ECONOMIC HEADWINDS AND geopolitical concerns are expected to affect U.S. hotel performance in 2024, according to PwC. The issues include continuing high interest rates and the Israel-Palestine conflict.

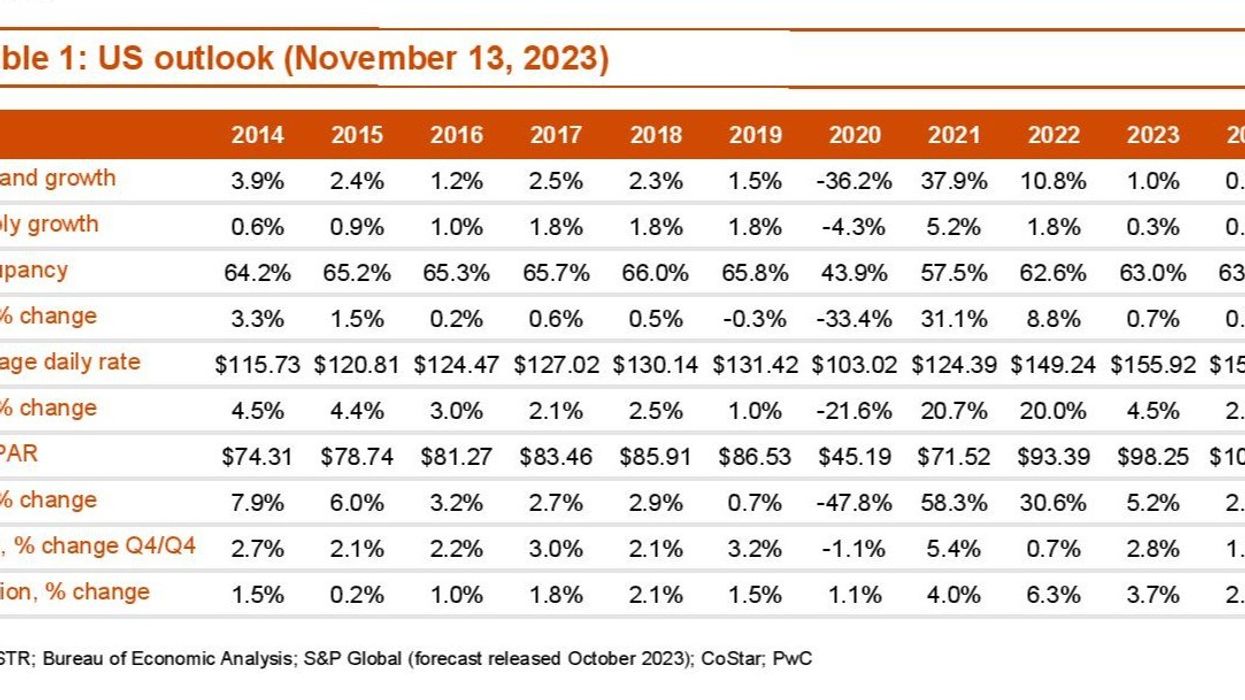

Occupancy levels have consistently decreased over the past seven months compared to the same period in 2022. This downward trend is anticipated to persist for the remainder of this year and extend into at least the first quarter of 2024. However, PwC forecasts a 63 percent annual occupancy rate for US hotels this year.

Hotels in the U.S. experienced a weakening in leisure demand during the latter part of this year, as global vacation destinations reopened, and leisure travelers regained confidence in traveling abroad, PwC said in its latest report titled U.S. Hospitality Directions: November 2023. Moreover, gains in individual and group business travel haven't completely counteracted this softening.

Room rate growth played a vital role in the initial recovery for US hotels but declined notably in the second quarter, dropping below inflationary growth levels in the third quarter, PwC said. However, ADR growth is anticipated to resume an upward trend, surpassing a diminishing inflation level from the fourth quarter onward into the next year.

According to the report, the Federal Reserve's ongoing policy rate hikes, sustained public market declines since early August, and the recent Israel conflict are now exerting a downstream influence on hotel demand.

Despite ongoing declines in occupancies for the rest of the year, the report anticipates a 4.5 percent increase in average daily room rates, leading to a 5.2 percent rise in RevPAR—approximately 114 percent of pre-pandemic levels in nominal dollars.

“A continued tightening of financial conditions has begun to have an impact on the overall economy,” said Warren Marr, PwC’s managing director for U.S. hospitality and leisure. “Since our last issue of Hospitality Directions U.S. in May, we've seen two consecutive quarters of decline in hotel occupancies and expect to see two more in the fourth quarter this year and the first quarter of 2024 before a gradual rebound. We expect to see RevPAR growth to once again exceed PCE inflation beginning in the second quarter next year.”

Key trends and highlights from the report

- Since PwC’s May 2023 outlook, the Fed's monetary policy has persistently raised concerns, and significant improvement is not anticipated until next year. This has led to limited availability of debt aligned with hotel asset asking prices. Consequently, transaction activity has been subdued and is expected to stay muted until the Fed makes substantial adjustments to monetary policy or the bid-ask spread on hotel assets narrows.

- Entering 2024, the midweek travel outlook is uncertain, with some companies signalling adjustments to their business travel policies to tighten corporate budgets and meet sustainability goals. Outbound international leisure travel continues to surpass inbound, driven by the robust dollar and pent-up demand for international travel post-pandemic. Anticipating relatively flat occupancy levels in 2024, performance gains are projected to derive predominantly from ADR, leading to an expected year-over-year RevPAR increase of 2.7 percent—approximately 117 percent of pre-pandemic levels.

- Significant risks to this outlook include the speed and scale of shifts in the macroeconomic landscape, along with escalating geopolitical tensions.

Revised outlook for 2024

- Demand growth continues to be sluggish during the first half of 2024, before gradually accelerating in the second half resulting in occupancy of 63.2 percent.

- Growth in ADR gradually decelerates throughout the year, as the FED continues to apply pressure on inflation up 2.4 percent.

- RevPAR continues to moderately increase, up 2.7 percent.

According to CBRE's recent study, U.S. hotel demand saw a 0.5 percent year-over-year decrease in the third quarter, accompanied by a corresponding 0.5 percent rise in supply, leading to a 1 percent occupancy decline. ADR registered a 0.6 percent increase, marking the slowest improvement in 10 quarters, while RevPAR experienced a 0.3 percent decline, balancing a slight occupancy decrease with an ADR uptick.