- YouTube www.youtube.com

AT ONE POINT in his life, Ritesh Agarwal had 30 rupees in the bank. Today, as the founder and CEO of OYO Rooms, he is one of the youngest billionaires on the planet.

“Sometimes, when I go to bed, I ask myself, ‘Is this all for real?’ Because exactly 10 years ago, I didn't imagine any of it,” Agarwal said.

Agarwal founded OYO in 2013 as a provider of full-stack technology products and services. Today it serves more than 157,000 hotel and home storefronts in more than 35 countries including India, the U.S., Europe and Southeast Asia. Near the end of last year, it completed its $525 million acquisition of G6 Hospitality from Blackstone Real Estate.

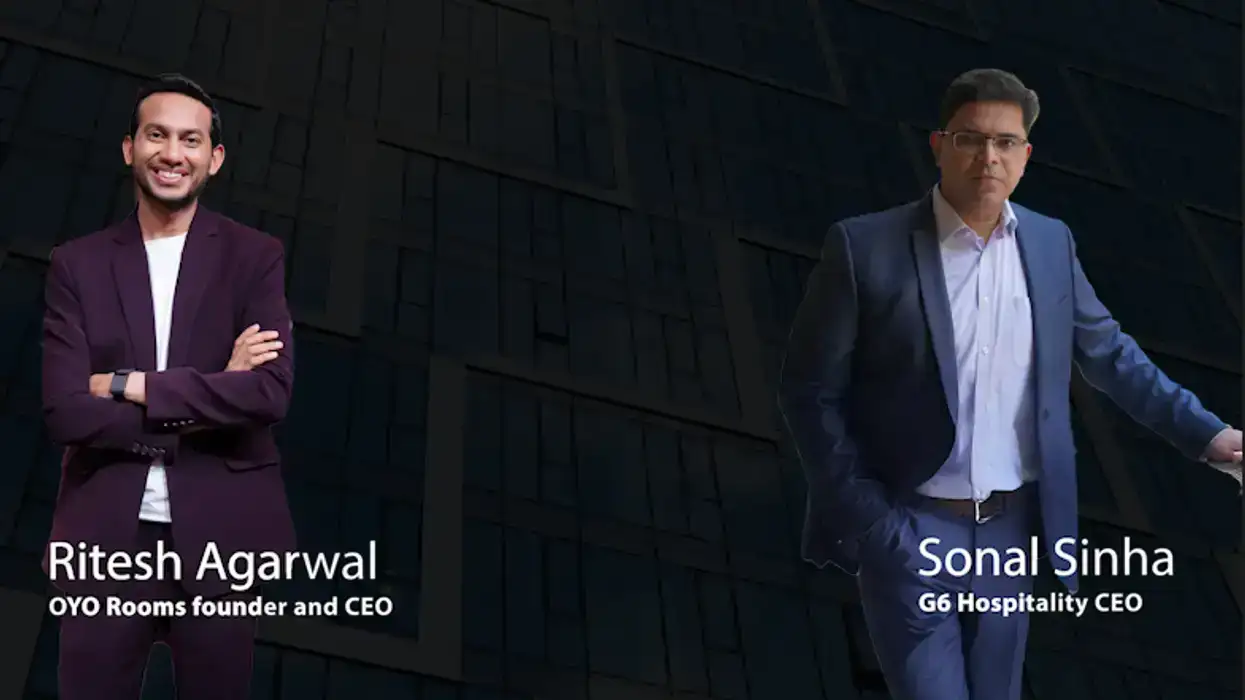

In April, Agarwal and his newly appointed G6 CEO Sonal Sinha attended the 2025 AAHOA Convention & Trade Show in New Orleans. They met with other business leaders and more than 300 of their franchisees, and Agarwal spoke on the View from the Top panel. Agarwal and Sinha sat with Asian Hospitality Editor Ed Brock for an interview, the video of which is embedded here and summarized below. The interview also can be found in our May issue.

Humble beginnings

Agarwal said the story of his beginnings in the hotel industry is similar to those shared by many AAHOA members.

