U.S. Hotel Performance: Week Ending March 15, 2025 Insights

U.S. HOTEL PERFORMANCE improved for the week ending March 15 but remained down year-over-year, according to CoStar. All key metrics, including occupancy, RevPAR and ADR, rose week-over-week.

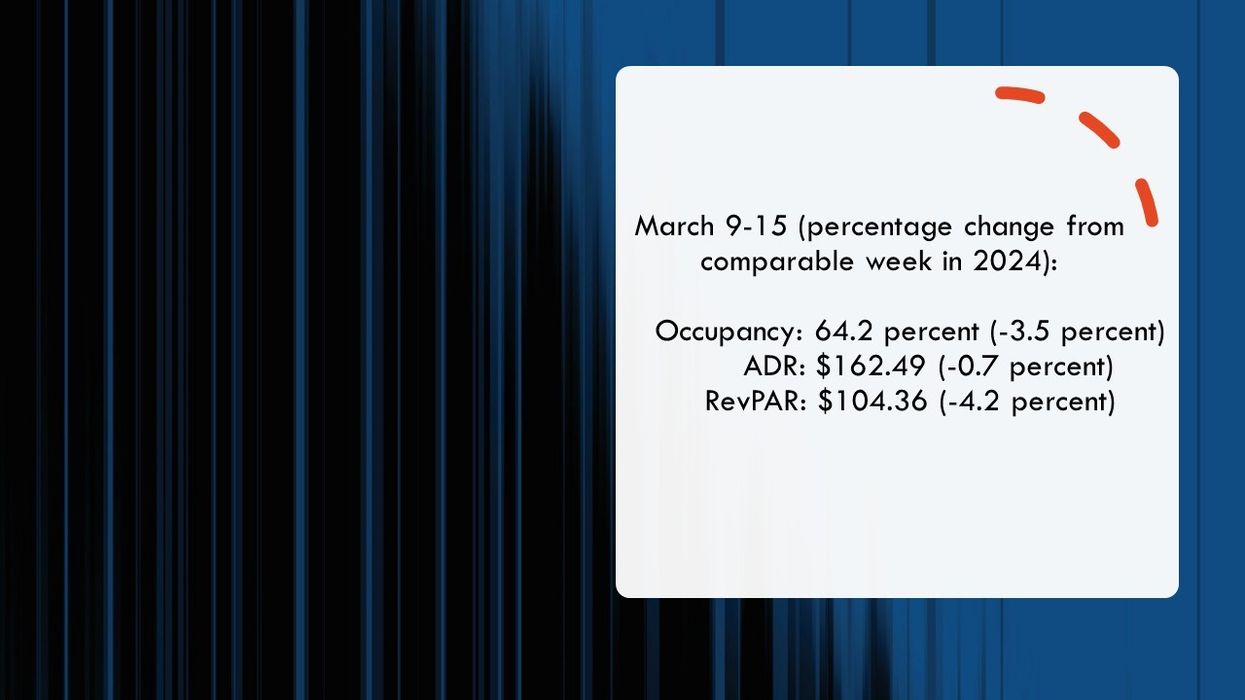

Occupancy increased to 64.2 percent for the week ending March 15, up from 62.4 percent the previous week but down 3.5 percentage points year over year. ADR rose to $162.49 from $160.53 the prior week but declined 0.7 percent. RevPAR increased to $104.36 from $100.11 but remained 4.2 percent lower than the same period in 2024.

Among the top 25 markets, San Francisco led in occupancy growth, rising 6.6 percent to 63.7 percent. Houston saw the largest ADR increase, up 13.8 percent to $137.98, and the highest RevPAR gain, up 16 percent to $97.21.

Anaheim saw the steepest RevPAR decline, dropping 27.8 percent to $149.51, followed by Seattle, down 15.5 percent to $101.77, impacted by a calendar shift of the Aerospace & Defense Suppliers Summit.