Summary:

- The One Big, Beautiful Bill Act became law on July 4 after President Trump signed it at an outdoor rally.

- The association said the bill offers tax relief, reinvestment incentives, and financial clarity for small businesses.

- India raised concern over the proposed 1 percent U.S. tax on remittances by non-citizens.

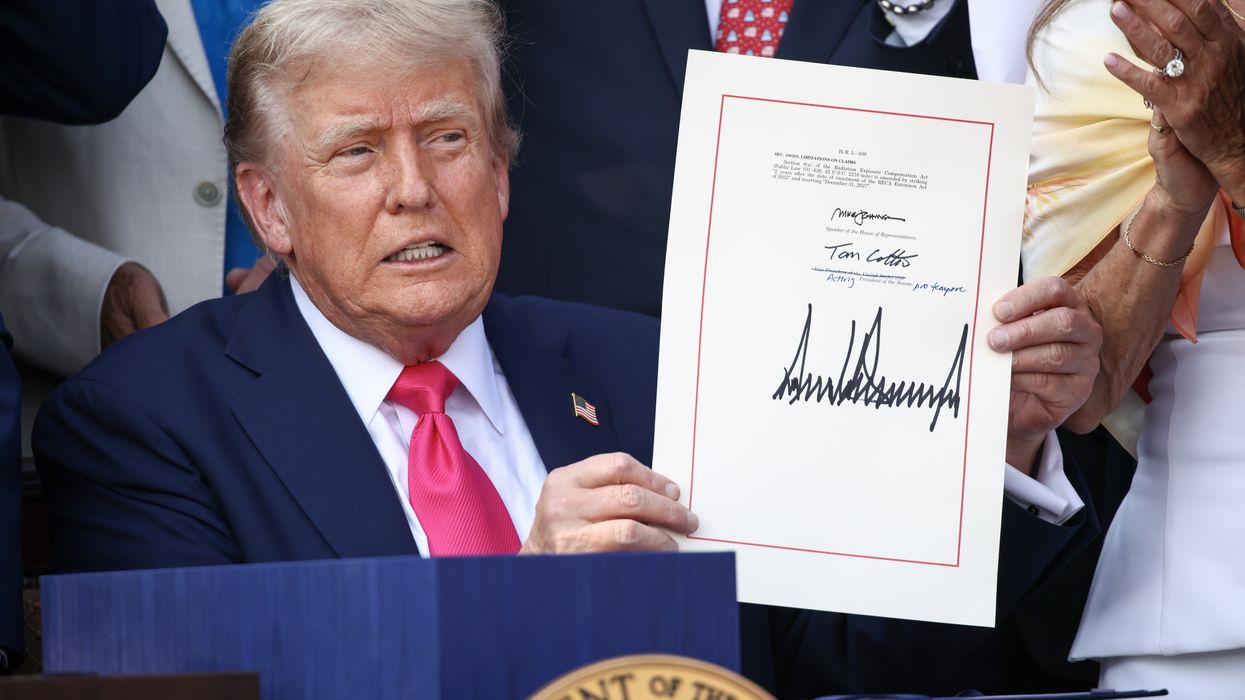

THE ONE BIG, Beautiful Bill Act became law on the Fourth of July after U.S. President Donald Trump signed it during an outdoor ceremony that resembled a political rally. AAHOA welcomed the signing, calling it a step forward for small business owners, particularly hotel operators nationwide.

The bill, officially known as H.R. 1, continues Trump’s 2017 tax cuts and also implements new tax incentives for businesses. At the same time, it makes several changes to the country’s social safety net, including Medicaid and federal food assistance programs, that Democrats say will be bad for low-income Americans.

It also targets international money transfers by non-U.S. citizens, including green card holders and temporary visa workers on H-1B and H-2A visas. It imposes a 1 percent levy on remittances sent via cash, money orders, or cashier’s checks—down from the originally proposed 5 percent rate.

