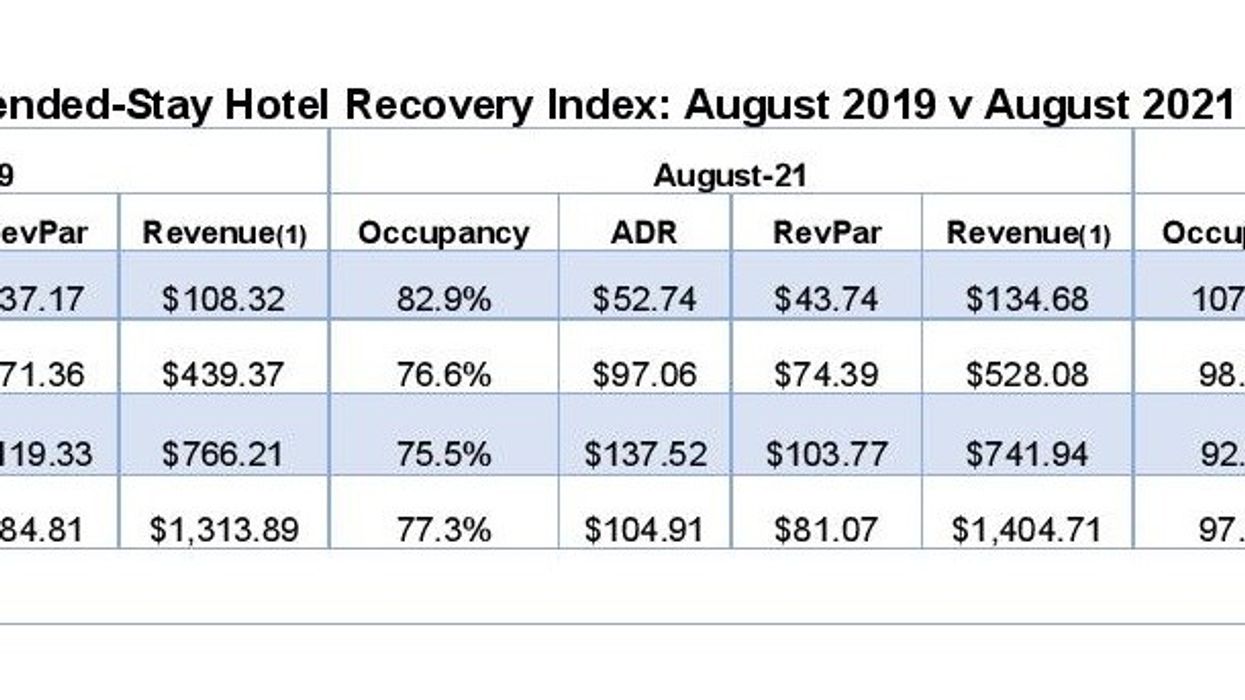

RECOVERY IN ECONOMY and mid-price extended-stay hotels continued in August as in July, according to a report from hotel investment advisors The Highland Group. However, occupancy in upscale extended-stay hotels declined about 5 percentage points mainly due to the tapering of the seasonal surge in leisure travel.

ADR for extended-stay hotels stabilized in August, but RevPAR and revenue recovery indices contracted, the U.S. Extended-Stay Hotels Bulletin: August 2021 report said. The average occupancy in U.S. extended-stay hotels hit the high point for 2021 in July at 81.8 percent.

According to the report, the 6.6 percent increase in extended-stay room supply in August was the lowest monthly gain in 2021, reflecting the declining uptick to supply growth from reopening hotels closed during the pandemic.

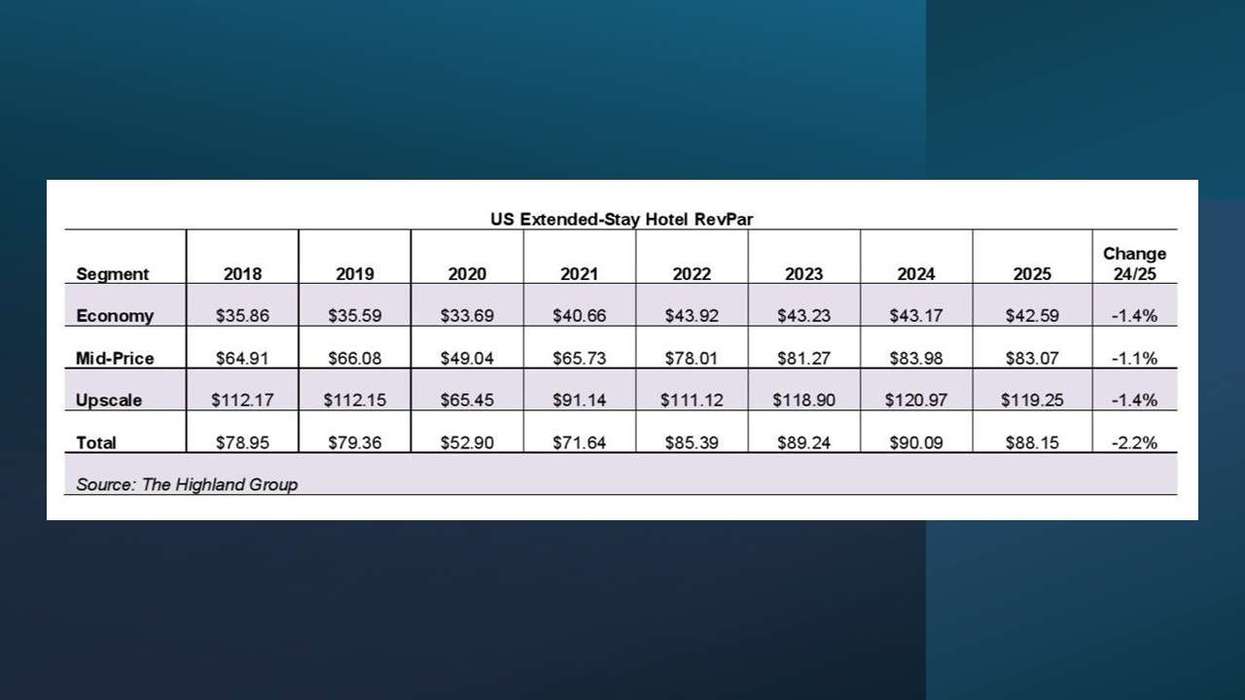

“The overall hotel industry lost far more revenues than extended-stay hotels in 2020, so it is now recovering them relatively quickly. Upscale extended-stay hotels endured the largest fall in demand and are now leading the demand recovery,” the report added.

STR reports all hotel room revenue was up 83 percent in August compared to a year ago.

Extended-stay hotel demand reached 13.39 million room nights in August, 9 percent higher than July 2019 level.

“The waning boost from summer travel impacted overall hotel industry occupancy more than extended-stay hotels, widening extended-stay hotel’s occupancy premium to 14 percentage points. The premium has stayed above its long term average for most of the last 18 months,” the report said. “August gains in ADR for economy and mid-price segments were generally consistent with July’s growth. For the first time since the recovery began, the upscale segment led ADR growth in July. However, the decline in peak summer room rates constrained the segment’s rate increase in August.”

RevPAR growth for the overall hotel industry in August 2021 was more than 50 percent greater than extended-stay hotels when compared to same period last year because of the steep decline in RevPar in the general category in 2020, the report further said.