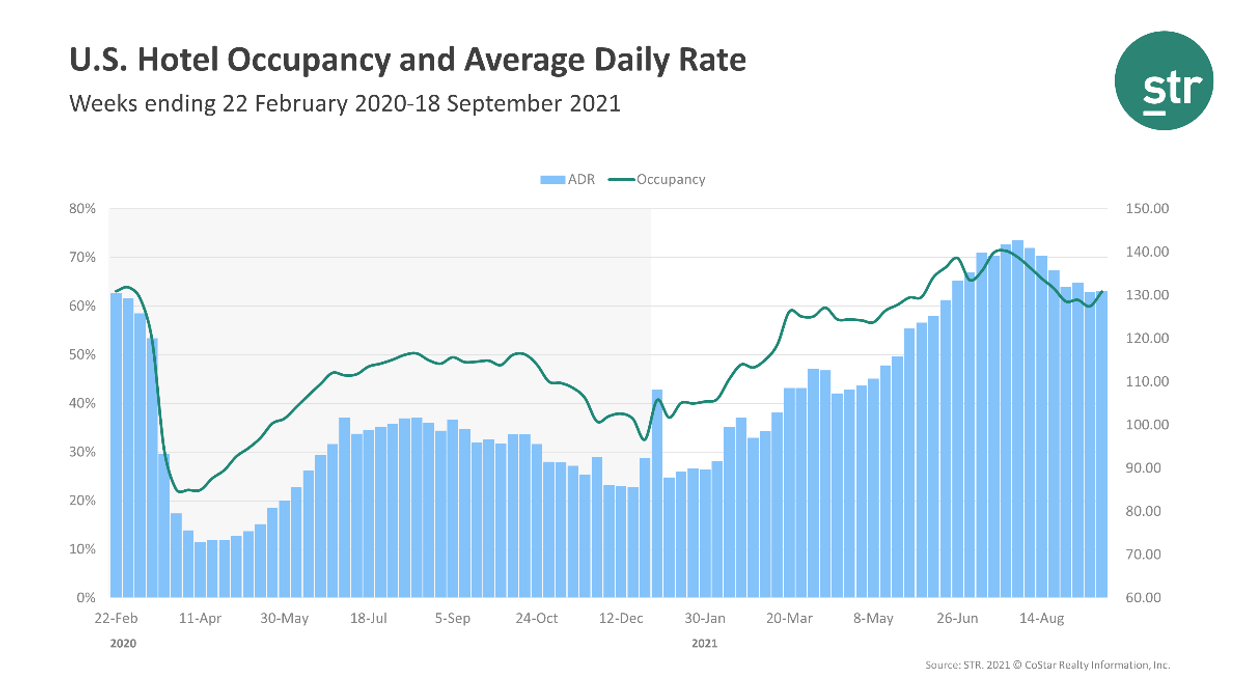

Occupancy reached 63 percent during the week ending Sept. 18, up from 60 percent the week before but down 11.6 percent from the comparable time period in 2019. ADR was $131.04, up from $130.82 weekly and down 2.6 percent from two years before. RevPAR rose to $82.50 on a weekly basis from $78.46 but dropped 13.9 percent from 2019 levels.

“The gain in occupancy was helped by weekly group demand eclipsing 1 million for the first time since the earliest days of the pandemic,” STR said. “More group demand created a lowering effect on ADR, as group rooms for upper-tier classes are typically priced lower than transient rooms.”

New Orleans was the top 25 market to see the highest occupancy gains over 2019, rising .3 percent to 72.6 percent, as well as RevPAR, up 18.2 percent to $114.37. Miami reported the largest ADR increase over 2019, up 22.5 percent to $166.04.

Oahu Island, Hawaii, experienced the steepest decline in occupancy from 2019 levels, dropping 43.9 percent to 49.6 percent. The largest RevPAR deficits were in San Francisco/San Mateo, California, which dropped 65.5 percent to $91.23, and Washington, D.C., which fell 53.1 percent to $ 69.87.