ANNUAL CHANGES IN U.S. hotel utility costs and in the Consumer Price Index, or inflation, have historically proven to be strongly correlated. As of August 2022, CBRE is forecasting CPI growth to be 7.7 percent in 2022, followed by another 3.6 percent in 2023. Since inflation has averaged just 2.2 percent since 2000, these inflation projections have hoteliers concerned about operating costs. Given that rising energy costs are a significant driver of the current rise in CPI, hotel managers are especially worried about utility department expenses.

Over the past 50 years, utility department expenses have averaged between 3 and 4 percent of total revenue, indicating that hotel managers have been successfully controlling energy costs in the face of fluctuating business volumes. This is particularly commendable given the highly fixed nature of utility expenses.

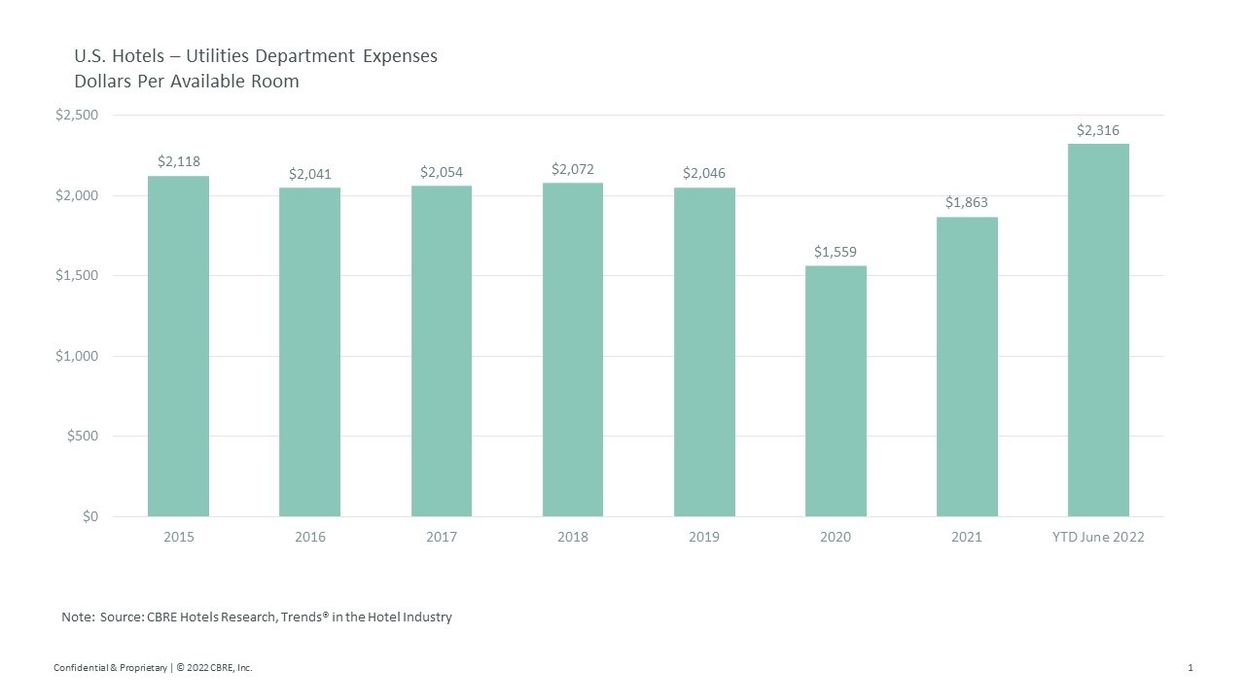

To provide some context to the current challenging environment, we studied recent trends in hotel utility department expenses. The data come from a sample of more than 2,800 U.S. hotels that reported utility department expenses each year from 2015 through 2021 for CBRE’s annual “Trends in the Hotel Industry” survey. In 2021 the properties in the sample averaged 209 rooms in size, with an annual occupancy rate of 54.2 percent and an average daily rate of $152.70.

COVID Was a Challenge

Hotel managers were especially challenged to contain utility costs during the recent industry recession. In 2020, the properties in our sample were able to cut their utility costs by 23.8 percent to offset the severe declines in occupancy. Unfortunately, the 23.8 percent decline was less than the 63.9 percent drop in total hotel revenues; therefore, the utility department expense ratio increased to a record high of 6.2 percent. The disparity between the decline in utility expenses and revenue is indicative of the fixed nature of most utility costs. Despite low occupancy or suspension of operations, maintaining the assets required a minimum level of utilities in 2020.

