U.S. Hotel Metrics: Strong Gains in 2025 with Regional Variations

U.S. HOTEL METRICS improved for the week ending April 26, with only occupancy remaining down year over year, according to CoStar. Chicago led the top 25 markets in year-over-year occupancy and RevPAR growth.

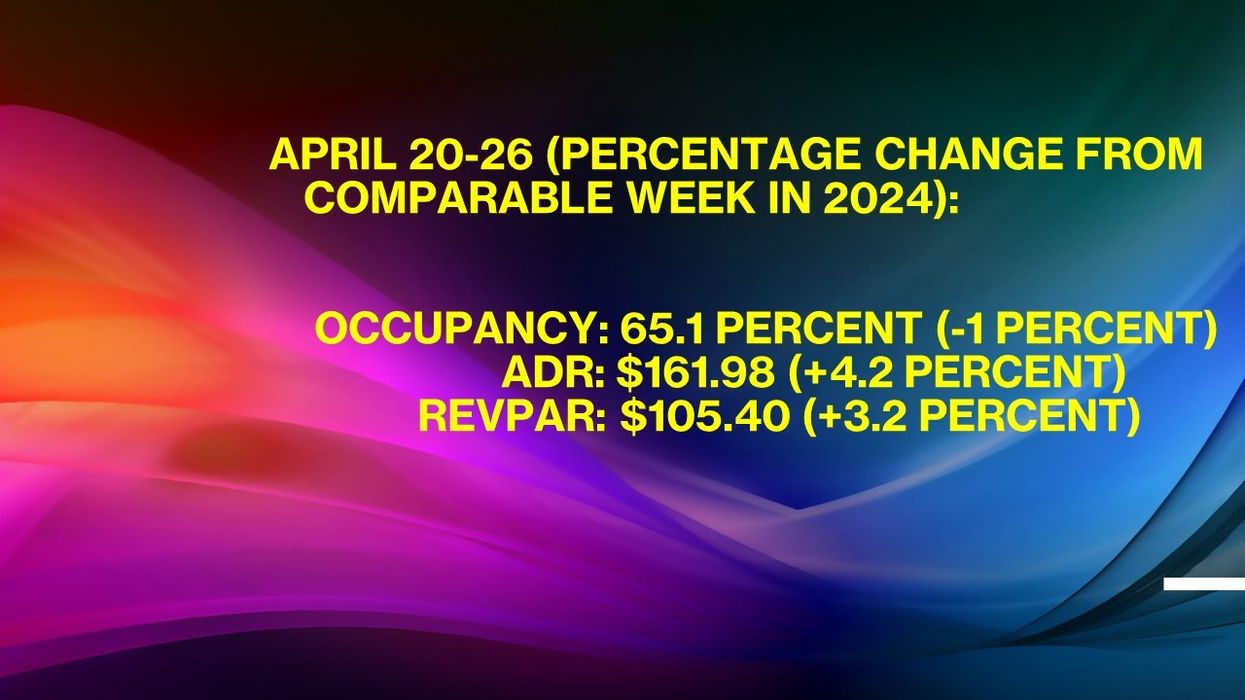

Occupancy rose to 65.1 percent for the week ending April 26, up from 61.4 percent the week prior but 1 percent below the comparable week in 2024. ADR increased to $161.98 from $158, a 4.2 percent year-over-year gain. RevPAR grew to $105.40 from $97.06, up 3.2 percent from last year.

Among the top 25 markets, Chicago reported the highest year-over-year occupancy increase, up 6.8 percent to 67.6 percent, and a 17.6 percent rise in RevPAR to $109.54. Las Vegas posted the largest ADR gain, up 19.6 percent to $222.42, driven by the LVL UP EXPO.

Detroit, which hosted the NFL Draft during the comparable week in 2024, reported the steepest performance declines: occupancy fell 13.4 percent to 55.5 percent; ADR dropped 17.8 percent to $121.78; and RevPAR declined 28.8 percent to $67.63.