WYNDHAM HOTELS & RESORTS’ board of directors has officially advised the company’s shareholders not to support an exchange offer from Choice Hotels International to acquire Wyndham. The offer is “insufficient” and prone to regulatory risks, the board said.

Choice announced its latest offer directly to Wyndham stockholders last week. At that time, Wyndham’s board said at that time that it would review the offer, though it also said it appeared to be the same as the original offer it rejected in November. On Monday, the board released its official statement rejecting the latest offer.

"Choice has, once again, failed to address the major value gap and risks of their offer – which remains virtually unchanged from the terms outlined in their previous unsolicited proposal," said Stephen Holmes, chairman of the board. "The core issues we have articulated remain the same: a likely prolonged regulatory review period of up to 24 months with an uncertain outcome; the pure inadequacy of the offer from a valuation standpoint, including the significant equity component of Choice stock; and the lack of consideration for Wyndham's superior, standalone growth prospects."

In its original proposal, made public in October, Choice said it sought to acquire all the outstanding shares of Wyndham at a price of $90 per share and shareholders would have received $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Choice claimed that is a 30 percent premium to Wyndham’s 30-day volume-weighted average closing price ending on Oct. 16, an 11 percent premium to Wyndham’s 52-week high, and a 30 percent premium to Wyndham’s latest closing price.

Wyndham’s board unanimously rejected Choice’s proposal, calling it unsolicited, “highly conditional” and not in the best interest of shareholders. On Nov. 14, however, Choice sent a letter to the Wyndham board with an “enhanced proposal” intended to address Wyndham’s concerns about clearing federal regulations.

In its own statement released Dec. 12, Choice said it had decided to its “compelling proposal” was too important for both companies to let go.

“Choice continues to believe that a transaction with Wyndham is pro-competitive and would generate value for both Wyndham and Choice shareholders as well as deliver significant benefits to franchisees, guests and associates of both companies,” the company said.

The reasons against

Wyndham’s board listed more details in its statement regarding its concerns about the proposed merger. Some highlights include:

- Choice’s offer involves an uncertain regulatory timeline and outcome without sufficient protections and compensation for some of the risks Wyndham shareholders would face. A merger of the two would create the largest U.S. provider of hotel franchise services in the chainscales that serve middle-income guests, economy and midscale, with more than 55 percent market share in each, so the Federal Trade Commission may not approve the transaction.

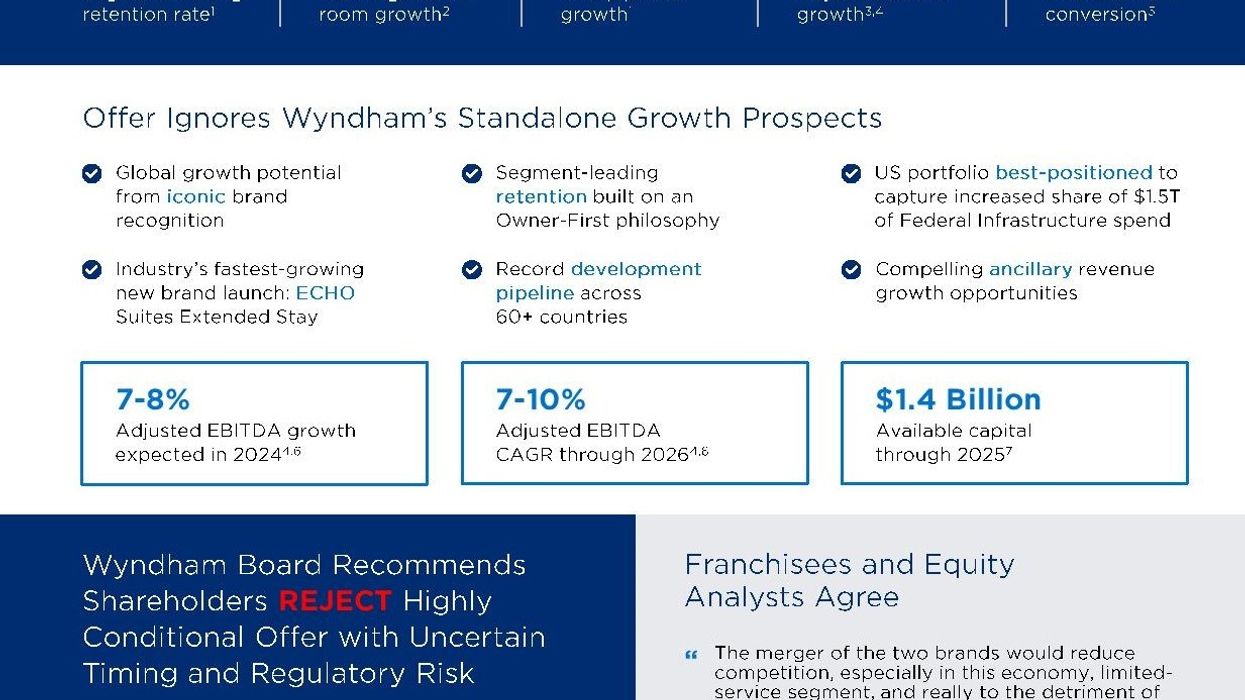

- The offer undervalues Wyndham's standalone growth prospects, which the company says under its existing business plan will exceed the $85 per share under Choice. Wyndham's pipeline provides additional opportunity for accelerated net room growth, above-market RevPAR growth and royalty rate expansion, the board said. It also is expecting additional revenue from the federal government's $1.5 trillion Infrastructure Bill through its ECHO Suites Extended Stay by Wyndham, along with new credit card products, new strategic marketing partnerships and other monetization opportunities.

