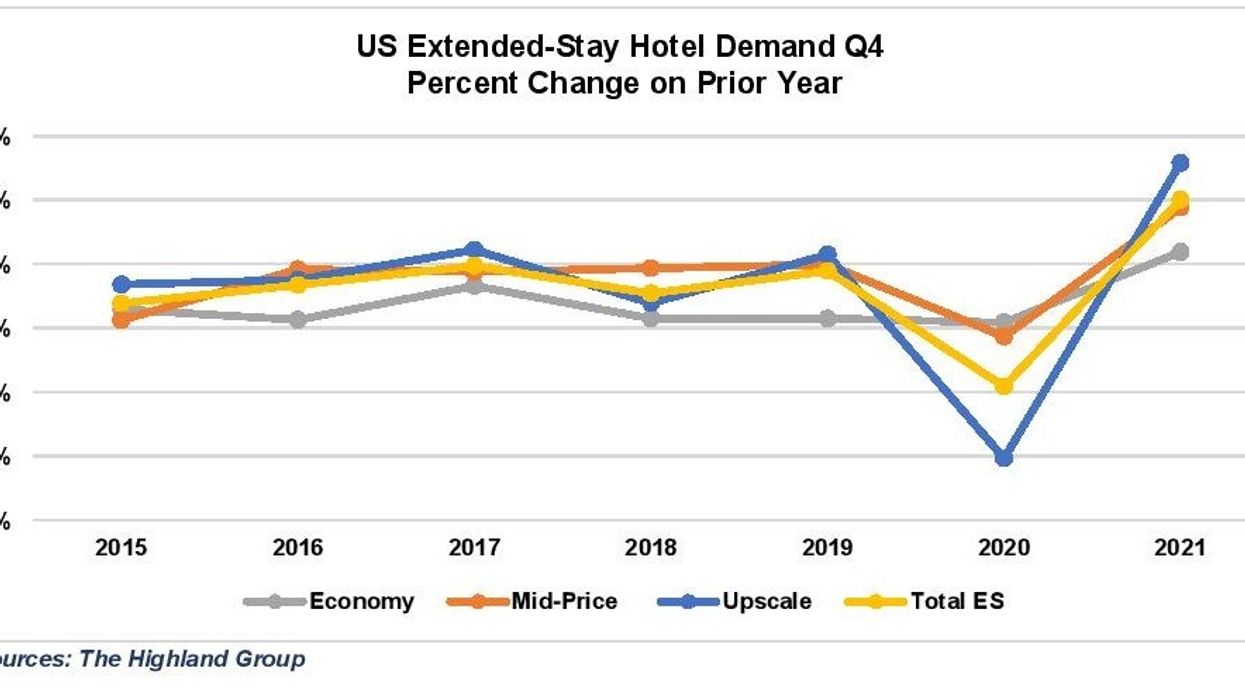

DEMAND FOR U.S. extended-stay hotels in the fourth quarter of 2021 was more than five times greater than supply, resulting in overall occupancy just below its 2019 peak, according to the Highland Group. December’s monthly report from the group also showed the segment to be firmly in recovery.

According to the research consulting firm’s “U.S. Extended-stay Hotels: Fourth quarter 2021” report, the bottom up recovery continues with economy and mid-price extended-stay hotels in the fourth quarter posting record nominal average rate and RevPAR.

Demand in the fourth quarter is at a record high and room revenues are almost 97 percent of their nominal high reached during the same period in 2019, the report said.

Occupancy and ADR remain 4 to 5 percentage points off previous high levels but should pick up in the near term as the demand change was six times the corresponding change in supply, it added.

"Supply gain at 3.8 percent was the slowest quarterly increase for all quarters since 2015. The recent supply growth rate in the economy segment is generally consistent with the segment’s average gain over the last six years. However, mid-price and upscale segment supply growth has fallen well below their six-year average," the report said. "All extended-stay hotel segments reported demand growth. The upscale segment recorded the largest disparity with demand growth running close to nine times its average fourth quarter gain over the last six years."

According to the report, extended-stay room revenues are at an all-time high during the period and greater than 11 percent above the previous record two years ago. The mid-price segment has seen the strongest revenue recovery.

