CONSUMERS ARE EXPECTED to reprioritize travel in 2024, albeit with demand fluctuations for various products and amenities in 2024, according to Deloitte's 2024 Travel Outlook. The report says hospitality providers need to enhance the experiences they offer or risk losing travelers' attention. Those adept at applying technology to create personalized and flexible services will do better than others this year.

The pent-up demand seen following the pandemic that led to travel surges in the prior two years is dwindling, the report said. It’s being replaced, however, by a steady increase in traveling for experiences, aided in some cases by the increased prevalence of remote working, meaning travel remains a priority for many consumers.

An economic downturn could dampen that enthusiasm, according to the Travel Outlook. However, technology can help provide the flexibility to offer affordable, personalized packages that may compensate for consumers’ responding parsimony.

U.S. travel industry resilience

The U.S. travel industry has shown resilience amid financial uncertainty, with consumers prioritizing experiences and exploiting flexible work arrangements, Deloitte said in its report. In both the summer of 2023 and the recent holiday season, there was an increase in budgets and the intent to stay in hotels compared to 2022.

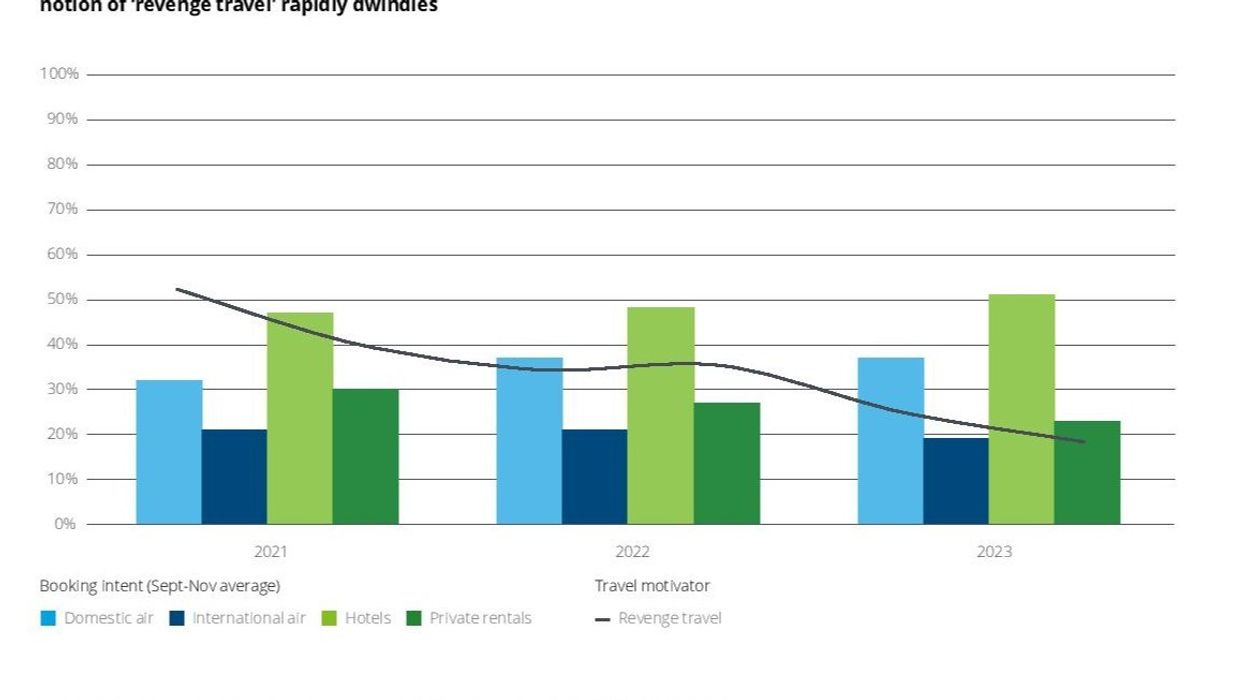

According to the report, "revenge travel" fueled demand for two years as Americans sought escape from lockdowns and made up for missed trips due to the pandemic. In 2021, nearly half cited the need for an escape, and by the 2023 holiday season, only 11 percent were compensating for missed trips.

As Americans move on from revenge travel, travel intent remains robust, the report said. The interest in booking hotels and domestic flights holds steady, with more planned trips in 2023 compared to the previous year during both summer and holidays. While pent-up demand fades, the desire to travel and the outlook for 2024 remains strong.

One in five individuals increasing their travel budgets said travel spending has become more important to them since the pandemic, signaling a positive outlook for 2024, according to Deloitte. Even those who stayed home or reduced budgets previously said they had larger plans for the coming year. Also, baby boomers' recent return to travel serves as a positive signal for the industry, with three in 10 boomers who reduced their 2023 holiday travel budgets now saving up for future trips.

At the same time, concerns about an economic downturn continue and that event could slow consumer interest, particularly among those in lower-income households, according to the report. Effects could include travelers curtailing the number, distance or length of trips, and some may also opt for staying with relatives or friends rather than paying for lodging.

Also, while business travel remains strong, Deloitte’s report said surveys have found that 86 percent of corporate travel managers said that airfares had affected their companies’ ability or willingness to travel in 2023, just as 85 percent said in 2022. Still, Deloitte anticipates that “U.S. corporate travel spend is still likely to finally pass the pre-pandemic line within the next year.”

Technology to the rescue

Technology is affecting travel trends in several ways, Deloitte said. For example, the share of travelers planning to work on their longest leisure trip has risen from about 1 in 5 in 2022 to 1 in 3 in 2023. The report found that 47 percent of “laptop luggers” take more shorter trips and 27 percent took longer trips while “disconnectors” mostly preferred fewer, shorter trips or more shorter trips.

Those willing to work on vacation also are more likely to seek local activities, visit attractions and take guided tours, according to the report. In terms of lodging needs, they are more likely to seek convenient workspaces and access to amenities.

The Deloitte report also suggested the need by airlines and hospitality providers to enhance the experiences they offer travelers can be aided by advances in marketing technology. It also is likely to involve continued investment in back-office technology and generative artificial intelligence, or Gen AI, to improve operational efficiency and better align resources with demand.

The findings are based on Deloitte's research on leisure and corporate travel, coupled with data from its monthly ConsumerSignals survey.

In May, Motel 6 and Studio 6 surveyed over 2,000 Americans planning travel in 2023 and found that 70 percent intend to embark on longer excursions, traveling over three hours from their hometown.