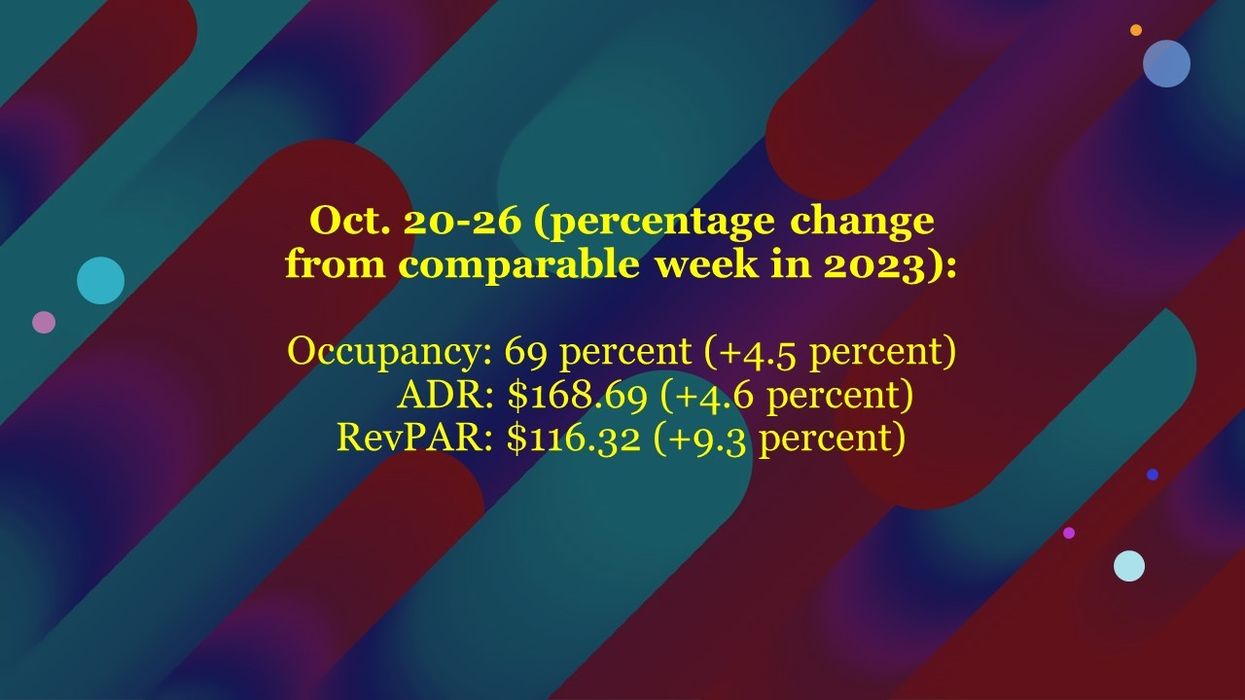

U.S. HOTEL PERFORMANCE declined slightly in the fourth week of October, though year-over-year comparisons remained positive, according to CoStar. Key metrics, including occupancy, RevPAR, and ADR, saw slight decreases from the previous week.

Occupancy fell to 69 percent for the week ending Oct. 26, down from 70.1 percent the prior week but up 4.5 percent year-over-year. ADR declined to $168.69 from $169.85, marking a 4.6 percent increase year-over-year. RevPAR dipped to $116.32 from $119.01, showing a 9.3 percent gain over the same period in 2023.

Among the top 25 markets, Tampa recorded the highest occupancy increase, up 28.1 percent to 84.2 percent, driven by ongoing displacement demand from Hurricane Milton. New Orleans saw the highest increases in ADR, up 64.1 percent to $301.30, and in RevPAR, up 77.6 percent to $227.24, boosted by Taylor Swift’s Eras Tour.

Las Vegas had the steepest RevPAR drop, down 7.9 percent to $196.40, followed by Minneapolis, down 6.5 percent to $86.31.