A CONTINUING SENSE of optimism about the nation’s recovery among investors sent the Baird/STR Hotel Stock Index up in October. Hotel brands led the increase as concerns about the COVID-19 Delta variant began to ease.

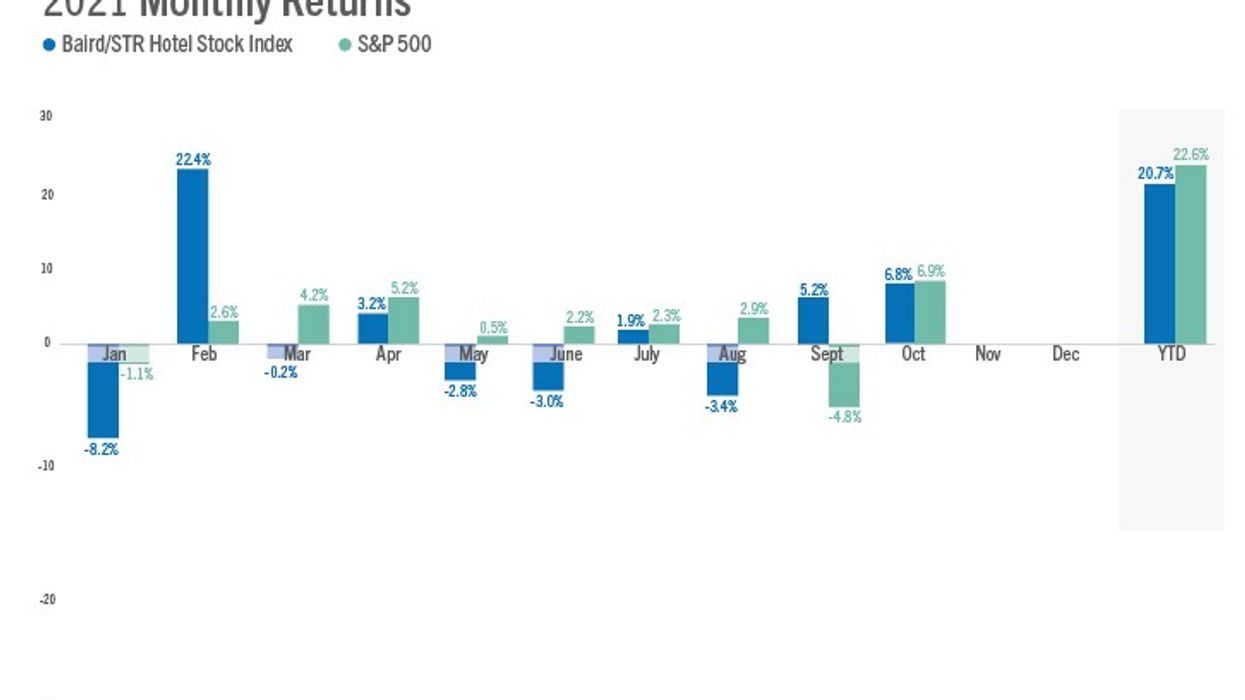

The Baird/STR index rose 6.8 percent during the month, and it also was up 20.7 percent year to date through the first 10 months of 2021. The index rose 5.2 percent during September compared to August.

Still, the index was behind both the S&P 500, which rose 6.9 percent in October, and the MSCI US REIT Index, which rose 7.6 percent. The hotel brand sub-index rose 9 percent from September while the hotel REIT sub-index increased 0.5 percent.

“Hotel stocks increased for the second straight month, but performance was led by the hotel brands once again,” said Michael Bellisario, senior hotel research analyst and director at Baird. “The hotel REITs were marginally higher in October, while the hotel brands were the absolute and relative winners. Delta variant concerns are in the rearview mirror now, and investors are looking forward to the recovery continuing in 2022, particularly in some of the harder hit segments, markets, and regions that are poised to rebound strongly.”

There are several positive signs that the recovery is strong, said Amanda Hite, STR’s president.

“As businesses bring their workers back to the office, weekday occupancies are steadily improving, adding to the already strong room demand from weekend leisure travelers,” Hite said. “The industry has also seen a lift from improved group demand, which has been above 1 million each week since the start of ‘conference season.’ Industry stakeholders, especially in major cities, are also drawing optimism from the border opening to international travelers next week, although we expect a more delayed impact for hotels. Overall, industry recovery remains solid with weekly ups and downs continuing as well as labor costs pressuring profitability into at least the winter.”

STR and Tourism Economics released their latest industry forecast at the 43rd Annual NYU International Hospitality Industry Investment Conference. The expect ADR will be near full recovery in 2022 and RevPAR is expected to be fully recovered in 2023.