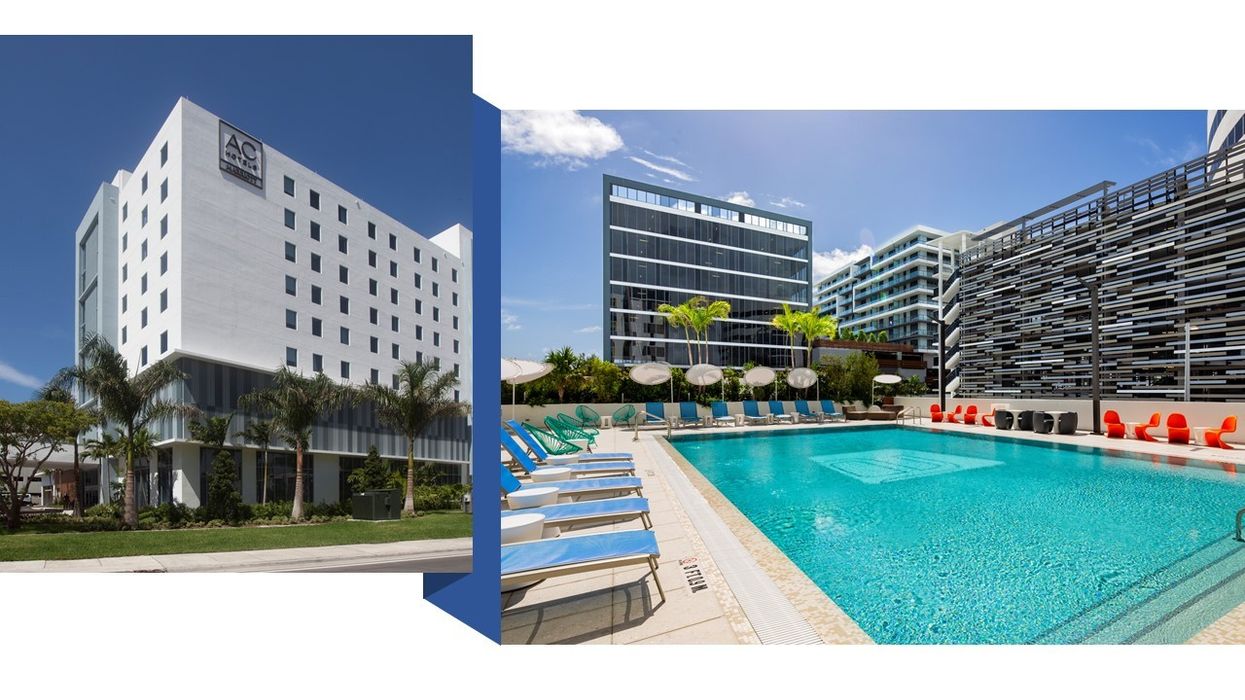

PEACHTREE HOTEL GROUP recently acquired two upscale hotels in Florida. They are the 207-key AC Hotel Miami Aventura and the 233-key Aloft Miami Aventura, in Aventura, Florida, outside Miami.

With these recent acquisitions, Atlanta-based Peachtree, led by partners Greg Friedman, Jatin Desai and Mitul Patel, has acquired approximately $2 billion in hotel assets this year. The company expects to continue making opportunistic hotel acquisitions amid the current hospitality recovery cycle.

"Our growth strategy since Peachtree's inception is to capitalize on cycle-specific opportunities," said Greg Friedman, Peachtree's CEO. "Today, we are seeing opportunities to acquire hotels at compelling levels, which hasn't been available over the last 15 months. With strengthening economic tailwinds boosting hotel fundamentals and compelling cap rates compared to other asset classes, the lodging sector is among the best real estate classes for investing. Also, with the ongoing inflationary environment, hotels are an excellent hedge against inflation due to daily adjustments in average daily rates."

Near the two hotels, which are across the street from each other, are the 2.4-million-square-foot Aventura Mall, the Aventura Arts & Cultural Center, Aventura Hospital & Medical Center and the Gulfstream Park Racing and Casino. The AC Hotel is adjacent to an office campus, with expected plans for retail and entertainment developments as well as a new office tower. The Aloft is in a mixed-use district containing residential, office, medical, assisted living and retail components.

The terms of the transactions were not disclosed. The Florida purchases come weeks following the acquisitions of the 81-key Hampton Inn & Suites and the 60-key La Bellasera Hotel & Suites, in Paso Robles, California.

"These acquisitions are an opportunity to acquire valuable properties in a premier location of Greater Miami and Miami Beach, which has an important mix of corporate and tourism travel," said Brian Waldman, Peachtree's executive vice president for investments. "Acquiring these Marriott-branded lifestyle hotels also aligns with our strategy of owning growing RevPAR hotels in destination, downtown and lifestyle center locations."