U.S. EXTENDED-STAY hotels nearly reached 2019 levels in April, according to a report from to hotel investment advisors The Highland Group. Growth in the mid-price and upscale segments drove the surge.

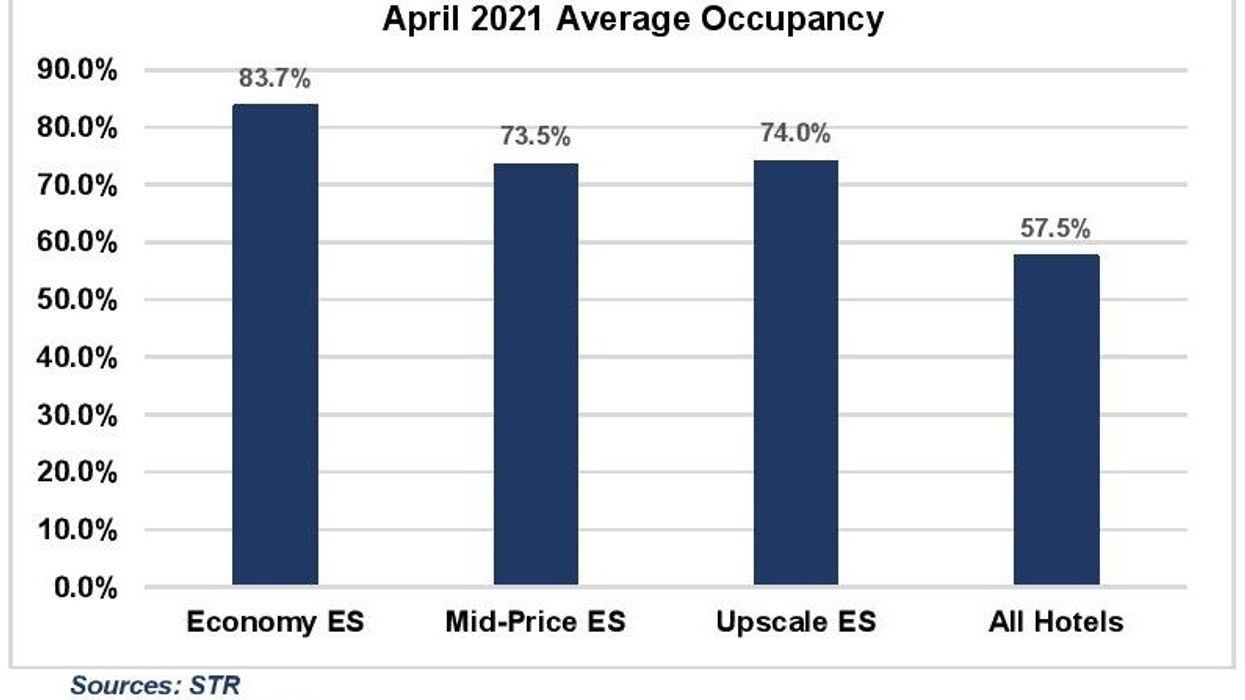

Extended-stay occupancy in April reached 18 percent higher than the overall hotel industry, according to the Highland Group’s report “U.S. Extended-Stay Hotels Bulletin: April 2021.” Mid-price extended-stay hotels posted higher revenues in April compared to the same month two years ago. Following the economy segment, which restored revenues back to their 2019 level six months ago, mid-price extended-stay hotel revenue was 5 percent higher in April compared to the same month two years ago,

According to the report, upscale extended-stay hotels reported the largest increase in RevPAR in April but monthly revenues remain below their level two years ago. The segment is recovering quickly, reporting an 83 percent RevPAR recovery index compared to 64 percent for all upscale hotels according to STR.

The economy extended-stay hotels posted positive change in ADR in April and the 10.9 percent increase was the strongest monthly gain since the segment’s ADR started increasing in December 2020. The mid-price segment reported the largest gain in ADR for the fifth consecutive month in April, partly due to the steepest monthly fall in ADR last year.

“Extended-stay hotels are restoring occupancy back to previous high levels in about half the time it took following the prior two downturns” said Mark Skinner, partner at The Highland Group.

There was a 13.2 percent increase in extended-stay room supply during the month under review due to new construction and the reopening of closed hotels. However, the supply growth rate will decline this year as most extended-stay hotels closed during the pandemic reopened before the end of 2020, the report indicated.

It should be noted that the overall hotel industry lost far more revenues than extended-stay hotels last year and are now recovering quickly. STR reports all hotel revenue was up more than 300 per cent in April 2021 compared to last year.

“Upscale extended-stay hotels endured the largest fall in demand and are now leading the demand recovery. Extended-stay hotel demand reached 12.43 million room nights in April, 13 percent higher than in April 2019. The extended-stay hotel occupancy growth is lower than the 136 percent gain STR reported for the overall hotel industry in April 2021, the 18-percentage point occupancy premium compared to all hotels remains well above its long-term average,” the report said.

Since the overall hotel industry lost far more RevPAR than extended-stay hotels, the segment’s RevPar growth in April 2021 compared to April 2020 was more than twice as much as extended-stay hotels.

According to previous reports, extended-stay hotels are leading the COVID-19 recovery.