U.S. EXTENDED-STAY HOTELS posted record-high demand, ADR and RevPAR despite reporting a third consecutive occupancy decline during the third quarter of 2024, according to The Highland Group. Occupancy declines have been minimal and average occupancy remains more than 11 percentage points above the overall hotel industry year-to-date through the third quarter.

The overall hotel industry saw a slightly smaller occupancy decline year-to-date through the third quarter than extended-stay hotels, according to STR/CoStar. The broader industry also posted stronger ADR growth, yielding a full percentage RevPAR gain, surpassing the 0.4 percent increase for extended-stay hotels.

The 2024 Third Quarter US Extended-Stay Hotels Report found that the upper-upscale and luxury segments are helping lift overall hotel industry performance. With minimal extended-stay rooms in these categories, STR/CoStar data shows a 0.3 percent year-to-date RevPAR gain when they are excluded—closely aligning with extended-stay hotel performance.

“While RevPAR growth is low compared to the last three years, if forecasts for the overall hotel industry materialize, more new performance records from extended-stay hotels are expected during the near term,” said Mark Skinner, The Highland Group's partner.

STR/CoStar projects that overall hotel occupancy and ADR will rise over the next year. Extended-stay hotels should follow this trend, aided by historically low supply growth, potentially achieving record performance levels in the near term.

Minimal supply growth

Extended-stay hotel supply growth remains low, though it slightly outpaces demand changes for the year-to-date through the third quarter, The Highland Group said. Current supply growth levels match those last seen in 2013 to 2014, following the post-recession cycle. Supply increases remained below their long-term average for two years thereafter.

With federal funds rates now at levels eight times higher than during that period, national supply growth is expected to stay modest. Although demand growth is below its long-term trend, extended-stay demand has consistently increased annually for the past 25 years, except in 2020.

Q3 highlights:

- Record high revenues across all segments.

- Record high demand across all segments.

- Supply growth remains below the long-term average.

- Slight decline in occupancy by 0.4 percent.

- Occupancy nine percentage points above all other hotels on average.

Demand dynamics

Approximately 592,195 extended-stay hotel rooms were open as of the third quarter, representing a net gain of 18,161 rooms over the year, the report said. This growth is more than twice that of the prior two years but still below the annual increases seen from 2017 to 2020. Room nights available rose by 3.2 percent over the past year, the second-smallest annual supply increase in a decade. Economy-segment room supply increases were mostly due to conversions, with new construction accounting for around 3 percent of new rooms.

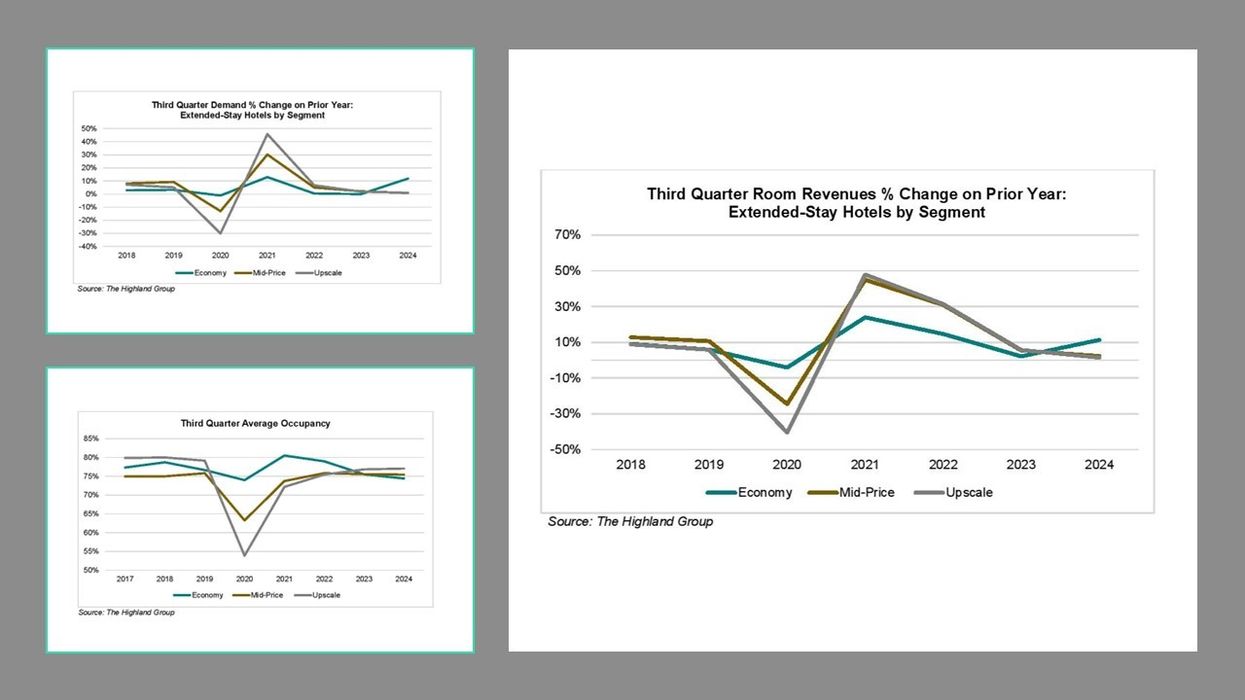

The third quarter saw record demand across all extended-stay segments, The Highland Group said. While room revenue growth has moderated since 2020, each segment reported record-high revenues this quarter. Third-quarter occupancy, generally the highest of the year, was slightly below the 2024 second quarter and reached its lowest level in the third quarter since 2010, except during 2020. The upscale extended-stay hotels were the only segment to report occupancy growth in the third quarter of 2024.

ADR for all extended-stay segments reached record highs in the third quarter, with rate growth generally in line with 2018–2019 levels, the report found. RevPAR rose by 0.6 percent in the third quarter, a slower increase than the second quarter but an improvement from the 1.6 percent decline in the first quarter of 2024. Extended-stay RevPAR performance slightly trailed the 0.8 percent growth of the overall hotel industry.

Extended-stay hotels have historically enjoyed an occupancy premium over the broader hotel industry, averaging between 6.2 and 6.9 percentage points from 2017 through 2019, the report said. This premium increased to 20 percent in the first quarter of 2021 and is now at 8.9 percentage points as of the third quarter of 2024. ADR and RevPAR ratios show similar trends, with RevPAR peaking at 112 percent in the third quarter of 2020 before settling to 86.1 percent in the third quarter this year.

Segment-wide comparisons

RevPAR in economy extended-stay hotels declined slightly over the past year, following strong post-pandemic recovery and record ADR increases in 2021–2022, the report said. However, economy extended-stay hotels continue to perform better than economy hotels overall, maintaining relative RevPAR growth over the past five years.

Mid-price extended-stay hotels remain among the top-performing segments in the industry, with significant gains over mid-price hotels in general. Since the third quarter of 2019, the RevPAR ratio of mid-price extended-stay hotels to all mid-price hotels increased from 91 percent to 102 percent, despite higher supply growth in this segment.

Upscale extended-stay hotels, with a high concentration of rooms in urban markets, lagged in recovery compared to the overall segment. RevPAR for upscale extended-stay hotels has fallen relative to upscale hotels since 2019 and continued to underperform over the past year.

The Highland Group recently reported a 3 percent growth in U.S. extended-stay room supply in September, surpassing the average monthly growth of the past two years, partly driven by WaterWalk by Wyndham's addition in May.