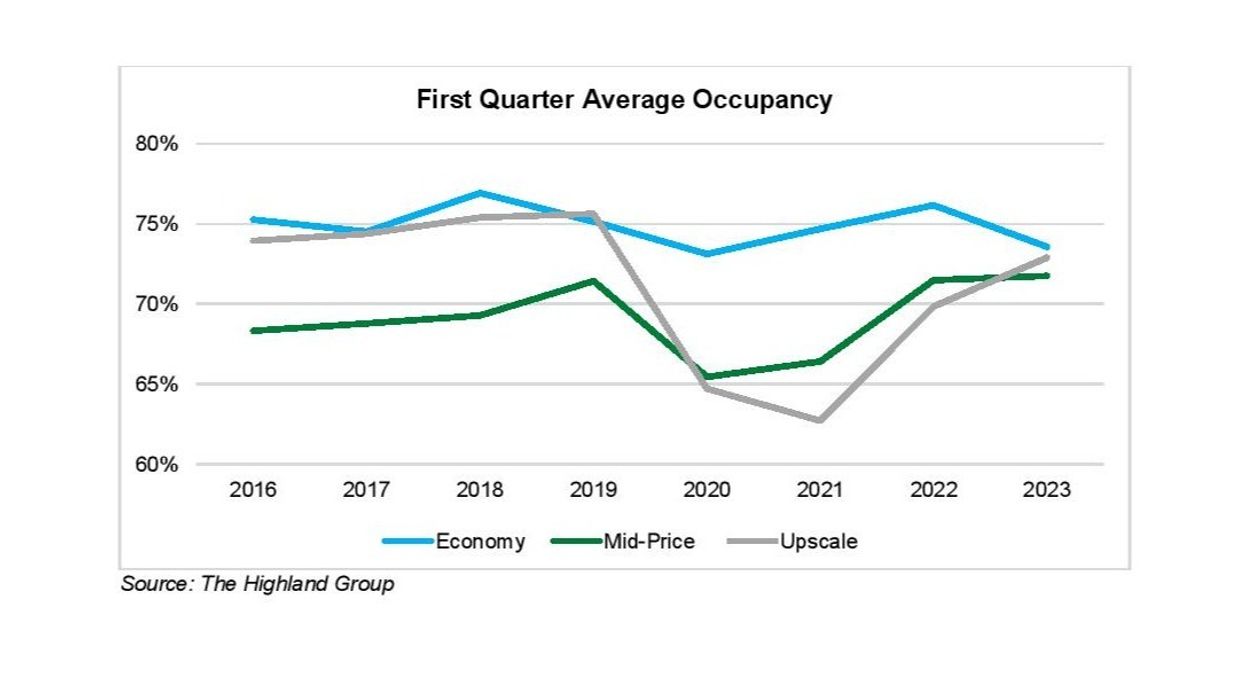

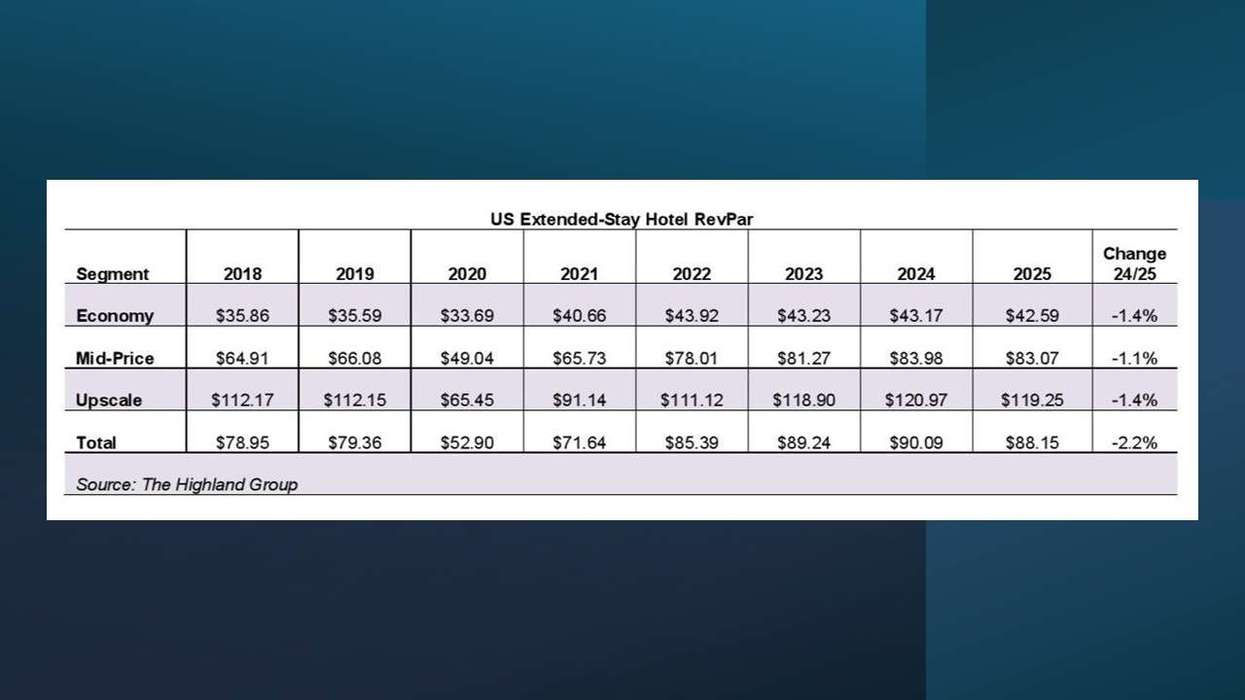

REVPAR FOR U.S extended-stay economy, mid-scale and upscale segments is recovering back to pre-pandemic levels, according to a report from consulting firm The Highland Group. Total extended-stay hotel occupancy is very close to the first quarter levels reported in 2016 and 2017 but below its peak years since 2015.

“Overall, first quarter extended-stay hotel ADR was the highest ever reported in 2023 and all three segments have more than fully recovered their 2019 nominal ADR values,” the report said.

In its “2023 First Quarter U.S. Extended-Stay Hotels Report,” Highland said the economy and mid-price extended-stay hotels made considerable gains in RevPAR relative to corresponding classes of all hotels between 2019 and 2023.

Due to high concentration of rooms in urban markets, upscale extended-stay hotels have seen RevPAR decline slightly relative to all upscale class hotels. However, the gap is expected to narrow as urban markets make a full recovery, the report noted.

“Rising interest rates and construction costs, as well as tightening loan underwriting, means extended-stay supply growth should be relatively low nationally for two to three years. Assuming the overall hotel industry does not endure a correction, extended-stay hotels should set more new performance records during the near term at least,” says Mark Skinner, partner at The Highland Group.

In the fourth quarter of 2022, U.S. extended-stay hotels set new records for demand, ADR, RevPAR and room revenues. Mid-price and upscale extended-stay hotel segments reported record high demand during the quarter, The Highland report showed in February.

Occupancy peaks

According to the report, total extended-stay hotel occupancy is very close to the first quarter levels reported in 2016 and 2017 but below its peak years since 2015. In 2023, mid-scale extended-stay hotels reported their highest first quarter average occupancy in more than 20 years.

The pandemic had a far greater impact on mid-scale and upscale segment occupancy with the latter growing the fastest over the last two years, the report said.

“Upscale is the only extended-stay segment not to have recovered occupancy to 2019 and it remains under its first quarter level from 2016 through 2019,” he said.

Additionally, although economy extended-stay segment first quarter occupancy surpassed 2019 last year, the decline over the last 12 months means first quarter 2023 occupancy was the segment’s lowest since 2010, the report revealed.

ADR zooms

Overall, first quarter extended-stay hotel ADR was the highest ever reported in 2023 and all three segments have more than fully recovered their 2019 nominal ADR values.

