THE OCCUPANCY RATE in U.S. extended-stay hotels has roared back in April and May, with highest average occupancy this reported in May at 76.5 percent, according to a report from to hotel investment advisors The Highland Group. The segment also performed consistently well throughout the pandemic months of 2020.

The rate was 73.5 percent and 71.9 percent in April and March respectively. The Highland Group report showed a 12.5 percent increase in room supply, which reflects both new construction and the reopening of hotels closed during the pandemic. The supply growth rate will decline during 2021 as most extended-stay hotels closed during the pandemic reopened before the end of 2020.

“Economy and mid-price extended-stay hotels have more than recovered revenue lost during the worst of the pandemic,” the report said. “While upscale extended-stay hotels are recovering faster than all upscale hotels, high room concentration in urban centers and a greater proportion of demand from white collar business travelers are key headwinds to recovery compared to economy and mid-price extended-stay hotels.

“However, the summer months are usually the best performing for upscale extended-stay hotels and they are likely to benefit most from the expected seasonal surge in domestic leisure traveler demand.”

STR reports all hotel room revenue was up more than 200 percent in May 2021 compared to one year ago.

Upscale extended-stay hotels endured the largest fall in demand and are now leading the demand recovery, as the segment reached 13.07 million room nights in May, up by 9 percent when compared to April 2019. While the growth in the segment is lower than the 79 percent gain STR reported for the overall hotel industry in May, the 17-percentage point occupancy premium compared to all hotels remains well above its long-term average.

Also, upscale extended-stay hotel occupancy growth was higher than the overall hotel industry in May.

The 11.5 percent increase in ADR in May 2021 in the economy segment was the strongest monthly gain since December 2020.

“The mid-price segment reported the largest gain in ADR, partly because it had posted the steepest monthly fall in ADR one year ago,” the report said. “The segment’s ADR was 93 percent of its nominal value in May 2019. Because the overall hotel industry lost far more RevPAR than extended-stay hotels, its RevPAR growth in May 2021 compared to May 2020 was almost twice as much as extended-stay hotels.”

The April report stated that extended-stay hotel RevPAR approached 90 percent of its nominal value in April 2019. With economy extended-stay hotel monthly RevPAR already 13 percent higher in April than two years ago, coupled with rapid gains in mid-price and upscale segment RevPAR recovery indices, the RevPAR recovery is about double the pace compared to the past two downturns, it noted.

Extended-stay occupancy returned to its April 2019 level this April. But it took about four years for extended-stay occupancy to recover to its previous high following the 2001/2 and 2008/9 recessions.

Path to recovery

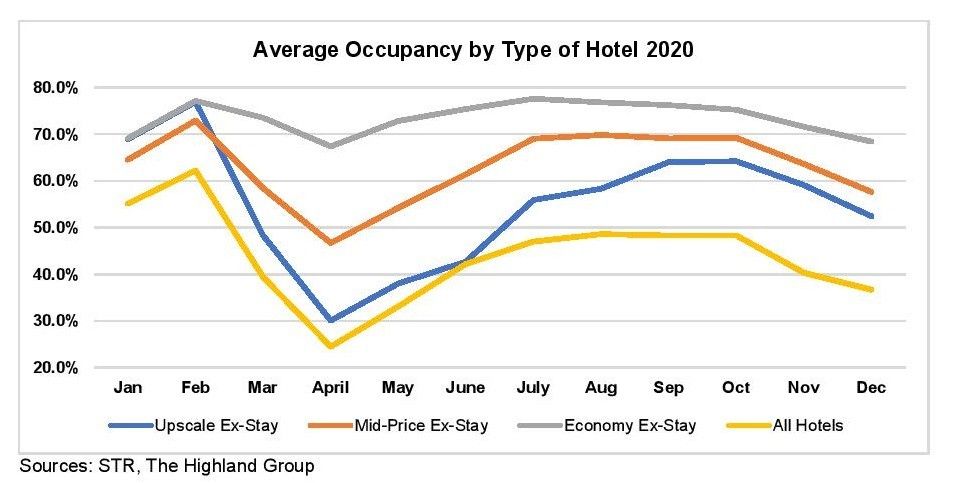

During 2020, the occupancy achieved by upscale extended-stay hotels over all upscale hotels was about 12 percentage points, which is about double its historical average. The premium has risen markedly in 2021.

The Highland Group report highlighted that extended-stay hotels weathered the impact of the COVID-19 pandemic far better than the overall hotel industry across all performance metrics. Like the broader hotel industry, extended-stay hotels have suffered the greatest revenue losses at higher price points. However, when compared to hotels of the same class, extended-stay hotels have performed much better, it said.

Extended-stay hotels began 2020 with a 12 to 13 percentage point occupancy premium over the all-hotel average which is within the 10 to 15 percentage point range reported over the last 20 years. During contractionary periods, extended-stay’s occupancy premium tends to widen and, at 17.8 percentage points in 2020, it was the widest ever reported.

The occupancy premium peaked at 23 points in November 2020 and averaged 20 points for the second half of the year.

“Upscale extended-stay hotels have a stronger correlation with the overall hotel industry than economy and mid-price segments. The trajectory of the upscale segment’s early RevPAR losses was very similar to the overall hotel industry through August. Less aggressive rate discounting was the main reason the difference between upscale extended-stay and all-hotel RevPAR declines widened during early fall.

Aggressive rate discounting helped mid-price extended-stay hotels cushion RevPAR losses in the second quarter of 2020.

“As occupancy strengthened, mid-price and upscale extended-stay hotels decelerated rate reductions for most of the second half of the year despite the overall hotel industry increasing rate cuts in the fourth quarter,” the report said. “Economy extended-stay hotels reduced discounting consistently from June through November and was the only segment of the hotel industry to report month-on-month ADR growth in December 2020.”

Extended-stay room supply growth averaged 6.7 percent annually from 2016 through 2019 with growth beginning to peak in 2020. However, the start of the pandemic closed and delayed construction of many extended-stay hotels. This occurred mainly in the mid-price and upscale segments. They have the highest levels of new construction and incurred far greater revenue loss than economy extended-stay hotels which suffered only negligible closures.

Meanwhile, the economy segment posted month-on-month supply growth throughout 2020 but the rate of increase remains slightly below the 2.9 percent annual average from 2016 through 2019.

The report said that the supply growth in mid-price segment growth picked up to its pre-pandemic level from August 2020. At the same time, upscale extended-stay supply increased but remained significantly below the 7.4 percent annual average from 2016 through 2019.