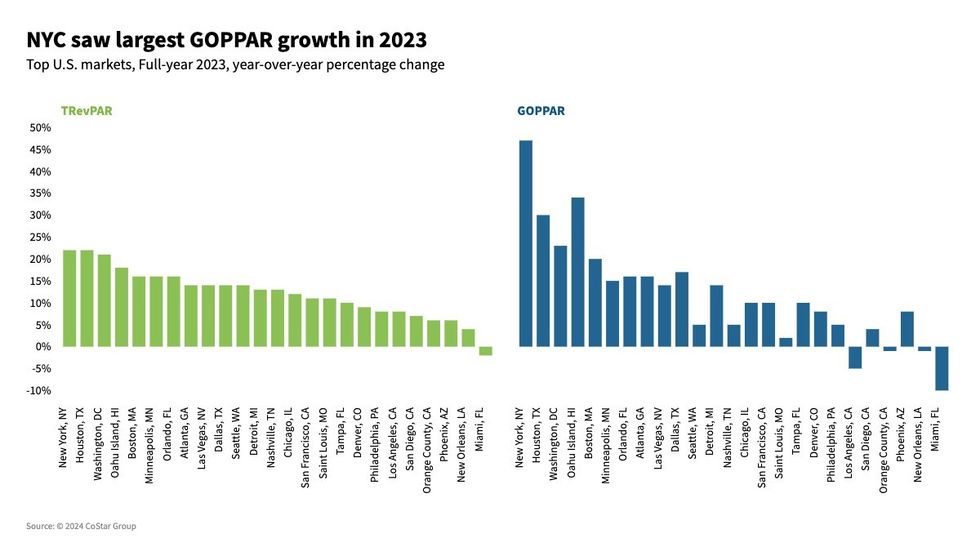

U.S. HOTEL REVENUES and profitability saw an increase in 2023 compared to 2022, with improvements in group business across the top 25 markets and upper-scale chains, according to STR's 2023 P&L data. Overall, 14 of the top 25 markets reported double-digit increases in GOPPAR.

“Total industry revenues and profits were well beyond 2022 levels as pricing power continued to outweigh the impact of softer leisure demand,” said Claudia Alvarado Cruz, senior analytics manager at STR. “A lift in corporate demand made improvements especially notable across the upper-upscale brands and major markets. New York City was the shining example with 47 percent growth in GOPPAR.”

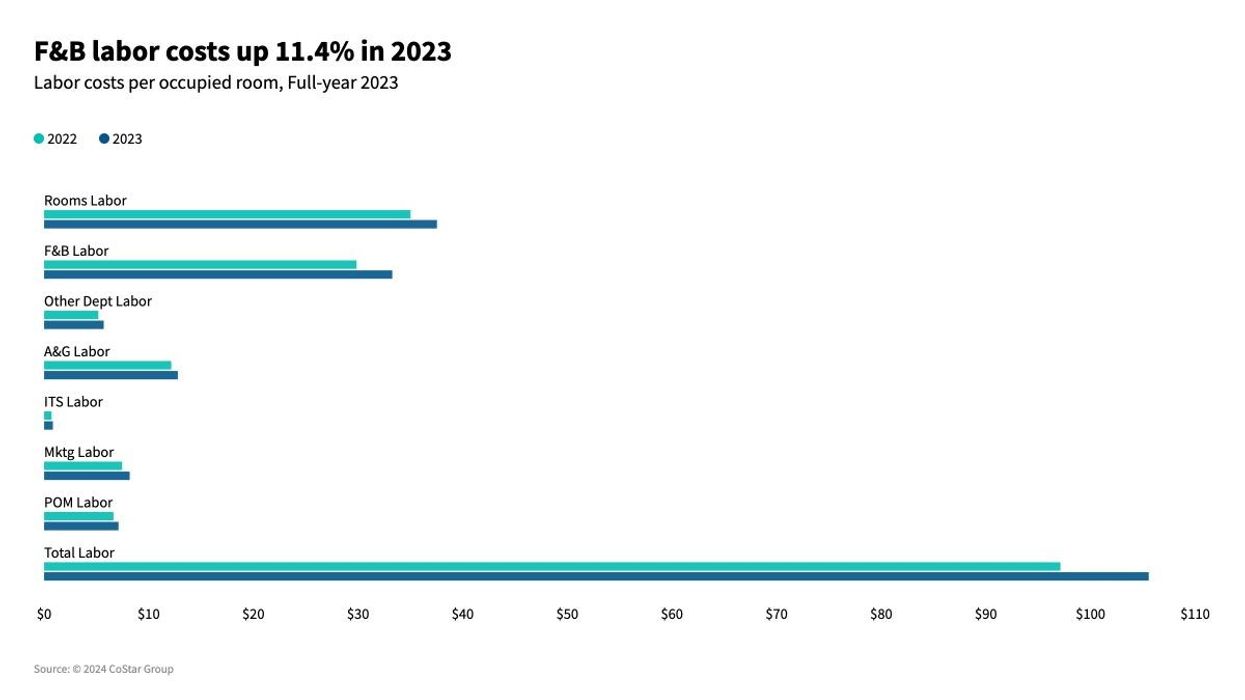

In 2023, GOPPAR reached $75.83, marking an 8.2 percent increase from 2022. TRevPAR stood at $211.49, indicating a 9.6 percent rise, while EBITDA PAR amounted to $53.05, up 7.6 percent from the prior year. Labor costs notably increased, reaching $71.56, reflecting a 13.2 percent rise.

“F&B labor costs on a per-occupied-room basis showed the largest growth of any department in 2023,” said Alvarado Cruz. “Year over year, F&B revenues on the same basis were up 9.1 percent but remained down compared to 2019 when adjusted for inflation. Further evidence of the improvement in group business, banquet and catering per occupied room showed an increase of 13 percent this year.”

In September, U.S. hotel profitability surged with increased corporate demand and group bookings, aligning with a rise in labor costs. According to CoStar, the positive trend aligned with a recent uptick in U.S. hotel labor costs that signaled a shift towards a more balanced business mix and significant growth in group demand.