As hotel occupancy and revenue levels have recovered since 2020, utility costs have increased. CBRE estimates that hotel utility costs will return to pre-COVID levels on a nominal basis in 2022. Of note is the recent inability to control utility costs on a dollar-per-occupied-room basis. In June 2022, utility costs increased on a POR basis, the first such monthly increase during the past two years. In other words, utility costs grew at a greater pace than the increase in business volume (occupied rooms) during the month. Much of this increase can be attributed to inflation.

Largest Utility Expenses: Electricity and Water

CBRE tracks four different expenses within the utility department: electricity, gas, steam, and water/sewer. Among these four categories, electricity and water/sewer have seen the largest utility cost increases on a POR basis. From 2015 through 2021, the compound annual growth rate (CAGR) for electricity was 3.1 percent, while water/sewer rose by 4.0 percent. This is important since electricity makes up roughly 60 percent of the utility department budget, and water/sewer averages 22 percent. Fortunately, there are several strategies that can be implemented during hotel renovations or ongoing Capex efforts to limit the consumption of these costly utilities.

Controlling Energy Costs through Reduced Electricity Consumption

Energy management systems have become mainstream in hotels, monitoring occupancy of guestrooms to ensure heating and cooling efforts are curtailed when rooms are not occupied. Beyond that, however, these systems also present opportunities for sophisticated operators to cap the temperature range to prevent guests from excessively heating or cooling their room.

Within the guestroom, lighting typically accounts for 20 to 30 percent of electricity costs, so ensuring decorative and architectural lighting utilize the latest technologies can further reduce hoteliers’ electricity costs. Once cost prohibitive, LED light bulbs have become widely adopted in recent years, causing prices to fall tremendously since the technology was first introduced. LED bulbs can use 80 percent less energy than traditional incandescent lightbulbs, and last 15 to 20 times as long. Properties that have switched to compact florescent bulbs can still find value in switching to LED bulbs for reduced energy costs and increased longevity. In addition, occupancy sensors can be paired with existing light fixtures to further reduce electrical costs in areas like hotel corridors which only need to be lit when they are occupied.

Hoteliers interested in leading the sustainability movement might even consider onsite power generation to reduce their electricity consumption costs. Large, flat surfaces like rooftops of meeting spaces and parking decks present incredible opportunities to develop onsite solar farms which can have a profound impact in reducing, or altogether eliminating, hotels’ energy costs. Sophisticated real estate advisors can help hoteliers understand the payback on such investments and the ability to offset investments with tax credits and local sustainability incentives. Many companies, including CBRE, are helping propel widespread adoption by acquiring or partnering with solar companies themselves to provide hoteliers with integrated, end-to-end delivery of sustainable solar solutions.

Controlling Water Costs by Curbing Water Consumption

Traditional methods for reducing water usage in guestrooms include adding aerators to faucets; implementing preventive maintenance programs to identify and fix leaky plumbing fixtures; and selecting low flow plumbing fixtures like showerheads with 1.5 gallons per minute or less flow rates, sink faucets with 0.5 gallons per minute rates or less and toilets with 1.28 gallons per flush or less) during renovations or ongoing fixture replacements. Tub-to-shower conversions, often required during renovations of branded hotels, can also reduce water usage, as showering typically uses 50 percent less water than bathing.

Beyond these proven techniques, new technologies present opportunities to transform how water is consumed in hotels. Orbital Systems, for instance, has created a recirculating shower system that measures water quality 20 times per second, sending dirty water down the drain while cleaning and filtering impurities to recirculate shower water, reducing water consumption by as much as 90 percent during showers.

The Future of Energy Controls

Concurrent with above average levels of inflation, CBRE is also forecasting U.S. hotel occupancy levels to continue to grow through 2026. Accordingly, hotel managers will be facing the dual impact of rising energy prices and greater business volumes in the future. This will make it even more challenging to contain utility department costs in the next few years. Thankfully we have seen new technologies enter the market that will assist hotel owners and operators in their efforts to contain energy costs.

Hotel managers have been challenged in the past. Given the new tools that are available to them, we believe they will be successful in the future.