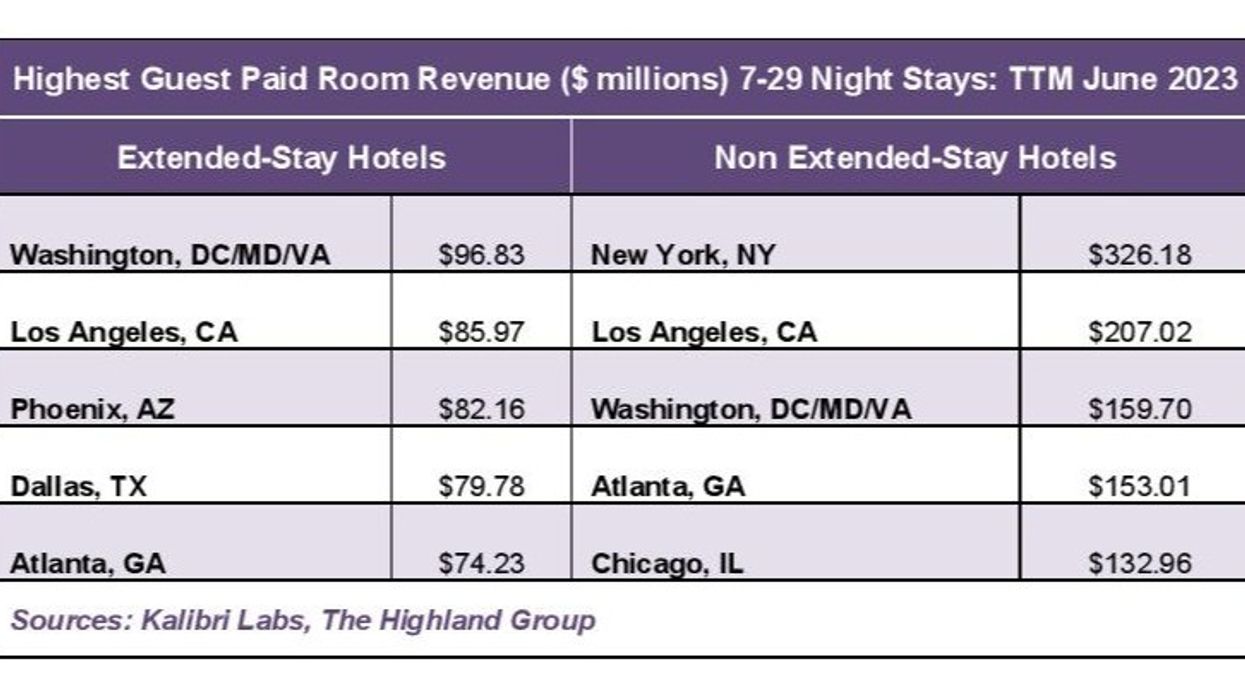

EXTENDED-STAY ROOM revenues in traditional hotels outperformed those in extended-stay hotels by 21 percent, indicating potential for further development in the extended-stay sector, according to consulting firm The Highland Group and Kalibri Labs. For the 12 months ending June 2023, guest-paid room revenue for stays of seven consecutive nights or more totaled $8.97 billion in traditional hotels, compared to $7.39 billion in extended-stay hotels.

“Traditional hotels are still accommodating more extended-stay demand than extended-stay hotels despite the latter’s substantial gains in market share over the last 25 years,” said Mark Skinner, partner at The Highland Group.

Accommodated room nights tallied 74.3 million and 72.2 million, respectively. Nationally, extended-stay demand (ESOC) constitutes 53 percent of extended-stay hotels. In traditional hotels, ESOC is 13 percent, yet the room count is tenfold compared to extended-stay establishments, the report said.

“Despite the growth in extended stay during the pandemic, in the current lodging environment we expect continued expansion of this segment for the foreseeable future,” said Mark Kren, director of real estate and investment reporting at Kalibri Labs.

Extended-stay guests, defined as those staying seven nights or longer, contributed to 72.18 million room nights in extended-stay hotels for the 12-month period ending June 2023. Meanwhile, traditional hotels recorded 74.27 million extended-stay room nights, marking a difference of over two million, the report said.

In nine markets covered in this report, traditional hotels cater to higher extended-stay demand than extended-stay hotels. Nationally, extended-stay hotels average a 53 percent demand share (ESOC) from extended-stay guests, while traditional hotels estimate around 13 percent.

Stay duration and discounts

The average length of stay for extended-stay guests in extended-stay hotels and traditional hotels was 25 and 14 nights, respectively. Over the 12 months ending June 2023, extended-stay hotels offered a 22 percent rate discount compared to traditional hotels for guests staying 7 consecutive nights or more.

According to the report, for guests staying 7-29 nights and 30+ nights, the corresponding discounts were 10 percent and 3 percent. Extended-stay guests staying in extended-stay hotels book 17 days in advance, on average, compared to 18 days in traditional hotels.

Market dynamics

For guests staying 30 nights, the differential remains consistent. However, for stays spanning 7-29 nights, advance bookings at extended-stay hotels average 15 days, in contrast to 20 days at traditional hotels. Reservation costs in extended-stay hotels average 5.7 percent of guest-paid revenues, while in traditional hotels, it's 7.1 percent.

New York recorded 1.34 million more extended-stay room nights accommodated in traditional hotels than in extended-stay hotels for the 12 months ending June 2023. This substantial gap is attributed to the limited supply of extended-stay rooms in New York City.

Virginia Beach leads with extended-stay hotels reporting a remarkable 66 percent share of demand from guests staying seven or more nights. Markets with the highest share often feature a significant portion of economy extended-stay hotels, known for their elevated ESOC.

Extended stay and residential guests

Older economy extended-stay hotels, catering to a significant residential clientele, are prevalent in markets with extended stays over 30 nights. While stay durations in non-extended-stay hotels tend to be shorter, they exceed 80 nights in high-performing markets.

In Miami, guests staying seven to 29 nights at extended-stay hotels enjoy a substantial 36 percent discount compared to traditional hotels for equivalent stays. These discounts are based on guest-paid ADR in both accommodation types.

Cleveland and Chicago lead in rate discounts for guests with stays over 30 nights, influenced by factors specific to their extended-stay markets.

Booking patterns

Booking lead times vary widely, ranging from eight to 47 days for guests staying seven or more nights. In New York, high overall market occupancy and limited extended-stay room availability contribute to lead times 75 percent longer than the next highest average in Anaheim.

In Anaheim, robust summer-related leisure demand extends the average booking lead time, offering insights into the influence of seasonality on booking patterns.

Booking costs, inversely tied to length of stay, are lower at extended-stay properties compared to traditional hotels. Longer-term guests tend to book directly with the hotel, reducing reservation expenses.

Booking costs at extended-stay hotels average 5.1 percent of guest-paid revenue for stays of seven to 29 nights, with variations influenced by market-specific channel mix. Major markets, relying heavily on costly channels like OTAs and FIT Wholesale, exhibit higher booking costs relative to revenues.

Costs and ADR

The percentage differential in booking costs per actualized room night between the highest and lowest markets far outweighs the differences in ADR for equivalent lengths of stay.

In September, extended-stay hotels saw modest growth in July, aligning with the seasonal trend favoring the broader hotel industry over extended-stay establishments, according to The Highland Group. Total hotels experienced a marginal dip in occupancy and a slightly greater rise in ADR compared to all extended-stay hotels in July 2022.