Although recent economy segment ADR gains have not been as rapid as mid-scale or upscale segments, at 25.4 percent, its ADR growth since 2019 is the largest and it was the only segment to not report an ADR decline in first quarter 2020 compared to the previous year, the report further said.

Consistent with the overall hotel industry, extended-stay hotel quarterly RevPAR growth is slowing compared to the first half of 2022, the report said, adding that the 12.3 percent gain in first quarter was a slight uptick on RevPAR increases in the second half of last year.

New trends

Extended-stay hotel’s occupancy premium above the overall hotel industry averaged 11.6 percentage points from 2016 through 2019, which is typical over the last 25 years.

“The premium tends to rise during contractionary periods, and it widened during the pandemic-induced downturn, peaking at 20 percent in first quarter 2021, and posting a 13-percentage point premium in first quarter 2023,” Highland said.

Extended-stay hotels increased ADR slightly faster than the overall hotel industry from 2016 through 2019. Relative growth accelerated in 2021 with the ratio peaking at 83 percent before declining to 77 percent in first quarter 2022 as the overall hotel industry recovered ADR more quickly due to much deeper losses during the pandemic, it added.

Relative RevPAR followed a similar trajectory, accelerating gains made from 2016 through 2019 and peaking at a ratio of 119 percent in first quarter 2021. As the overall hotel industry recovered RevPAR more quickly, extended-stay hotel’s RevPAR ratio declined to 95 percent in first quarter 2023 which is the same as in 2019, Highland data showed.

Advantage economy

Economy extended-stay hotel’s 123 per cent RevPAR recovery ratio compared to 2019 is the highest in the hotel industry. The segment, which was the first to report a full rebound in 2021, led the recovery through 2022 and made considerable gains against economy hotels overall, according to Highland.

The report said mid-scale extended-stay hotels have made significant gains when compared to all mid-scale hotels.

“In the first quarter of 2019, the ratio of mid-scale extended-stay hotel RevPAR to all mid-scale hotel RevPAR was 102 percent,” the report said. “Four years later it was 109 percent despite far higher supply growth over the period.”

Upscale extended-stay hotels lagged in overall extended-stay recovery mainly because of a relatively high concentration of rooms in urban sub-markets, the report said.

“At 105.8 percent RevPAR recovery, this segment is slightly behind all upscale hotels,” it said. “Upscale extended-stay hotels have also recorded a small decline in RevPAR relative to all upscale hotels since 2019.”

Rooms tally

According to Highland, there were 572,740 extended-stay hotel rooms open at the end of the first quarter 2023. Excluding 2020, which the pandemic distorted, the 8,344 net gain in rooms open over the last year was the lowest annual increase since 2012 and less than half the gain in 2022 compared to 2021.

“Room nights available increased 1.5 percent over the last year. Quarterly supply comparisons are still impacted by re-branding moving rooms between segments in our database, de-flagging of hotels which no longer meet brand standards, as well as the sales of some hotels to multi-family apartment companies and municipalities,” the report said.

This will dissipate later in 2023 but the full year increase in supply compared to 2022 will remain well below the long-term average. “Mid-price and upscale extended-stay hotel segments reported record high demand in first quarter 2023 with total extended-stay demand increasing at almost twice the rate of supply over the last 12 months,” the report further added.

However, generally consistent with all economy class hotels, economy extended-stay segment demand declined 2.2 percent in first quarter 2023 compared to the same period last year. The strongest ADR increases ever reported over the last two years are likely to have contributed to the decline in economy segment demand, Highland noted.

Although it had the slowest revenue gain over the last year, in 2023 the economy extended-stay segment reported its fourteenth consecutive record for first quarter revenues. Mid-price and upscale segments recorded their second successive record for first quarter revenues.

At almost 14 percent, the total extended-stay hotel quarterly revenue gain is one of the smallest over the last two years and similar to rates of increase made during the period the third quarter of 2014 through 2015’s third quarter, the report said.