ADR GROWTH FOR U.S. extended-stay hotels reached a record high in February, according to hotel investment advisors The Highland Group. Owing to this, the segment saw record high demand and monthly RevPAR up by more than 40 percent during the month compared to a year ago.

During the month, occupancy growth was also significant with extended-stay hotel’s occupancy premium compared to the overall hotel industry staying well above its long-term average.

The 3.1 percent increase in extended-stay room supply in February is the fifth consecutive month of 4 percent or lower supply growth, according to “U.S. Extended-Stay Hotels Bulletin: February 2022” report by Highland Group. It suggested that mid-price and upscale supply increases should be well below pre-pandemic levels during the near term, the report added.

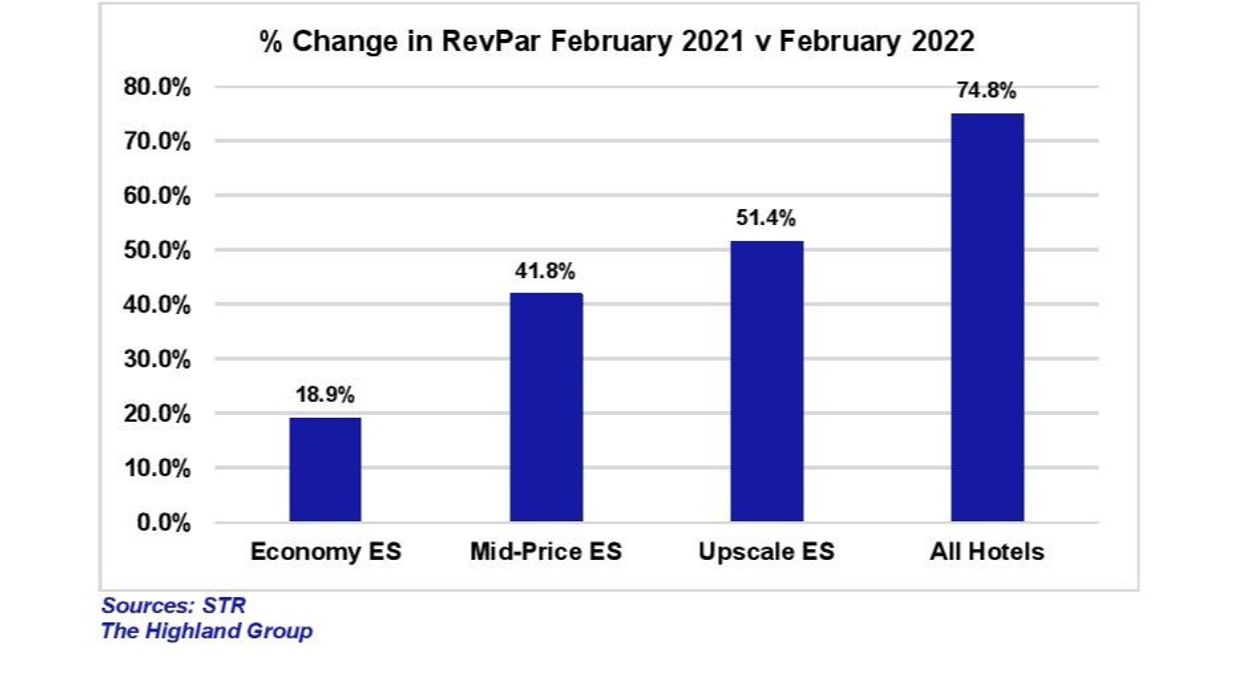

According to the report, the overall hotel industry lost far more revenue than extended-stay hotels in 2020 and 2021, so the revenue recovery is quicker. STR reported that all hotel room revenue was up 81.8 percent in February 2022 compared to a year ago.

"Upscale extended-stay hotels endured the largest fall in demand in 2020 and the greatest rebound in 2021. Extended-stay hotel demand exceeded 11.5 million room nights in February 2022 which was higher than the 10.9 million room nights reported in February 2020 despite the leap year,” the report said. “Upscale extended-stay hotels increased demand the fastest in February partly because they had the lowest occupancy."

Overall hotel occupancy gained more than extended-stay hotels in February 2022 compared to a year ago, decreasing extended-stay hotel’s occupancy premium to 15.3 percentage points. However, the premium remains above its long-term average, it added.

"Mid-price and upscale extended-stay hotels continued to lead the ADR recovery in February and most ADR recovery indices were higher than in January. The upscale segment continued posting the strongest RevPAR growth over last year," the Highland Group report pointed out. "However, unlike the economy and mid-price segments, it has not recovered monthly RevPAR back to 2019. Because the overall hotel industry lost far more RevPAR than extended-stay hotels in 2020, its RevPAR growth in February 2022 relative to a year ago was considerably greater."

Extended-stay hotels posted record high demand in January and monthly RevPAR was up by more than one third mainly due to record ADR growth.