Extended-stay hotels break records in Q4 2024 with soaring demand

U.S. EXTENDED-STAY HOTELS saw strong performance in the fourth quarter of 2024, with RevPAR and room revenue reaching six-quarter highs, according to The Highland Group. Supply growth exceeded 3 percent for the fourth consecutive quarter, the first time in nearly three years, while demand rose 4.6 percent, the highest since the first quarter of 2021.

The Highland Group’s 2024 fourth quarter U.S. Extended-Stay Hotels Report found occupancy at a three-year high.

“Extended-stay demand growth in the fourth quarter of 2024 was the largest quarterly increase in three years and well ahead of the accelerating gain in supply,” said Mark Skinner, partner at The Highland Group.

Fourth-quarter highlights:

- Largest RevPAR gain in six quarters.

- Strongest room revenue increase in 1.5 years.

- Highest demand growth in 11 quarters.

- Highest occupancy in three years.

- Occupancy averaged 12 points higher than all hotels.

At the end of the fourth quarter of 2024, 595,634 extended-stay hotel rooms were open, with a net gain of 17,750 over the past year—the largest in four years, excluding 2021. Room nights available increased 3.1 percent year over year.

Economy extended-stay supply rose 12.5 percent, with smaller gains in mid-price and upscale segments, largely due to conversions. New economy construction accounted for only about 3 percent of open rooms year over year.

Supply changes were also influenced by rebranding, de-flagging and sales to multifamily and municipal buyers.

Demand soars

All extended-stay segments hit record demand in the fourth quarter of 2024, with total demand up 4.6 percent year over year, The Highland Group said. Excluding the post-pandemic rebound, it was the strongest fourth-quarter growth since 2019, far outpacing the 2.2 percent increase STR/CoStar reported for the overall hotel industry.

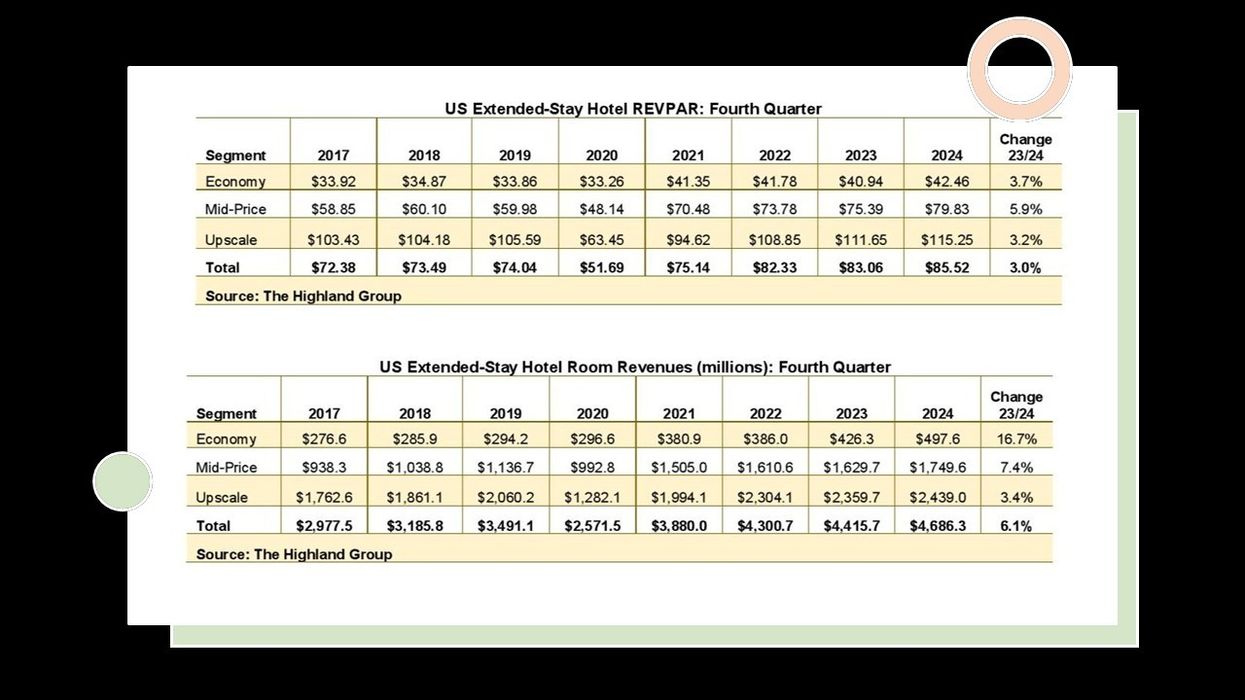

Extended-stay room revenue rose 6.1 percent in the fourth quarter, the largest increase since the second quarter of 2023, outpacing the 4.2 percent gain STR/CoStar estimated for the total hotel industry.

Key metrics overview

Extended-stay occupancy reached 72.7 percent in the fourth quarter, the highest for that period in three years, maintaining a 12-point premium over the total hotel industry.

Extended-stay ADR growth accelerated with a 1.4 percent increase, the highest of any quarter in 2024 but below the 2 percent gain STR/CoStar reported for the overall industry. RevPAR followed a similar trend, with the fourth-quarter increase being the largest in six quarters but remaining below STR/CoStar’s 3.6 percent industry-wide gain.

Extended-stay occupancy averaged an 11.3-point premium over the total hotel industry from 2017 to 2019, rising to 21 points in the fourth quarter of 2020. Over the past three years, it averaged 12.4 points.

During 2017-19, extended-stay ADR also grew at a similar rate as all hotels. During the pandemic, extended-stay hotels discounted rates less, pushing the ADR ratio to 88 percent in 2020. Since then, overall hotel ADR has grown faster, lowering the ratio to 74.8 percent, partly due to a rising share of economy extended-stay supply.

RevPAR followed a similar path, peaking at 133 percent of the total industry in the fourth quarter of 2020 before falling to 90 percent in the fourth quarter of 2024, 2 to 3 points below 2017–2019 levels.

Economy extended-stay hotels outpaced overall economy hotels in RevPAR growth over the past five years. More recently, gains have been similar, with a 3.7 percent increase in the fourth quarter of 2024—the segment’s largest quarterly growth in two and a half years.

Mid-price extended-stay hotels have outpaced the overall mid-price segment in RevPAR growth. Their RevPAR was 97 percent of all mid-price hotels in the fourth quarter of 2019, rising to 109 percent in the fourth quarter of 2024 despite significantly higher supply growth.

Due to a high concentration in urban submarkets, upscale extended-stay hotels lagged the broader extended-stay recovery. Since 2019, their RevPAR has declined relative to all upscale hotels but remained steady over the past year.

The Highland Group’s December 2024 U.S. Extended-Stay Hotels Bulletin reported a third straight monthly RevPAR increase for economy extended-stay hotels, with December’s 5.5 percent growth the highest since June 2022.