U.S. HOTEL PERFORMANCE improved in the second week of September compared to the previous week, but year-over-year results remained negative, according to CoStar. Key metrics—occupancy, RevPAR and ADR—all saw week-over-week growth.

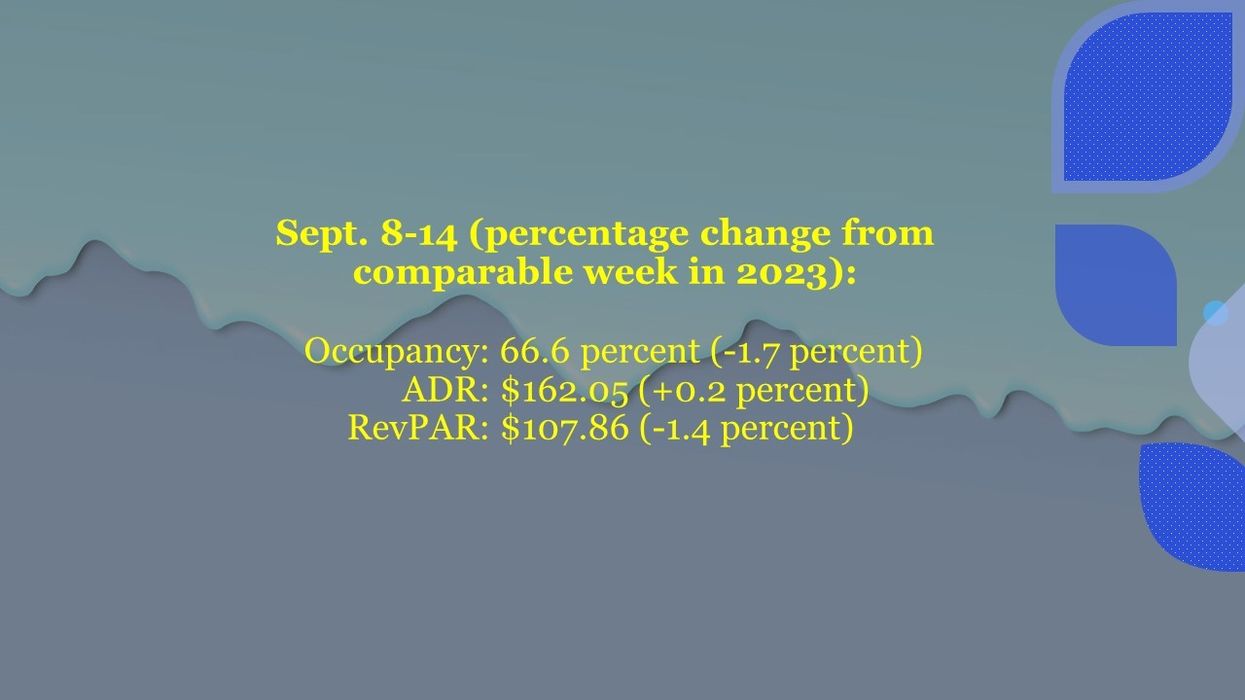

Occupancy rose to 66.6 percent for the week ending Sept. 14, up from 57.8 percent the previous week but 1.7 percent lower year-over-year. ADR reached $162.05, an increase from $149.67 the prior week and 0.2 percent higher than the same week last year. RevPAR climbed to $107.86 from $86.48, though it marked a 1.4 percent decline compared to the same period in 2023.

Among the top 25 markets, San Diego posted the highest year-over-year occupancy gain, up 10.5 percent to 79.9 percent. Chicago recorded the largest ADR increase, up 15.5 percent to $216.57

Las Vegas saw the sharpest RevPAR drop, down 37.2 percent to $171.26, due to a comparison with the week of Dreamforce 2023.