Minneapolis–St. Paul Hotel Pipeline Falls to 15-Year Low in 2025

FEWER THAN 250 HOTEL rooms were under construction in the Minneapolis–St. Paul metro at the start of 2025, the lowest level since 2010, according to Marcus & Millichap. The limited pipeline, however, signals strong demand for existing inventory.

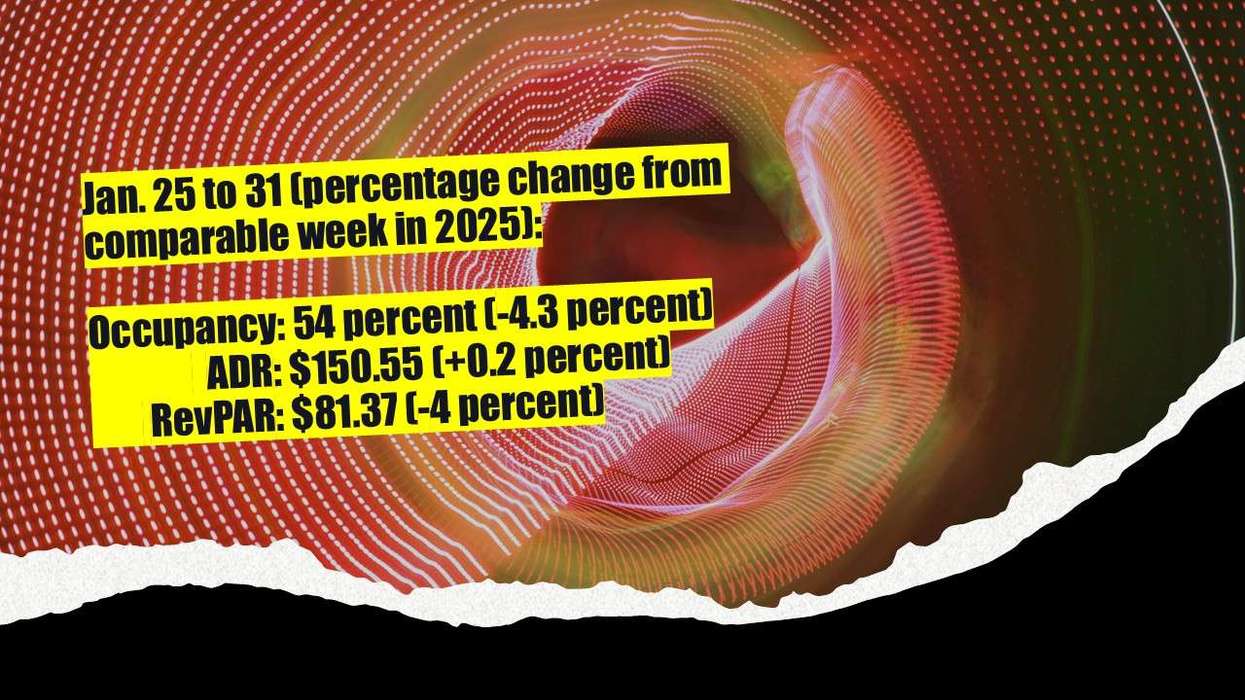

Marcus & Millichap’s “2025 Hospitality Investment Forecast for Minneapolis–St. Paul” projects metro-wide occupancy will rise for a sixth straight year to 59.4 percent, above the past decade’s average but still below pre-pandemic levels.

“Despite below pre-pandemic occupancy levels, the Twin Cities hospitality sector is showing signs of a steady, demand-driven rebound supported by limited new supply and record ADR,” said Todd Lindblom, Marcus & Millichap’s first vice president and regional manager.

ADR is projected to reach a record $136.18, driven by upper-upscale hotels with the highest expected occupancy at 62.3 percent, the report said. RevPAR is set to rise to $80.92, its highest level since 2019, led by gains in downtown Minneapolis.

Investment sentiment remains optimistic as average room prices rose 20 percent year-over-year and a 10.4 percent cap rate positions the metro as attractive to yield-driven investors despite uncertainty.

“This year’s constrained development pipeline, coupled with improving fundamentals and new urban projects like Upper Harbor Terminal, positions the Twin Cities market for cautious yet promising growth,” said Lindblom.

PricewaterhouseCoopers said hospitality and leisure dealmakers entered 2025 with cautious optimism, but market and policy volatility led to a reassessment of growth strategies.