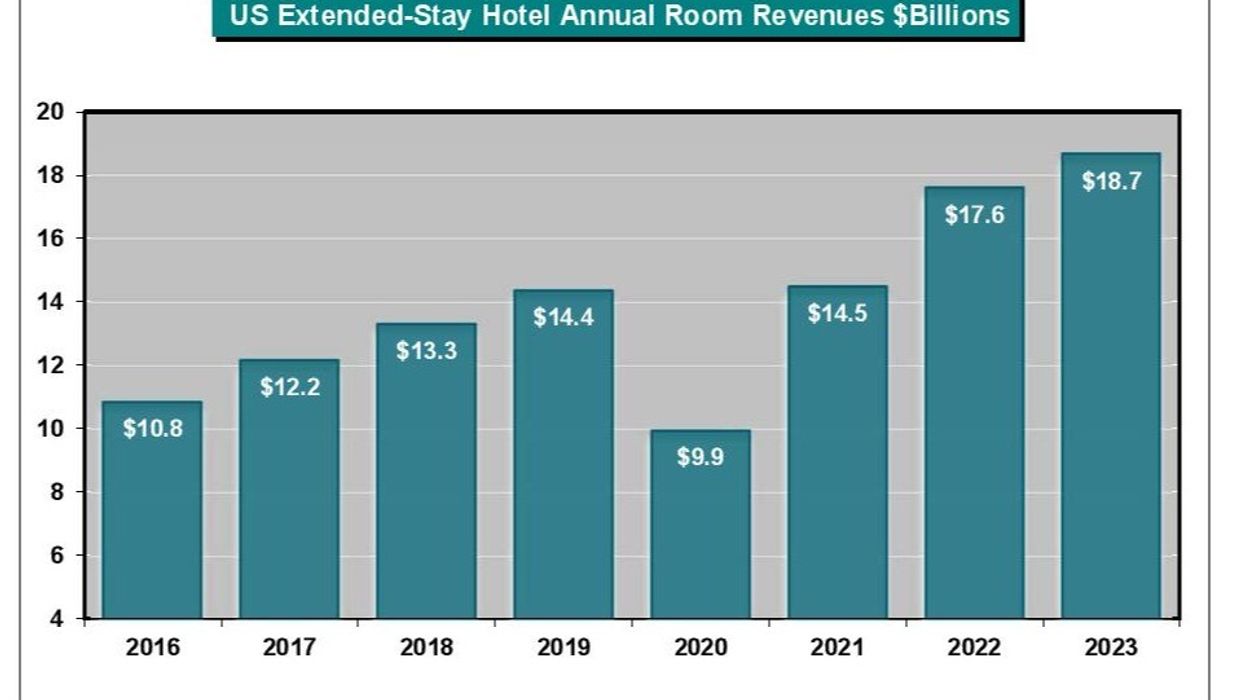

U.S. EXTENDED-STAY HOTEL room revenues increased by $1.1 billion in 2023, similar to 2018 and 2019, though with a lower relative gain due to a larger room base, according to The Highland Group. All three extended-stay segments reported record-high room revenues in 2023, with the upscale segment leading despite previously lagging behind the pandemic recovery.

The 6.1 percent increase in extended-stay hotel revenues outpaced the corresponding 5.5 percent gain reported by STR/CoStar for the overall hotel industry, the report said. However, extended-stay hotel supply experienced its smallest annual increase on record in 2023, at just 1.8 percent. Factors such as re-branding, de-flagging of non-compliant hotels, and sales to other sectors influenced supply fluctuations, a trend expected to persist into the first half of 2024, particularly with older extended-stay hotels remaining on the market.

The report also highlighted a 6.6 percent increase in economy extended-stay supply, alongside modest gains in mid-price and upscale segments, primarily driven by conversions. New construction in the economy segment is estimated at around 3 percent of rooms open compared to one year ago.

Rooms reported under construction rose by 53 percent in the past year, reaching a level comparable to three years ago, The Highland Group said. The economy and mid-price segments experienced the most significant increases in rooms under construction, coinciding with the launch and growth of five new brands in these sectors.

However, reporting inconsistencies suggest that not all rooms listed as under construction are actually in progress and slated for eventual opening.

Interest rates and inflation impact

Extended-stay hotel companies project a 4.1 percent compound average annual increase in rooms through 2028, according to the report. This uptick in projected supply growth, compared to a year ago, is attributed to the introduction and expansion of new brands in the economy and mid-price segments.

Overall, the total extended-stay supply growth projections align with the average annual increase observed from 2012 to 2017, following the previous construction trough in 2011/12.

