- Extended-stay hotels are stabilizing, The Highland Group reported.

- RevPAR fell 2.1 percent, the smallest decline since April.

- Occupancy fell for the 12th consecutive month.

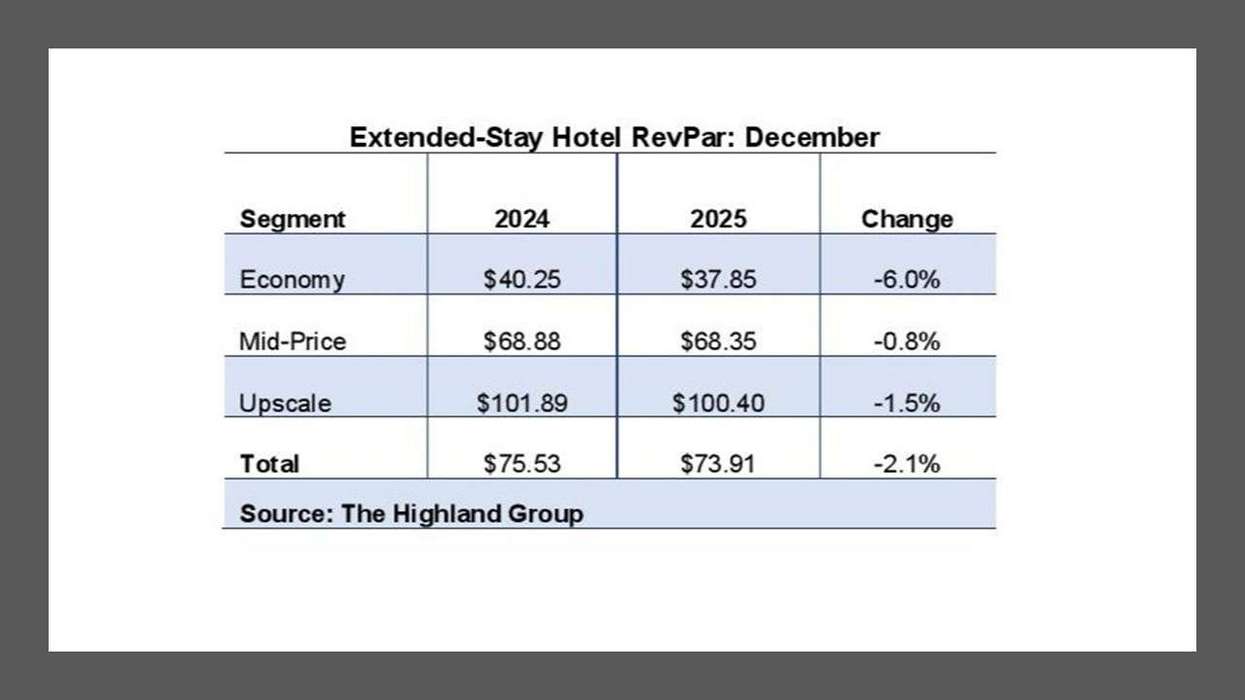

EXTENDED-STAY HOTEL SHOWED signs of stabilizing in December, with RevPAR falling 2.1 percent, the smallest monthly decline since April, according to The Highland Group. Additionally, extended-stay occupancy was 14.6 percentage points above the overall hotel industry.

The Highland Group’s “US Extended-Stay Hotels Bulletin: December 2025” attributed the limited RevPAR decline to a 0.7 percent drop in occupancy, the 12th consecutive monthly decline and below the 1.1 percent loss for all hotels. Total extended-stay room revenues rose 2.8 percent year-over-year, the largest monthly increase since March 2025.

Room nights sold increased 4.3 percent, more than double the trailing 12-month average. By comparison, total hotel industry demand rose 0.1 percent over the same period.

“December’s extended-stay hotel performance metrics provided an early signal that the nadir of monthly RevPAR losses is approaching,” said Mark Skinner, partner at The Highland Group.

Performance, supply and outlook

Economy extended-stay hotels had the largest ADR decline, but their RevPAR fell less than all economy hotels, which dropped 6.3 percent in December. Mid-price extended-stay hotels saw a slight ADR increase, while all mid-price hotels declined 1.4 percent. Upscale extended-stay hotels had ADR down 1.5 percent, resulting in a larger RevPAR decline than the overall upscale segment.

Extended-stay room supply rose 5.1 percent year-over-year in December, matching November and the largest monthly increase since February 2020, excluding pandemic-related closures and reopenings. Year-to-date supply growth in 2025 was about 3.7 percent, above the 1.8–3.1 percent range of the last three years but below the long-term average of 4.9 percent.

Excluding luxury and upper-upscale hotels, total hotel RevPAR fell 1.7 percent and room revenues rose 0.8 percent year-over-year. Extended-stay hotels performed better across most metrics, particularly in the economy and mid-price segments.

December metrics indicate extended-stay hotels are handling ADR pressures better than the broader market. Demand growth, moderate occupancy losses and higher revenues suggest the sector is stabilizing after months of RevPAR declines. Supply growth continues but remains below long-term averages, limiting the risk of oversaturation.

The data show extended-stay hotels outperforming, with economy and mid-price segments ahead of peers and indicate potential improvement in early 2026 as RevPAR losses may have bottomed.

The Highland Group found that economy extended-stay hotels had smaller RevPAR declines than all economy hotels for six consecutive months through November. Midscale extended-stay hotels’ RevPAR fell about two-thirds as much as all mid-price hotels over the past three months.