Key Metrics: Occupancy, ADR, and RevPAR Trends for April 2025

U.S. HOTEL PERFORMANCE increased in the week ending April 12, with mixed year-over-year comparisons, according to CoStar. Occupancy, ADR and RevPAR rose from the prior week.

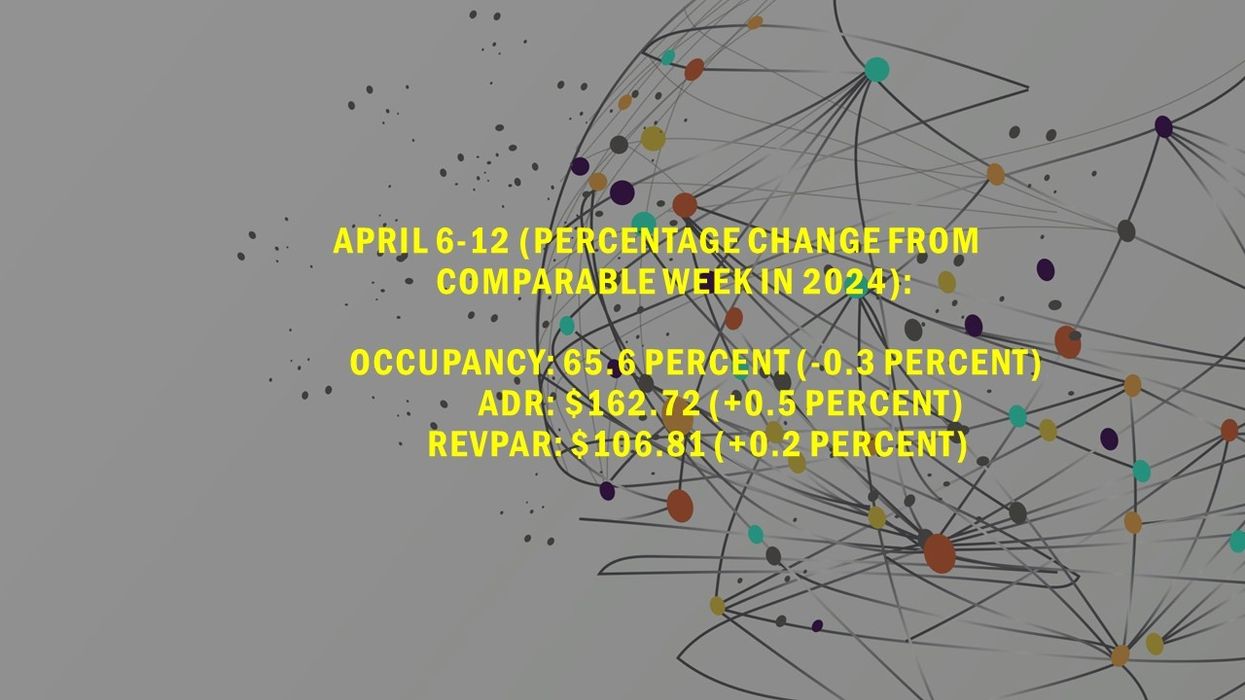

Occupancy rose to 65.6 percent for the week ending April 12, up from 63.8 percent the previous week, but remained 0.3 percent lower than the same period last year. ADR increased to $162.72 from $160.18, a 0.5 percent year-over-year gain. RevPAR rose to $106.81 from $102.21, reflecting a 0.2 percent increase from 2023.

Year-over-year comparisons were lower due to the boost from the 2024 total solar eclipse during the same week.

Among the top 25 markets, San Francisco reported the highest year-over-year occupancy increase, up 17.1 percent to 65.1 percent. Orlando posted the largest ADR gain, up 12.1 percent to $230.05, and the highest RevPAR increase, rising 23.8 percent to $167.47.

The steepest RevPAR declines were in Philadelphia, down 18.5 percent to $108.85, and Dallas, down 17.1 percent to $98.63.