However, given the current higher interest rates and inflation-adjusted construction costs compared to that period, supply growth projections are expected to fall below expectations, particularly in the near term.

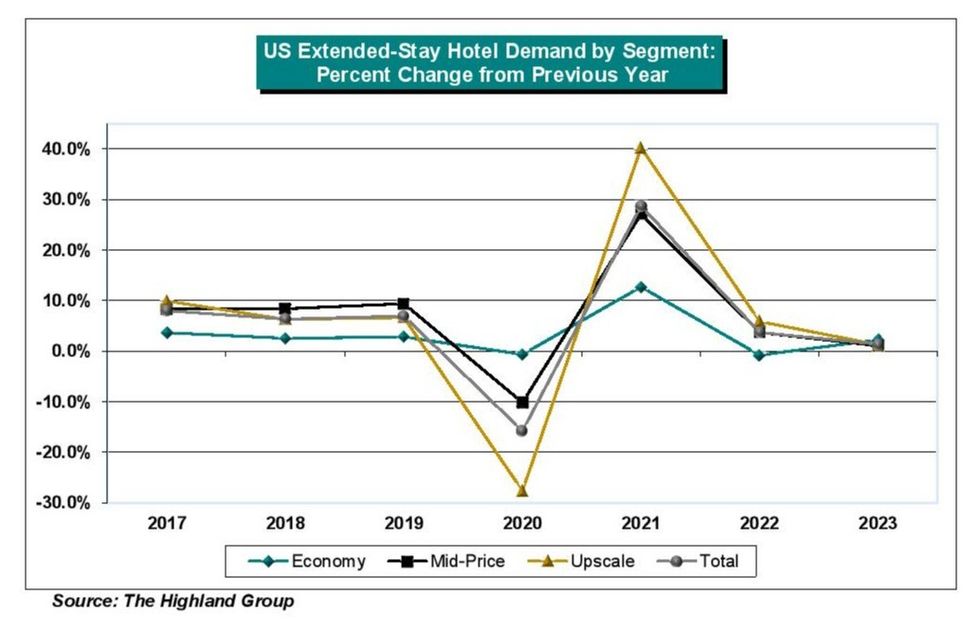

2023 extended-stay demand hits record

Extended-stay rooms represented approximately 9.3 percent of total room nights available at the end of 2019, The Highland Group said. Following the conclusion of pandemic-induced room supply distortions, extended-stay hotels have increased their share of national room night supply to 10.1 percent in 2023.

In 2023, extended-stay hotel demand reached a peak with a 1.4 percent increase, surpassing the overall hotel industry's reported 1 percent gain by STR/CoStar. However, this rise marks the smallest increase in demand in 25 years, excluding 2020 when extended-stay hotel demand dropped for the first time on record.

Notably, due to robust ADR growth during the pandemic recovery, occupancy in economy and mid-price extended-stay hotels declined in 2023, with the economy segment reporting its lowest annual occupancy since 2009, excluding 2020.

However, total extended-stay hotel occupancy stood 11.8 points higher than the overall hotel industry, albeit lower than the last three years, the report said. It remains approximately one and a half points above its average occupancy premium from 2016 through 2019.

In 2023, room revenues for all extended-stay hotel segments reached a peak, the report added. Excluding 2003, 2009, and 2020—years in which total extended-stay revenues declined from the previous year since 1999—the 6.1 percent revenue gain in 2023 was the smallest since 2008.

ADR growth decelerates

After double-digit gains in January and February, ADR growth decelerated for most of the remainder of 2023, following a 30 percent increase over the previous two years, the report said.

Extended-stay ADR growth by segment generally mirrors trends in the broader hotel industry. However, the 4.7 percent increase in total extended-stay hotel ADR exceeded the 4.4 percent gain reported by STR/CoStar for the overall hotel industry.

Economy extended-stay hotel RevPAR declined monthly after the first quarter of 2023, ending the year down by 1.6 percent. This decline trend was more pronounced for all economy class hotels, witnessing a 2.5 percent RevPAR contraction, according to STR/CoStar.

Mid-price extended-stay hotels outperformed all mid-price hotels, with STR/CoStar reporting a 3.1 percent gain in RevPAR compared to 2022, The Highland Group said. However, while the upscale segment recorded the highest RevPAR increase for extended-stay hotels, it fell behind all upscale class hotels, which achieved a 7.1 percent RevPAR growth, according to STR/CoStar.

The Highland Group recently reported that total extended-stay hotels achieved new fourth-quarter milestones in 2023, setting records in supply, demand, ADR, RevPAR, and room revenues. However, occupancy declined in line with the broader hotel industry trend, accompanied by slower growth in ADR and RevPAR throughout the year.