“I started by being the front office of one of the hotels. I cleaned the back office, cleaned the bedrooms, did the work, and most people would have imagined that I'd be lucky if I scraped by and get that one property, and rightfully so, because I had no logical reason to succeed,” Agarwal said. “But I have learned the difference between somebody who makes it versus not is only how desperately they wanted this as an outcome. They're willing to work hard, they're going to put their perspective, they're wanting to learn everything, and that's what I did.”

Starting OYO was definitely a challenge, he said. It was worth the work, but future entrepreneurs should maintain realistic expectations.

“I love the outcome, but the process, while I enjoyed it, I think it's hard, right?” Agarwal said. “Often people, when they start companies, they are told that the reason you should start a company is you will have no boss. You realize very quickly, your customers are your boss, your suppliers are your boss, your lender is your boss, your equity partner is your boss, your team members are your boss, your external business partner is your boss, your city is your boss. Everybody expects accountability from you and hence you have to be comfortable to be accountable to a large number of people.”

However, Agarwal said that with that responsibility comes rewards.

“You get to solve exciting problems. You’ve got to create great outcomes, and I feel like the outcome is well worth it,” he said.

Agarwal and Sinha brought this philosophy into executing one of the company’s largest transactions so far, its acquisition of G6.

Keeping the light on

In December, Oravel Stays, OYO’s parent company, completed the acquisition of G6 that was announced in September. Sinha was named CEO, with Tina Burnett continuing as chief development officer, the company said at that time. The company plans to add 150 hotels to the Motel 6 and Studio 6 brands next year and accelerate G6 Hospitality's growth through technology integration, property upgrades, and market expansion.

Agarwal and Sinha said the process to make the acquisition began in 2019.

“We've known G6 for a few years. It's an iconic American brand loved largely not just by customers, but also franchisees to be a part of this ecosystem,” Agarwal said. “OYO, on the other hand, had figured out its ability to drive the best digital revenue for our franchisees. So, our perspective was, we could take the best of both worlds.”

When the bidding process began, Agarwal called Sinha for his opinion.

“The moment Ritesh called and said, ‘Okay, this is what I'm thinking,’ we had this conversation where we thought, we'll do it someday, and now is the day,” Sinha said. “That was the feeling I had. We know the power these two platforms have. OYO being a tech platform, we know how to run a mobile app. We know how to distribute with multiple agencies. That's the tech strength that OYO brings. We have more than 500 engineers back in India, and they do a lot of coding.”

OYO aims to invest $10 million to enhance G6’s digital assets, including its website and app, targeting a quadruple increase in apps before summer. The company will use digital targeting, focusing on high-intent customers through direct partnerships with Google and Microsoft.

“Our primary commitment today is to make sure our current franchisees make so much more. We just came out of the first quarter. I'm happy to share that when the industry declined year-on-year on revenue, we have delivered three and a half percent up year on year,” Agarwal said.

Maintaining optimism

As the U.S. economy continues to rock from President Trump’s tariffs, even though some are on hold, Agarwal said he remains optimistic about doing business in the U.S. During his panel AAHOACON2025 discussion, he talked about meeting Trump in New Delhi when he was visiting and getting a good impression of the two countries’ relationship.

“I think the relationship, people to people, between India and the U.S., has been incredible,” Agarwal said.

Indian Prime Minister Narendra Modi also visited the U.S. right after President Trump's inauguration, building on their existing relationship. Agarwal s

“I think that there is a unidirectional sentiment of more investments from India to the U.S. and the U.S. to India. I don't think that's changing anytime soon. And the good thing is we are less impacted by tariffs,” Agarwal said. “I'm an entrepreneur. I'm an optimist by definition, because we have American hotels, mostly American customers, I'd say over 95 percent of our customers are domestic and American workers. If you combine three of those, we have very little impact from the tariffs.”

Agarwal said the company already is investing $10 million in G6’s technology stacks and it is hiring sales and marketing people. They also are recruiting and expanding on various different divisions.

Swimming with sharks

Agarwal also appears on the Indian version of Shark Tank, the show on which hopeful entrepreneurs pitch their business ideas to a panel of potential investors. For Agarwal, it’s an opportunity to give back.

“There are people who supported me, who supported others, and we all feel like we want to give back, right?” Agarwal said. “What better than Shark Tank, which millions of people watch, it's probably one of the most watched business shows around the world?”