THE U.S. HOTEL industry will continue its recovery in 2022, but the path will be uneven and potentially volatile, according to a report by the American Hotel & Lodging Association. It added that a full recovery from the impacts of the COVID-19 pandemic will take several years.

AHLA's 2022 State of the Hotel Industry report also revealed shifts in consumer and business sentiment. The report was created in collaboration with Accenture and is based on data and forecasts from Oxford Economics and STR.

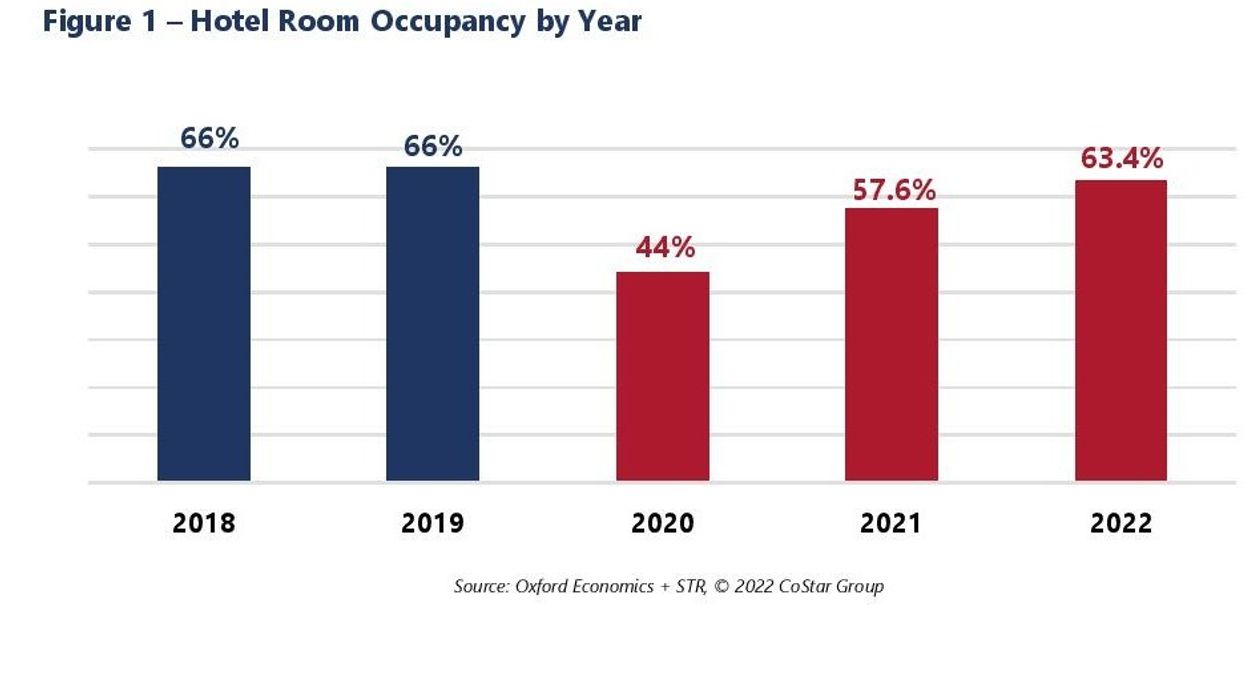

According to the report, hotel occupancy rates and room revenue will approach 2019 levels this year, but the outlook for ancillary revenue, which includes F&B and meeting space, is less optimistic. Leisure travelers will continue to drive recovery, the report added.

Hotels lost a collective $111.8 billion in room revenue alone during 2020 and 2021. Business travelers made up 52.5 percent of industry room revenue in 2019 and it will be 43.6 percent in 2022. Business travel will be down more than 20 percent for much of the year, the report said. As the full effects of Omicron is not yet known, just 58 percent of meetings and events are expected to return.

AHLA report said that the rapid rise of bleisure travelers—those who blend business and leisure travel—are impacting hotel operations now. A recent study revealed that 89 percent of business travelers wanted to add a private holiday to their business trips in the next twelve months.

According to the report, technology will be even more critical to a property’s success, as hotels investing in technology to meet the needs of both guests and employees.

“Hotels have faced enormous challenges over the past two years, and we are still a long way from full recovery. The uncertainty about the Omicron variant suggests just how difficult it will be to predict travel readiness in 2022, adding to the challenges hotels are already facing,” said Chip Rogers, president and CEO of AHLA. “The slow return of business travel and fewer meetings and events continue to have a significant negative impact on our industry. The growth of leisure and bleisure travel represents a shift for our industry, and hotels will continue evolving to meet the needs of these ‘new’ travelers.”

“Travel and hospitality brands still face an uncertain marketplace, but all these changes also herald a new era of opportunity to drive long-term customer loyalty. They should flex with demand and respond to the added complexities and volatility in travel by delivering a ‘travel partner’ mentality to their leisure and business customers,” said Liselotte De Maar, managing director in Accenture’s travel industry. “Travelers are now not only focused on price and quality of a location, but also on cleanliness and sustainability values and impact, and expect a clearer, more digital service. Companies will need to continue to transform digitally, reinvent their loyalty model, as well as rethink the employee proposition, if they wish to thrive.”

A recent survey commissioned by AHLA said that though the COVID-19 pandemic may be waning, other factors are leading many people to stay home.

The AHLA Foundation launched The Hotel Industry: A Place to Stay campaign to help job seekers discover the 200+ career pathways and many perks that the industry offers, including competitive wages, benefits, flexible schedules, and travel opportunities.