What’s Driving Easter 2025 Hotel Bookings Up 16.8% Globally?

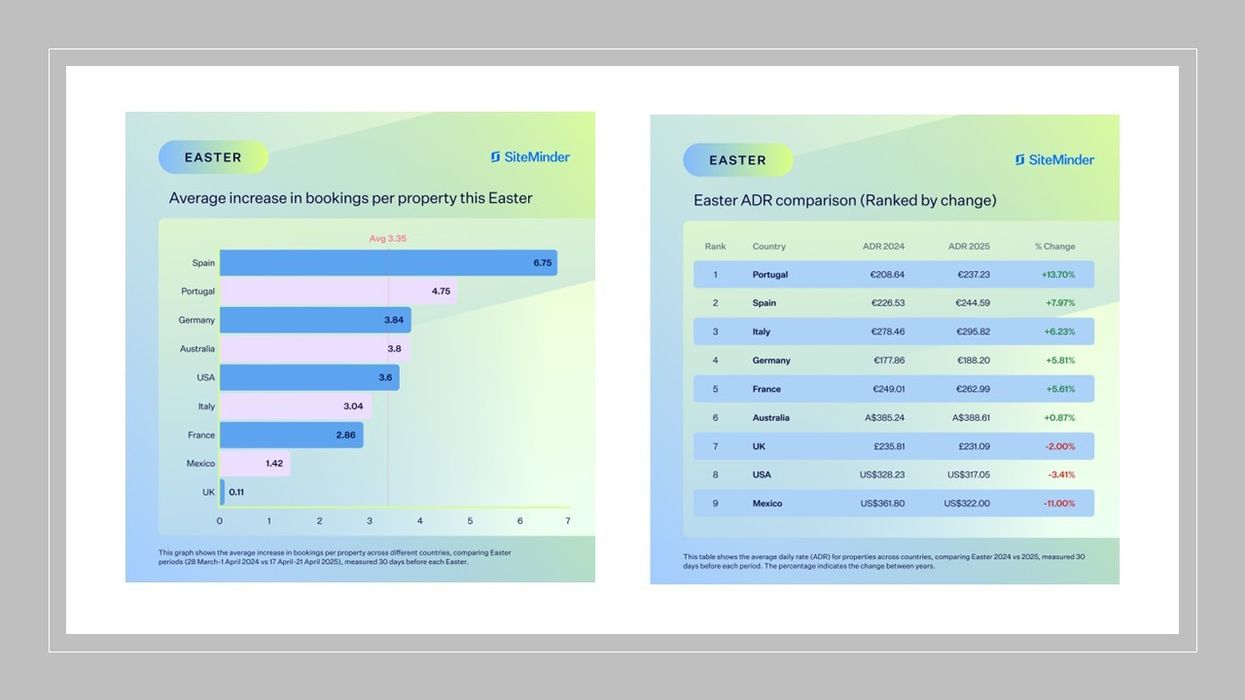

HOTEL BOOKINGS FOR Easter 2025 are up 16.8 percent from the same period last year, according to SiteMinder, a hotel distribution and revenue platform. The data, comparing bookings at the same properties across nine markets 30 days before Easter in 2024 and 2025, shows stronger demand, earlier bookings and growing interest in international travel.

These global trends are mirrored in the U.S., where SiteMinder data showed a 14.98 percent rise in Easter weekend bookings as of March 18—an average of 3.6 more reservations per property compared to the same period in 2024.

“With Easter falling later this year than in 2024, we’re not just seeing stronger travel demand—we’re seeing travelers rethink how they plan,” said James Bishop, SiteMinder's vice president for ecosystem and strategic partnerships. “Earlier bookings and a rise in international travel are shaping this year’s trends, with the later holiday creating more favorable conditions in many regions. But flexibility remains key—historically, domestic travelers tend to book closer to arrival, meaning the final guest mix and pricing dynamics could still evolve in the coming weeks.”

SiteMinder recently found that hotel websites led all booking sources in 2024 revenue per booking, averaging $519—60 percent higher than other channels.

Global booking lead times have risen 9.63 percent, from 87 days in 2024 to 96 days in 2025, as traveler confidence remains strong, the report said. In the U.S., lead times are up 13.43 percent to 100.99 days, outperforming the global average.

While booking volumes and lead times are up, the average stay for Easter 2025 has dipped 3.43 percent globally—from 2.33 to 2.25 days—as traveler origins shift. In the U.S., the trend is similar, with stay length down 3.86 percent to 2.24 days from 2.33 in 2024.

Compared to completed stays in Easter 2024, all analyzed markets, except Australia, are seeing a higher share of international guests for 2025. In the U.S., international bookings have risen to 41.40 percent of all reservations, up from 23.94 percent last year.

The data shows mixed ADR trends across markets. Two-thirds of analyzed destinations report year-over-year growth for the Easter weekend, led by Portugal with a 13.7 percent increase and Spain with nearly 8 percent. In contrast, U.S. hotel ADR is down 3.41 percent, from $328.23 to $317.05. Mexico is seeing an 11 percent drop, while the United Kingdom is down 2 percent.

Bishop said stronger Easter weekend demand at U.S. properties is encouraging, driven by earlier bookings and more international travelers.

“While this momentum reflects a confident travel market, ADR remains a challenge not just in the U.S. but across the region," he said. "To offset this, hoteliers should make full use of revenue management technology, ensuring their pricing and distribution strategies are dynamic, effective, and market-informed.”

SiteMinder earlier reported a 22 percent rise in U.S. Christmas hotel bookings for Dec. 21-25, driven by international bookings, which grew from 28 to 32 percent.