U.S. Hotel RevPAR Record High July 2024

U.S. REVPAR LEVELS hit a record high in the third week of July despite Hurricane Beryl's effects on the top 25 markets, according to CoStar. All metrics were up compared to the previous week, with positive year-over-year comparisons.

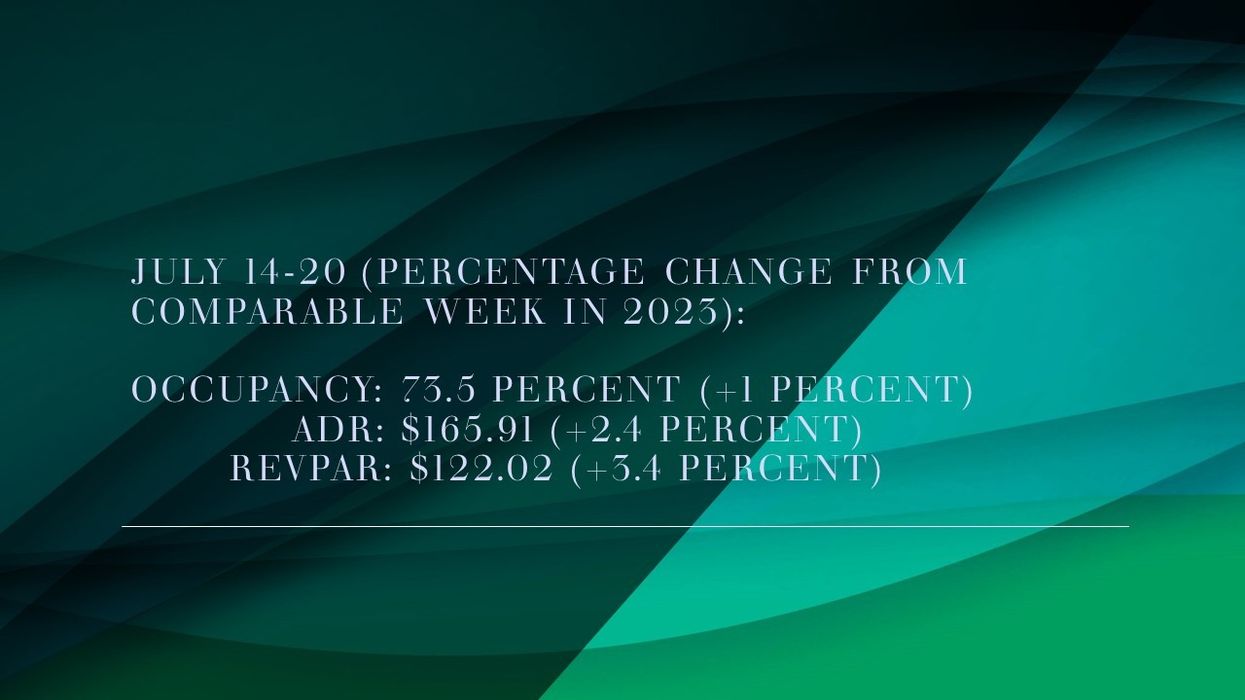

Occupancy rose to 73.5 percent for the week ending July 20, up from 69.2 percent the previous week, marking a 1 percent year-over-year increase. ADR increased to $165.91 from $158.21, reflecting a 2.4 percent rise compared to last year. RevPAR reached $122.02, up from $109.51 the prior week, showing a 3.4 percent increase from the same period in 2023.

Meanwhile, the U.S. RevPAR level reached the highest for any week on record.

Among the top 25 markets, Houston continues to record the highest year-over-year increases in key performance metrics: occupancy rose 29.6 percent to 82.2 percent, ADR increased 20.3 percent to $135.65 and RevPAR grew 56 percent to $111.49. However, the markets performance continues to be impacted by Hurricane Beryl.

The steepest RevPAR declines were reported in San Francisco, down 14.1 percent to $140.09, and Seattle, down 12.4 percent to $195.52.