- Choice portrays Wyndham's growth potential as $9 per share, which the Wyndham board calls “an egregious mischaracterization.” The board said the outlook Wyndham provided in its October investor presentation shows an incremental $20 per share from EBITDA growth potential over the next two years with an additional $16 per share from the deployment of available capital during that period.

"Our board has made itself consistently clear on these risks, but Choice continues to ignore what is in the best interests of Wyndham shareholders by repeatedly proposing illusory and unrealistic offers while making inconsistent and misleading public statements,” Holmes said. “We are confident Wyndham can deliver long-term shareholder value well in excess of the $85 per share offered by Choice by continuing to execute on our existing business plan. The board is steadfast in our recommendation that shareholders not tender their shares into this offer, and we remain fully committed to acting in the best interests of all Wyndham shareholders."

Concern among Wyndham stockholders

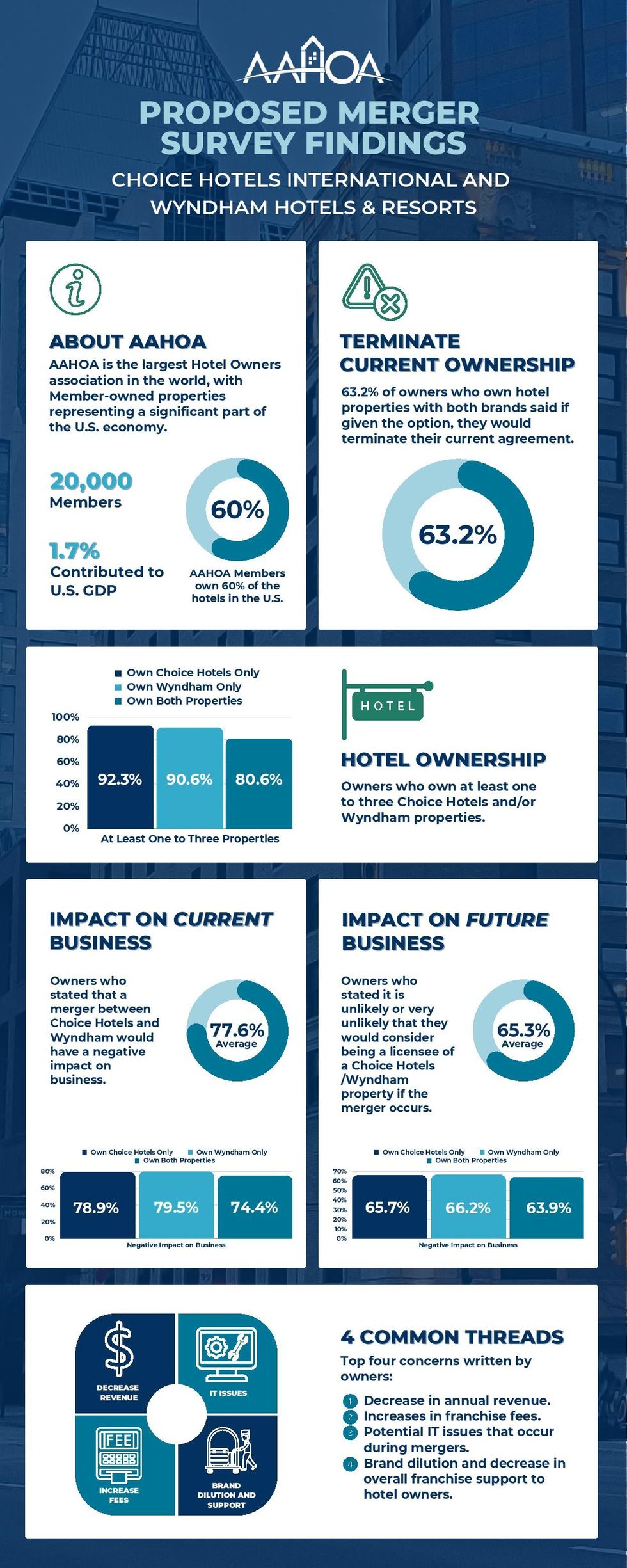

Previously, AAHOA also issued a statement opposing the transaction, saying a merged Choice/Wyndham would have 16,500 hotels with 46 brands and dominate the economy/limited service segment.

“As the owners of more than two-thirds of both Choice Hotels and Wyndham-branded hotels, AAHOA members have much at stake with Choice’s potential purchase of Wyndham,” said AAHOA Chairman Bharat Patel. “To have one franchisor Choice Hotels control so many economy and limited service hotels will give our members little opportunity to have a say in whether the franchise mandates and requirements are fair, and significantly limit their options to find a different brand under which they could successfully operate their hotels.”

Some AAHOA members who are Wyndham franchisees are also concerned the proposed acquisition would hurt their business, Laura Lee Blake, AAHOA’s president and CEO, said in an interview with Reuters. Blake said a survey of 1,000 AAHOA members found that 80 percent of Wyndham franchisee respondents said a tie-up would hurt their business and about 60 percent said they would terminate their contract in the event of a merger if they had the option.

Blake told Reuters that many AAHOA members saw revenue fall after previous mergers, including the 2018 combination of Wyndham and La Quinta and Choice's acquisition of Radisson Hotels Americas in 2022. Members are also worried about increased fees and brand dilution, she said.

"When you sign a 20-year franchise agreement, you are anticipating that you're going to be with this brand for the next 20 years and if you're unhappy with the brand or a merger like this occurs, you cannot just change your mind," Blake said.