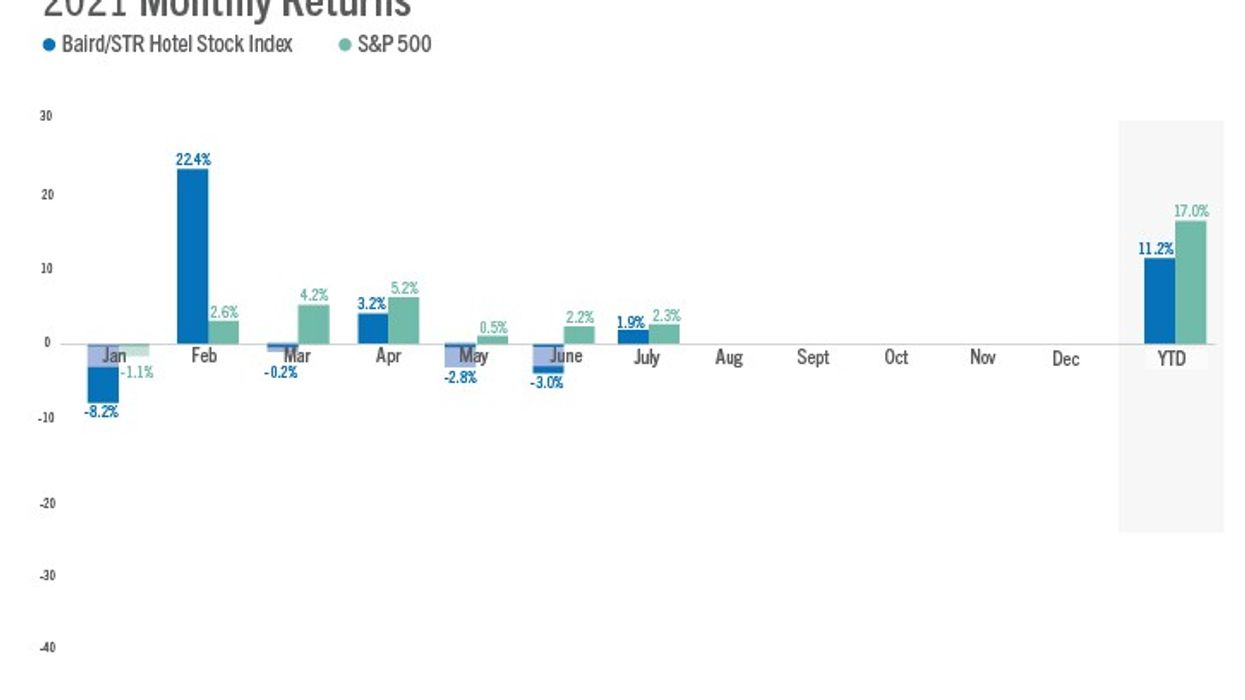

INVESTORS RETURNED TO the Baird/STR Hotel Stock Index in July, leading to a 1.9 percent rise to a level of 5,086 points. The summer leisure travel surge drove most of that performance and their continues to be some concern about the Delta variant of the COVID-19 virus and the possibility business travel will not bring the numbers to continue the upward trend.

The stock index was up 11.2 percent through the first seven months of 2021. Despite the increase, it fell behind both the S&P 500, up 2.3 percent, and the MSCI US REIT Index, which rose 4.7 percent. The hotel brand sub-index increased 5.6 percent from June to 8,993, while the Hotel REIT sub-index dropped 8 percent to 1,191.

The July increase put brakes on the decline the Baird/STR Index had been seeing up until June.

“Hotel stocks were positive but performance was mixed in July with the hotel brands significantly outperforming the hotel REITs,” said Michael Bellisario, senior hotel research analyst and director at Baird. “While second-quarter earnings so far have exceeded expectations, investors appear to be focused on the potential impact of the Delta variant domestically, how business travel might unfold post-Labor Day, and broader macroeconomic growth concerns. Sentiment toward the global and domestic recoveries appears to have normalized a bit in July, which we believe explains the large divergence in stock price performance between the hotel brands and hotel REITs last month.”

Despite the ongoing summer surge, there was some slowing in demand late in the month that fits historical trends, said Amanda Hite, STR president.

“At the same time, room rates are at an all-time high on a nominal basis. Outsized leisure travel is driving a demand disparity between strong weekends and softer weekdays, which is a cause for concern as the summer travel season nears its end,” Hite said. “The sharp rise in the Delta variant will likely put a damper on the expected business travel rebound post-Labor Day. Also, as more states and markets reinstate mask mandates, and the total cost of travel continues to increase, it is possible that corporate travel managers push business travel back to the early part of 2022.”