"At 72.8 percent, extended-stay hotel average occupancy was one of the highest fourth quarter values ever reported and almost 15 percentage points higher than the 57.9 percent STR reported for the overall hotel industry. Extended-stay hotels’ occupancy

premium compared to the overall hotel industry has stayed well above its longer-term average for the last two years. Only the upscale segment has ADR below its nominal Q4 value in 2019," the Highland Group report further said.

Extended-stay hotel RevPAR during the period was about 2 percent higher than its 2019 peak. According to STR, the overall hotel industry RevPAR was about 1 percent below the peak attained in the fourth quarter of 2019.

However, upscale extended-stay hotels are lagging with fourth quarter RevPAR about 10 percent lower than in 2019.

"One of the main reasons for this is the relatively high concentration of upscale extended-stay rooms in the urban sub-markets of gateway cities. While, upscale extended-stay hotel’s RevPAR recovery is ahead of all upscale hotels which STR reported at 12 percent below their 2019 levels in the fourth quarter," the report said.

Strong recovery finish in December

The “Highland Group US Extended-Stay Hotels Bulletin: December 2021” report said that extended-stay hotels registered a strong recovery finish in December last year compared to the last month of 2019.

According to the report, all three segments reported a monthly revenue recovery index above 100 percent for the first time in 2021 and all recovery indices except upscale segment occupancy were higher in December than in November.

The collective recovery indices of U.S. extended-stay hotels exceeded 100 percent in November.

With the mid-price segment leading, ADR growth was the dominant driver of gains in nominal RevPAR but economy and mid-price segments also reported significant gains in occupancy indices in December, the report said.

"The 3.3 percent increase in extended-stay room supply in December is the lowest monthly gain last year. December’s supply change further indicated that midprice and upscale supply growth should be well below pre-pandemic levels during the near term," the report added.

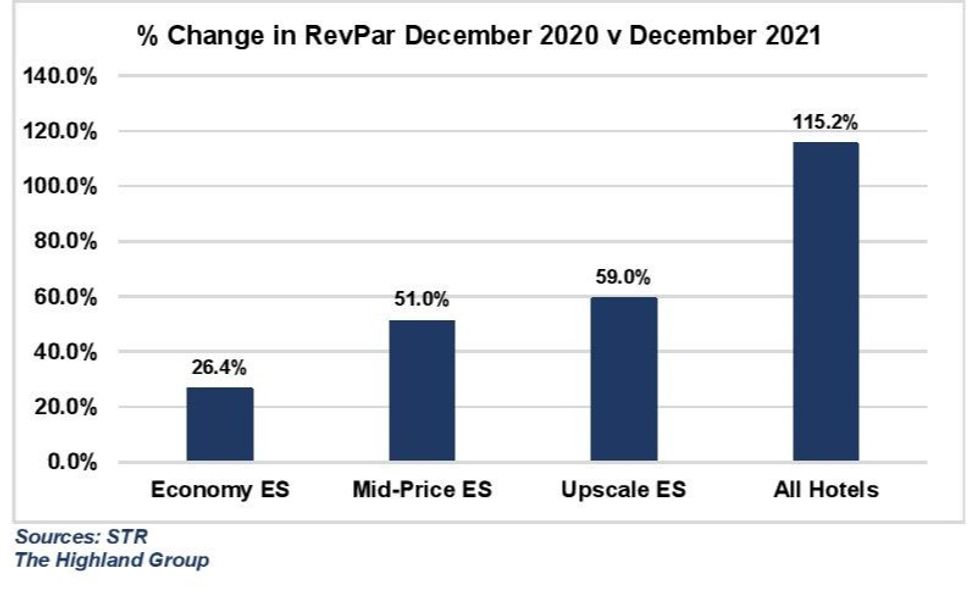

STR reports all hotel room revenue was up 124 percent in December 2021 compared to a year ago.

"Extended-stay hotel demand exceeded 11 million room nights in December 2021, up 14 percent when compared to 2019. Overall hotel occupancy gained more than extended-stay hotels in December, decreasing extended-stay hotel’s occupancy premium to 14.6 percentage points. However, the premium remains above its long-term average," the report added.

"Mid-price extended-stay hotels continued to lead the ADR recovery in December. ADR recovery indices in December were at their highest monthly level in 2021. The upscale segment continued leading the extended-stay RevPAR recovery during the month. The

RevPAR growth in December 2021 compared to a year ago was more than doubled," the report further said.