Extended-Stay Hotels Outperform in Q1 2025 RevPAR

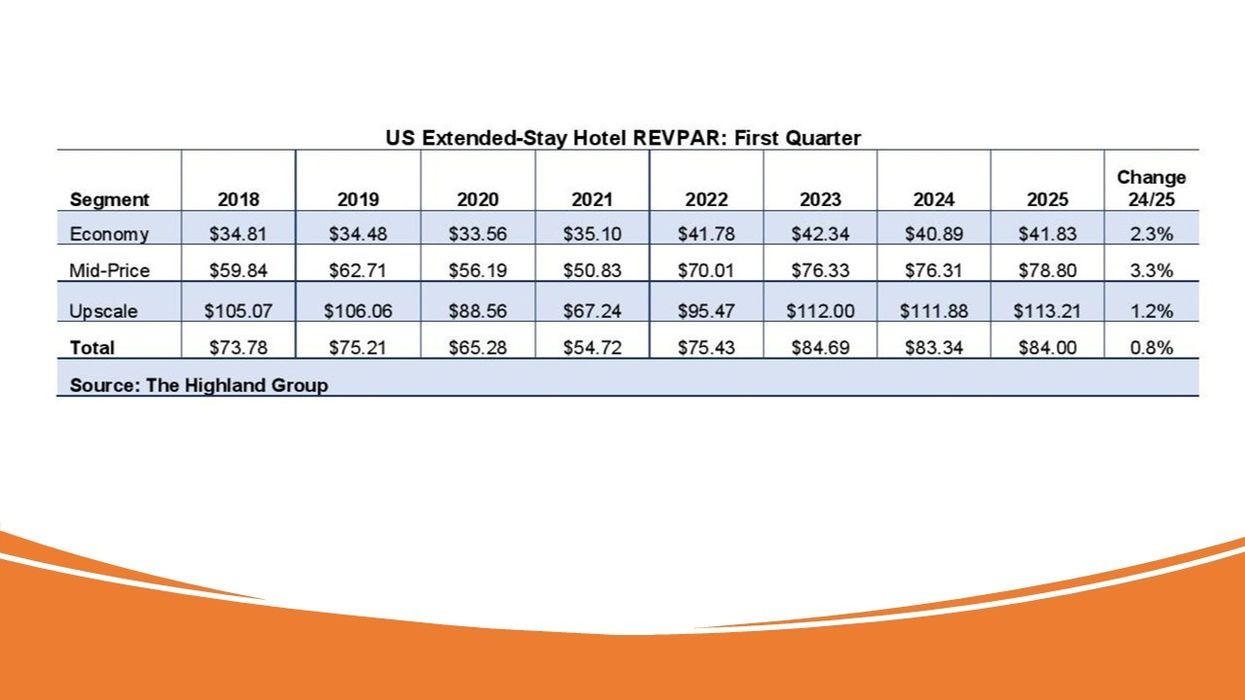

ECONOMY, MID-PRICE AND UPSCALE extended-stay segments outperformed their corresponding hotel classes in first-quarter 2025 RevPAR growth compared to the same period in 2024, according to The Highland Group. However, occupancy declined in the economy and mid-price segments, bringing overall extended-stay occupancy down to 70.9 percent—the lowest first-quarter level since 2010, excluding the pandemic years of 2020 and 2021.

The 2025 First Quarter U.S. Extended-Stay Hotels Report found 602,980 extended-stay hotel rooms open at the end of the quarter, with a net gain of 17,588 rooms over the past year—the largest annual increase in three years.

“The positive change in extended-stay hotel RevPAR decelerated during the first quarter of 2025, but when compared directly to corresponding classes of all hotels, all three extended-stay segments reported higher RevPAR growth from the first quarter of 2024 to the first quarter of 2025,” said Mark Skinner, The Highland Group’s partner.

Economy extended-stay hotels reported record-high demand in the first quarter of 2025, with total extended-stay demand increasing 1.1 percent (reflecting the extra day in the 2024 leap year) over the past 12 months. This contrasts with no change in demand for the total hotel industry, as reported by STR/CoStar for the same period.

The 2.7 percent gain in extended-stay room revenues in the first quarter was the lowest in the past year but higher than the 1.5 percent increase in the first quarter of 2024, which included an extra day. STR/CoStar reports total hotel industry room revenues grew 1.7 percent in the first quarter of 2025, but only 0.7 percent when excluding the upper-upscale and luxury segments, which have minimal extended-stay inventory.

Key metrics for Extended-Stay Hotels in the USA

At 70.9 percent, total extended-stay hotel occupancy in the first quarter of 2025 was the lowest since the pandemic-impacted years of 2020 and 2021, and the lowest for a first quarter since 2010.

Economy and mid-price extended-stay segments drove the 1.6 percent overall ADR growth in the first quarter, while STR/CoStar reported a 1.7 percent ADR increase for the total hotel industry.

The quarterly RevPAR change mirrored ADR, with economy and mid-price segments driving the increase and influencing overall extended-stay RevPAR change from the first quarter of 2024 to the first quarter of 2025. The total extended-stay RevPAR gain in the first quarter of 2025 was lower than the segment increases due to the economy segment's larger share of extended-stay room supply compared to the first quarter of 2024.

Extended-stay hotels’ occupancy premium over the overall hotel industry averaged 12 percentage points in 2018 and 2019, typical over the past 25 years. The premium tends to rise during downturns, peaking at 20 percent in the first quarter of 2021 during the pandemic. In the first quarter of 2025, the occupancy premium was 12.3 percentage points.

From 2017 to 2019, extended-stay hotels’ ADR grew slightly faster than the overall hotel industry. Growth accelerated in 2021, with the ratio peaking at 83 percent before declining to 77 percent in the first quarter of 2022, as the overall hotel industry recovered more quickly due to deeper pandemic losses. The first-quarter ADR ratio in 2025 was essentially unchanged from 2024.

Relative RevPAR followed a similar trajectory to ADR, with gains from 2017 to 2019 and a peak ratio of 119 percent in the first quarter of 2021. As the overall hotel industry recovered more quickly, extended-stay hotels’ RevPAR ratio declined to 91 percent in the first quarter of 2025, two to three percentage points lower than the 2018 to 2019 period.

The Highland Group reported U.S. extended-stay hotels outperformed the overall industry in March across all key metrics except occupancy, where their long-term premium remained steady.