Summary:

- Peachtree posted nearly $30 million in equipment finance transactions in its first quarter.

- The division was created to fill a gap as banks reduce lending to middle-market borrowers.

- Deals covered equipment for transportation, technology and material handling.

PEACHTREE GROUP’S EQUIPMENT finance division closed $29.8 million in capital lease and fair market value transactions across multiple industries in its first full quarter following the platform’s October launch. The deals included equipment for transportation, technology and material handling.

Peachtree Equipment Finance was created to address a gap in the equipment leasing market as banks reduce exposure to middle-market borrowers, Peachtree said in a statement. It focuses on capital leases and FMV transactions structured to businesses’ operational needs.

“Launched just months ago, our equipment finance division has quickly demonstrated strong demand for flexible nonbank capital,” said Greg Friedman, Peachtree’s CEO and managing principal. “As traditional banks continue to retreat from equipment lending, we see a growing opportunity to provide reliable financing solutions backed by real underwriting discipline and certainty of execution.”

Atlanta-based Peachtree is led by Friedman, CFO and Managing Principal Jatin Desai and Principal Mitul Patel.

Peachtree plans to expand the division in 2026, increasing origination capacity and industry coverage, the statement said. The firm expects equipment finance to play a larger role in its private credit business.

Roger Johnson, Peachtree’s executive vice president and principal for the division, said the company aims to scale while maintaining asset quality and long-term client relationships.

“This is exactly the type of market dislocation where experienced private credit platforms can step in and provide meaningful solutions,” Johnson said.

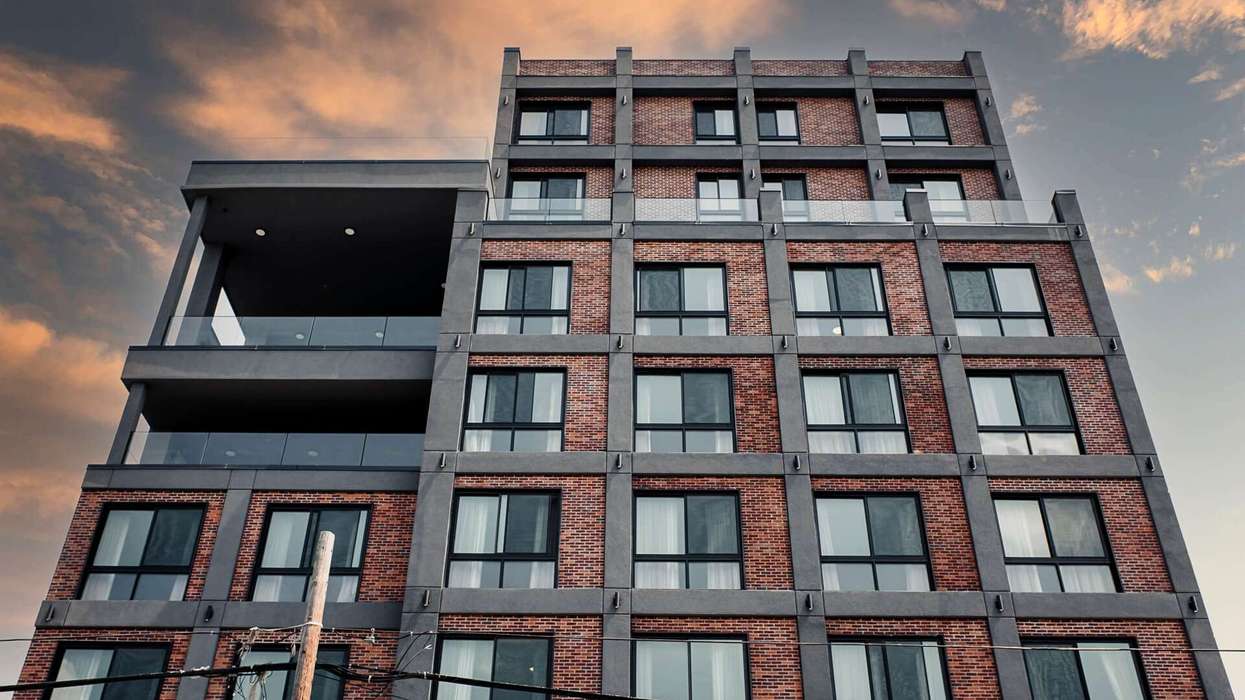

In other activity, Peachtree recently provided a $130 million construction loan to Vastland Co. for its first VOCE Hotel & Residence in Nashville, Tennessee.