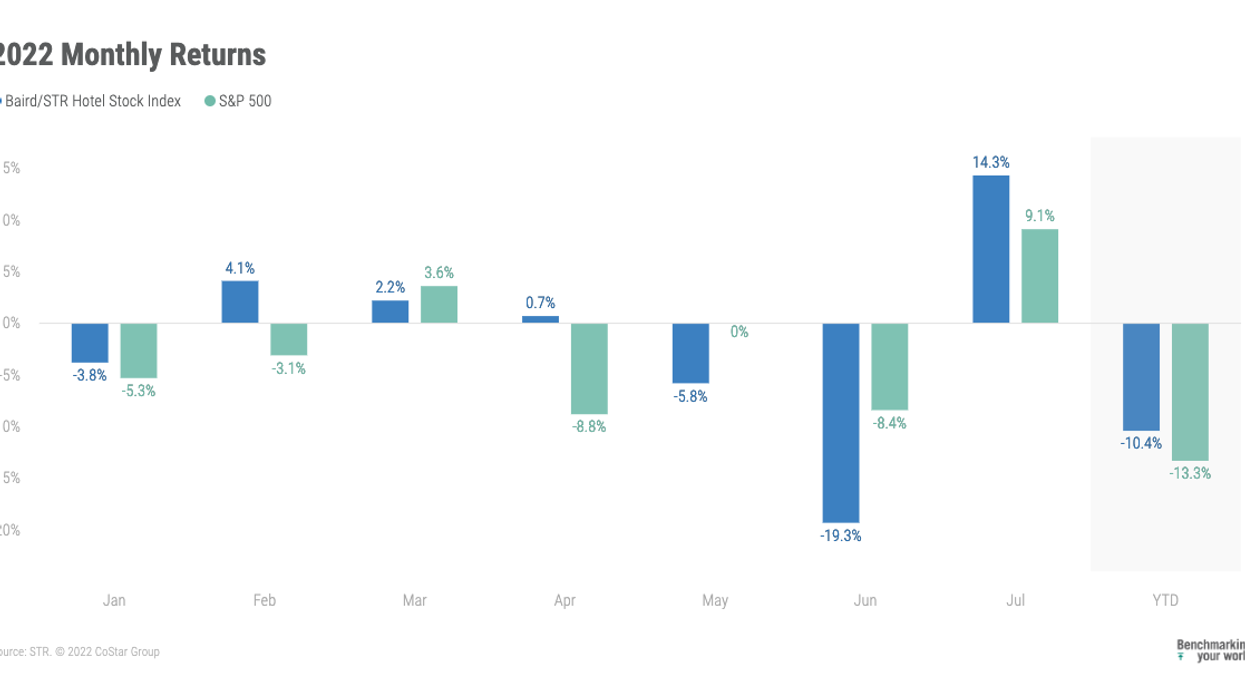

THE BAIRD/STR HOTEL Stock Index jumped in July, ending a downward trend for two consecutive months. The index decreased 10.4 percent year-to-date for the first seven months of 2022.

Baird/STR Index recorded a sharp increase of 14.3 percent in July, according to STR. The index fell 19.3 percent in June and dropped 5.8 percent in May. It went up 0.7 percent during April. It increased 2.2 percent in March after rising 4.1 percent in February.

The Baird/STR Index surpassed both the S&P 500, up 9.1 percent from June, and the MSCI US REIT Index, increased 8.7 percent, respectively during July. The hotel brand sub-index rose 14.2 percent from June, while the Hotel REIT sub-index increased 14.6 percent during the month.

“Hotel stocks rebounded sharply and outperformed their respective benchmarks in July; relative outperformance has continued in August,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Despite the big gains in July, hotel stocks did not fully recapture June’s losses. Positively, second quarter earnings exceeded analysts’ and investors’ expectations, and broader recession fears have begun to subside, which has boosted sentiment and stock prices. All eyes are on the post-Labor Day outlook that should reflect a more normalized travel environment.”

The positive sentiment expressed in second quarter earnings calls from several hotel companies continues to support a positive outlook, said Amanda Hite, STR president.

“Last week at the Hotel Data Conference, we unveiled our latest forecast, which lifted ADR projections once again as second quarter room rates exceeded expectations. Moving forward, we anticipate continued robust ADR growth in a positive demand environment,” Hite said. “With the fall season fast approaching, all eyes will be on group and corporate transient demand as leisure travel traditionally slows during this period. Group travel, thus far, has been one of the recovery success stories, while individual corporate travel continues to lag. Business transient is gaining traction, but we don’t expect a return to pre-pandemic levels for some time.”