After a long session on Capitol Hill, the House passed the bill on Thursday by a narrow 218–214 vote. The Senate approved it on Tuesday by a single vote. Trump, who had given the Republican-led Congress a July 4 deadline to deliver the final version, said the bill would “turn this country into a rocket ship.”

“I’ve never seen people so happy in our country—so many groups are being taken care of: the military, civilians, jobs of all types,” Trump said at the ceremony, thanking House Speaker Mike Johnson and Senate Majority Leader John Thune for shepherding the bill through Congress, according to Reuters.

“So, you have the biggest tax cut, the biggest spending cut, the largest border security investment in American history,” Trump said. “This is going to be a great bill for the country.”

However, critics argue the bill achieves savings by cutting food benefits and health care and scaling back tax breaks for clean energy. The Congressional Budget Office estimates the bill could add $3.3 trillion to the federal deficit over the next decade and leave millions without health coverage—a forecast the White House disputes.

AAHOA welcomes the Bill

The association said the bill provides targeted tax relief, reinvestment incentives and financial certainty for small businesses amid the need for long-term planning.

“This is a strong step in the right direction for hotel owners and the broader small business community,” said Kamalesh “KP” Patel, AAHOA Chairman. “Our members have actively advocated for these reforms, and we’re pleased to see their concerns reflected in the final legislation.”

Laura Lee Blake, AAHOA president and CEO, said the bill’s signing on Independence Day is a timely reminder of the values that drive the association’s members: opportunity, resilience and the freedom to build something of their own.

“Our nearly 20,000 members own over 60 percent of the hotels in the U.S. and provide more than 1 million jobs,” she said. “This bill gives them the clarity to reinvest, the confidence to grow, and the ability to keep fueling the communities they serve.”

India’s concerns

The proposed 1 percent U.S. tax on remittances sent abroad by non-citizens is raising concern in India, which could lose billions in annual foreign currency inflows, The Hindu reported, citing the Global Trade Research Initiative.

India is the world’s top remittance recipient, followed by Mexico, China, the Philippines, France, Pakistan and Bangladesh. GTRI warned the loss could tighten U.S. dollar supply in India’s forex market, putting modest depreciation pressure on the rupee.

The bill exempts remittances made through U.S. financial institution accounts or funded by U.S.-issued debit and credit cards. The levy does not apply to U.S. citizens.

Reserve Bank of India data shows the U.S. was the top source of remittances to India in 2023 to 2024, accounting for 27.7 percent, or $32.9 billion, of total inflows.

In Indian states like Kerala, Uttar Pradesh and Bihar, millions of families rely on remittances for essentials such as education, healthcare and housing.

“A tax on remittances would certainly dent the inflow of funds to India,” a government official told The Hindu. “But the government has not yet assessed the extent of that impact.”

The official added that India has not yet decided whether to seek relief from the U.S. on the issue.

Campaign promises realized

The legislation fulfills two key Trump campaign promises: making his 2017 tax cuts permanent and eliminating taxes on tips, overtime, and Social Security benefits—at a projected cost of $4.5 trillion over 10 years. It is also expected to leave millions of Americans without health insurance.

About $150 billion is earmarked for border security, detention centers, and immigration enforcement. Another $150 billion will go toward military spending, including the president’s “gold dome” missile defense program.

Democrats, who used procedural tactics to delay the House vote, sharply criticized the final bill, calling it a giveaway to the rich that strips health care and food aid from millions of Americans. House Minority Leader Hakeem Jeffries, D-New York, gave a record-long “magic minute” speech to delay the vote on the bill at the last minute, according to NBC News. He ended by citing Dr. Martin Luther King.

“As I take my seat, I just want to say to the American people that no matter what the outcome is on this singular day, we’re going to press on,” he said. “Press on for the left behind. Press on for the rule of law. Press on for the American way of life. Press on for democracy. We’re going to press on until victory is won. I yield back.”