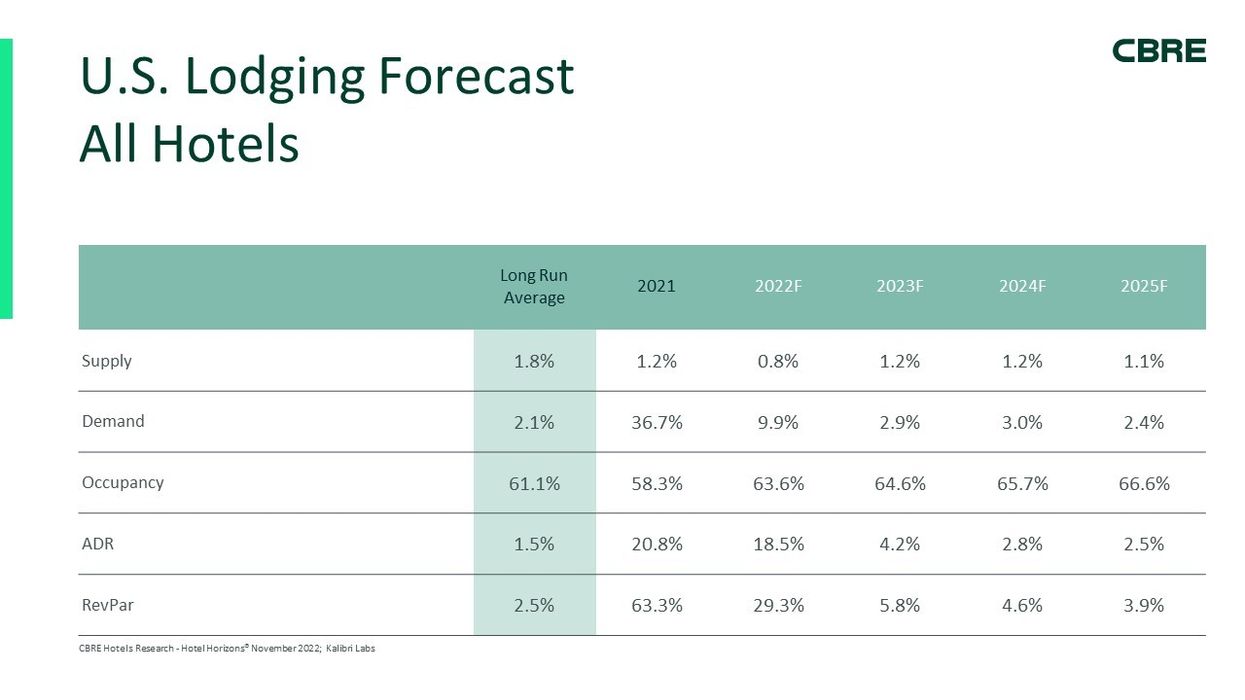

DESPITE PROJECTIONS OF persistent inflation and a moderate economic recession, CBRE’s November 2022 Hotel Horizons forecast calls for a 5.8 percent increase in RevPAR in 2023. This is up from CBRE’s previous forecast of a 5.6 percent increase in RevPAR for 2023.

Propelling CBRE’s increased outlook for RevPAR is an expected 4.2 percent rise in ADR, driven in part by the continuation of above long-run average inflation. For 2023, CBRE is forecasting the Consumer Price Index in the U.S. to increase by 3.5 percent year over year. Inflation continues to have a mixed impact on the hotel industry, bolstering top-line growth while pressuring margins.

Supply and Demand

Inflation is also impacting development activity. The combination of rising construction material costs, a tight labor market, and high interest rates will serve to keep supply growth over the next five years 40 percent lower than historical trends. Instead of construction, we expect cash flows in the near term to be focused on debt reductions, renovations and remodels given the backlog of Capex that built up during the pandemic.

Given its forecast for a 0.2 percent decline in 2023 gross domestic product, CBRE lowered its expectations for demand growth from 3.3 percent in their August 2022 forecasts to 2.9 percent in the November update. With the projected supply increase remaining at 1.2 percent for 2023, the net result is a reduction in CBRE’s occupancy growth estimate for the year to 1.6 percent, down from the 2 percent increase previously forecast. The lowering of occupancy expectations will somewhat offset the enhanced outlook for ADR growth.

It is worth noting that the 5.8 percent RevPAR growth forecast for 2023 is front-end loaded, particularly in the first quarter of the year given the easy comparisons created by the outbreak of the Omicron variant in early 2022. Our RevPAR forecast for the first quarter of 2023 calls for a 15.6 percent gain, followed by 2-4 percent growth over the balance of the year.

Chain Scales

By the end of 2023, CBRE forecasts all chain scales to have surpassed their respective 2019 RevPAR levels. Economy and midscale hotels recovered to 2019 levels in 2021. Closures, higher rents and displacements from shelters will continue to shift people from homes and apartments to lower-priced hotels offering weekly and monthly rates.

Luxury and upper-upscale properties have lagged in recovery because of their dependence on individual corporate and group demand. Hotels that operate in these segments will not achieve RevPAR recovery until the end of 2023.

Markets

CBRE prepares Hotel Horizons forecasts for 65 of the largest markets in the U.S. By year-end 2023, 53 of the 65 Horizons markets are expected to have reached, or surpassed, their 2019 RevPAR levels. That leaves 12 more to recover in 2024 or beyond. The majority of markets lagging in recovery are in northern California, the upper-Midwest, and along the northeast corridor from Washington, D.C. through New York.

At the other end of the spectrum, the leisure-centric destinations of Savannah, Miami, St. Petersburg and the Coachella Valley in California are forecast to exceed their 2019 RevPAR levels by more than 20 percent in 2023.

The Economy

CBRE’s Hotel Horizons forecasts are based on economic assumptions prepared by CBRE Econometric Advisors. As of October 2022, CBRE EA expected the following for the U.S. economy in 2023.

A Recession

CBRE EA anticipates that a moderate recession will last through the first half of 2023 for the following reasons:

- The key trigger of this downturn is the Fed’s aggressive rate hikes delivering its intended effects.

- Higher household debt costs are weighing on consumption of big-ticket items, such as housing and reportedly autos.

- A strong USD will impede exports.

- Higher corporate cost of capital is forcing firms to shelve expansion plans and layoff announcements are increasing. This will soften the labor market via a falling job openings rate in the near term, and the unemployment rate should increase to 5% by 2024.

Inflation

The pace of annual inflation likely peaked during the summer of 2022. Moving into autumn, easing commodity and consumer goods prices are weighing on CPI. The largest component of CPI—housing—is also peaking. Some monthly data points suggest that both rental and for-sale prices are falling. Nevertheless, the Fed remains vigilant about rising services costs and the prospect of embedded inflation. This should keep the Fed Funds Rate trending upward through mid-2023 and peaking north of 4.5 percent. Indeed, this outlook is predicated upon inflation decelerating to 3.5 percent by year-end 2023. It is entirely plausible that inflation could remain stubbornly high, which would trigger a stronger response from the Fed and a more painful recession.

It should be noted that the CBRE lodging forecasts presented in this article do not contemplate a global war, a pervasive recession or a more acute COVID variant.

In September, CBRE released a revised forecast for the second half of 2022.