Summary:

- U.S. hotel metrics declined for the week ending Aug. 16.

- Seattle led top 25 markets in occupancy and RevPAR growth year over year.

- Houston posted the largest occupancy and RevPAR declines.

U.S. HOTEL METRICS continued their downward trend in mid-August but were mixed year over year, according to CoStar. Seattle led the top 25 markets in occupancy and RevPAR growth compared with the same week in 2024.

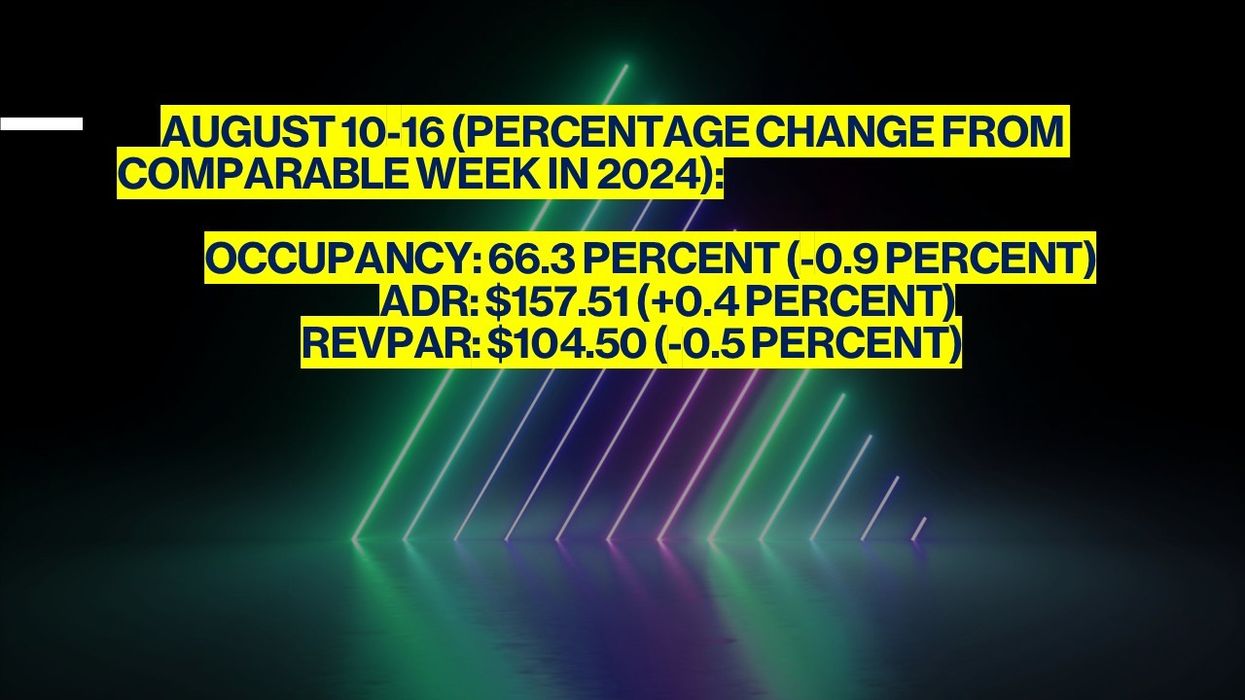

Occupancy declined to 66.3 percent for the week ending Aug. 16, down from 68 percent the previous week and 0.9 percentage point lower year over year. ADR fell to $157.51 from $159.61 but was up 0.4 percent from the same week in 2024. RevPAR dropped to $104.50 from $108.47, down 0.5 percent year over year.

Among the top 25 markets, Seattle posted the highest year-over-year occupancy gain, up 7.5 percent to 83.9 percent, along with a 10.9 percent increase in RevPAR to $178.62.

Houston reported the largest declines in occupancy and RevPAR, with occupancy down 24 percent to 57.2 percent and RevPAR down 27.1 percent to $66.84. The decreases were largely due to the elevated displacement demand that followed Hurricane Beryl in 2024.

New Orleans reported the second-largest declines, with occupancy down 13.7 percent to 45 percent and RevPAR down 17.2 percent to $53.82.