Summary:

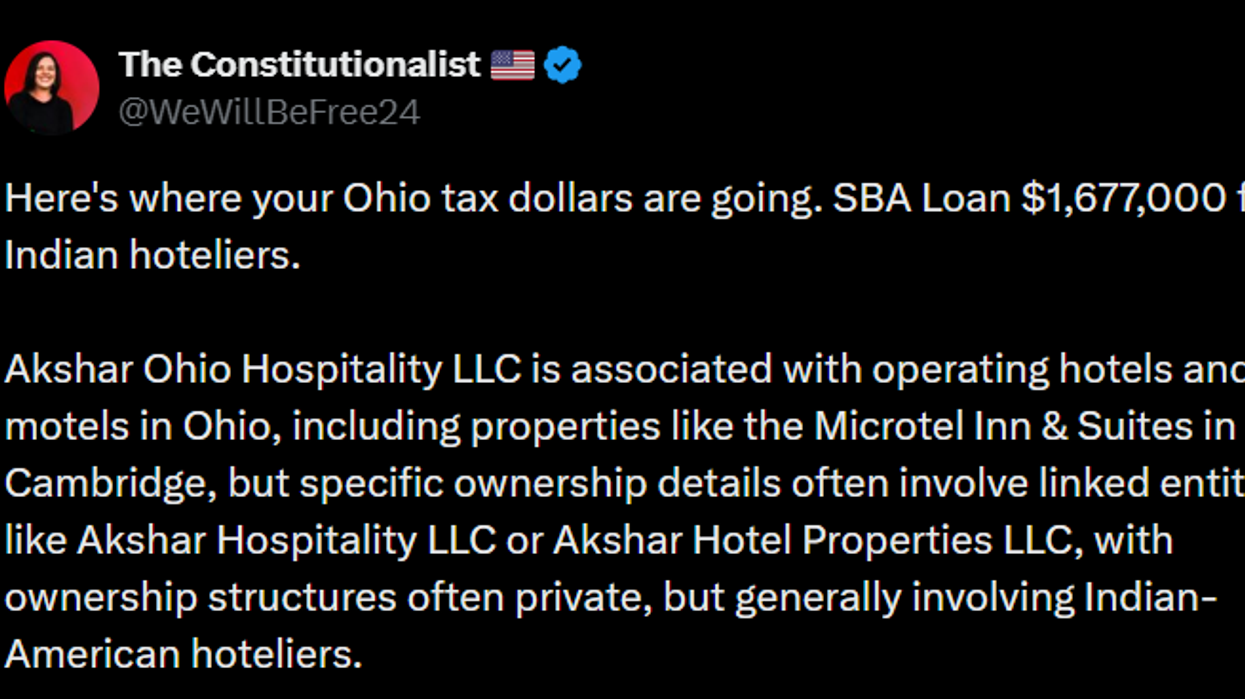

- A viral post on X claimed that a $1.677 million SBA loan went to Indian hotel owners.

- The user raised concerns about taxpayer money in Ohio.

- AAHOA president responds to the claim.

A POST ON X questioned the legitimacy of Small Business Administration loans to Indian American hotel owners. The user raised questions over how American taxpayer dollars are spent in Ohio, but AAHOA, in response, said their members contribute much to federal, state and local economies.

“Here’s where your Ohio tax dollars are going. SBA Loan $1,677,000 for Indian hoteliers,” X user The Constitutionalist posted.

They attached screenshots that appear to show federal spending records from sites like USASpending.gov, linking the firm, Akshar Ohio Hospitality LLC, properties like the Microtel Inn & Suites in Cambridge, according to The Times of India.

The screenshots indicated ownership records showing Akshar Hospitality officers with Indian names. Asian Hospitality was not able to confirm those records independently or find contact information for Akshar Hospitality.

Other X users on the post questioned how these loans could be legal.

“SBA loans are for small American businesses, not already established corporations. Why is this legal?” asked one user.

The person who shared the post replied, “Good question. They also took a lot of PPP.”

“Indian nationals own almost all gas stations & several hotels in NY,” another user claimed.

Another user called for a boycott of “fraudulent Indian establishments.”

“I don't buy anything from a store, gas station, sandwich shop any place run by Indians,” they posted.

AAHOA responded when shown the posts.

“Conversations about hotel ownership and federal small business programs deserve a fact-based, thoughtful approach—not conclusions driven by anecdotal social media claims,” said Laura Lee Blake, AAHOA’s president to Asian Hospitality, “Indian American hospitality entrepreneurs, like millions of immigrant-founded small businesses nationwide, participate in these programs legally and responsibly. They contribute significantly to federal, state and local tax bases, create jobs and help sustain communities across the country.”

About 60 percent of U.S. hotels are owned by Indian Americans, according to AAHOA. This constitutes more than 34,000 properties, built through various methods including community networks, family savings and SBA loans accessible to eligible immigrants.

Blake highlighted a study undertaken by AAHOA along with Oxford which reported that AAHOA members contribute $100 billion in federal, state and local taxes and employ 1 million people, earning over $51 billion annually.

“In Ohio, which was the state discussed, our members contribute $1.8 billion in federal, state and local taxes, contribute $7 billion to the state's gross domestic product and contribute some $4.2 billion in wages, salaries and other compensation," she said.

Recently, Indian Americans protested Palm Bay, Florida, City Councilman Chandler Langevin’s social media posts calling for the deportation of people of Indian background.

The prominence of Indian Americans in U.S. hospitality industry has also been represented across multiple media. These include Mahendra Doshi’s book, “Surat to San Francisco: How the Patels from Gujarat Established the Hotel Business in California 1942-1960" and “The Patel Motel Story,” a documentary filmed by Emmy-winning producers Amar Shah and Rahul Rohatgi.

The Indian American Advocacy Council recently urged the Federal Bureau of Investigation to investigate a rise in hate speech and violent rhetoric targeting Indians.